Ever wondered how to become financially independent? Let's explore together.

To answer this question, first we need to define what we mean by financial independence.

Think about what is financial independence for you?

It could be something like early retirement with sufficient savings to support a decent lifestyle or increasing revenue sources to meet your lifestyle needs or living your dream life without being tied to a corporate job. Whatever it is for you, one thing is certain, it involves making real world money for a better lifestyle. As we all know, there are multitude of ways to make money, however, in this series we'll stick to our tried and tested US equity markets.

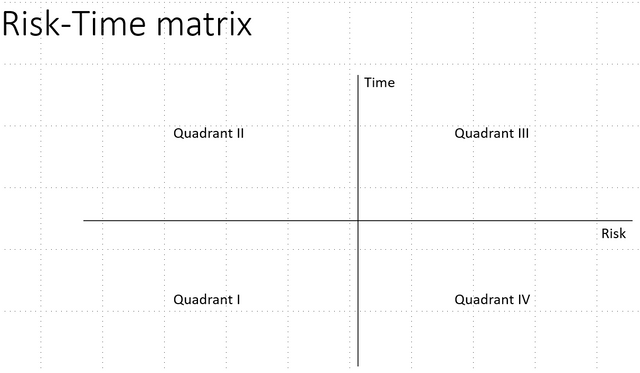

When we think about investing there are couple of things that are paramount - a) what is your expected time for return on investment? and b) what is your risk appetite? Let's understand this content in a little more detail.

If we plot these two things on a 2x2 plot of risk and time matrix the big picture will start to emerge. Lets take a look at it.

Legends to interpret the below description:

Short time horizon = anything less than 2 weeks

Medium time horizon = greater than 2 weeks and less than 6 months

Long time horizon = greater than 6 months

Quadrant I:

Risk is low and time horizon is shorter. So what?! With these parameters, you can expect low to moderate returns in a short amount of time with fairly low risk. Example assets that sit in this quadrant include growth sector focused ETFs, small cap index funds.

Quadrant II: Risk is low and time horizon is longer. In this quadrant, an investor can expect moderate to high returns with fairly low levels of risk and long time horizons. For example, investment in blue chip stocks or value driven midcap companies. These companies are fundamentally strong.

Quadrant III: Risk is high and time horizon is longer. This space is dominated by growth companies, typically, small to mid-cap pretty much in every sector. The key is growth.

Quadrant IV Risk is high and time horizon is shorter. Typically day traders play in this quadrant. Investors can expect exponential gains in a short duration, however, the downside is equally bad and therefore you'll find that this quadrant is typically occupied by professional traders . Exponential growth could be event driven too. For example, after President-elect Joe Biden won, cannabis stocks shot up north of 50% in just 2 days and came back at the same level after the rally. So if you were smart and bought the stocks before election results and sold after you could have easily made a healthy return. IPOs are yet another gem in this quadrant.

Now that we are all on the same page lets understand what kind of investor you want to be? Everyone should start here. For us, we decided on using a mixed-bag strategy meaning we diversified our assets across the 4 quadrants. And goes without saying that it is a constantly evolving portfolio.

Having said that, our portfolio is biased in quadrant III and IV. In the coming series, we would love to give you a deep-dive into our strategy.

Would love to know what kind of investor you are in comments below. Thanks for reading!

NOTE: Please note that all of the above content is based on our experience in the US equity markets that we would like to share with the community. Please use your own judgement when investing in stock market.

My portfolio is also based on quadrant III and IV. It is a portfolio of mixed investments outside the US equity market. Quadrant III and IV, being high in risk, requires intensive research.

Interesting question.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you are absolutely right @devann Thanks for sharing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good work. We look forward to reading your future posts in the series.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for reading :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit