Spotlight on Poloniex- killer feature its makes poloniex stand out-Margin Lending.

jemisteem (52)in SteemAlive • yesterday (edited)

Introduction

Poloniex remains a go-to cryptocyrency exchange platform for may users and traders. This exchange platform which was launched in 2014 has continued to grow from strength to strength. Many of its features, which are very strong selling points among cryptocurrency traders and users include their very low network fees. While many platforms charge very high fees, cyptocurrency traders always prefer exchange platforms with relatively low fees. The reason is simple: you might make a huge profit trading cryptocurrencies in the market, but keeping your profit becomes a huge challenge because of high transaction fees. So with Poloniex, depending on the user's level, there are very negligible trading fees. That is not all though.

.png)

Another nice feature of the Poloniex platform is the ease with which new users sign up new accounts. With just your email, you are ready create your wallet and start trading in Poloniex. In other words, it takes just few seconds to have an account created. Poloniex does not force new users to undergo a compulsory KYC. This is a great feature that makes entry requirements for first time users easy. I find it hard to use a platform that enforces strict KYC procedures before allowing me to have a taste of their service. Its in the best interest of exchange platforms to allow new users in, let them have a trial of the services, before mandating them to verify their identity. With just your email, Poloniex allows you to trade up to $10,000 worth of cryptocurrency transactions each day. This is more than enough volume to give new users the opportunity to use Poloniex for the first time.

Other Poloniex features that Poloniex a popular selection includes high-profit margin trading and lending, a wide selection of cryptocurrencies to trade on, and an ever-improving customer support. These and many other features make Poloniex great. However, no exchange platforms are perfect. Each continues to improve their services to make them more attractive to its users. I love Poloniex, which is why I want it to implement a feature that will help bring in new users in masses. The new feature is: accepting fiat deposits

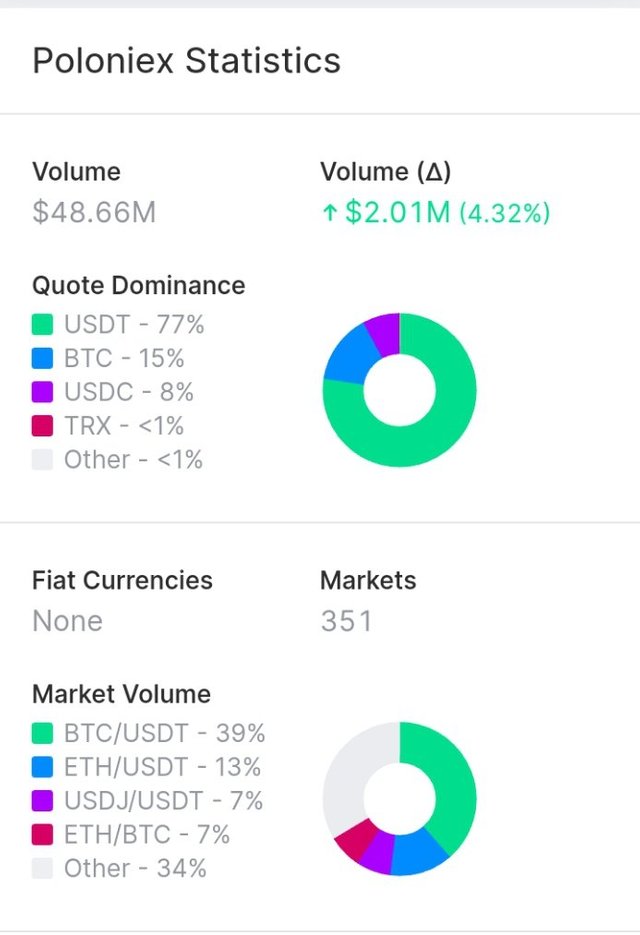

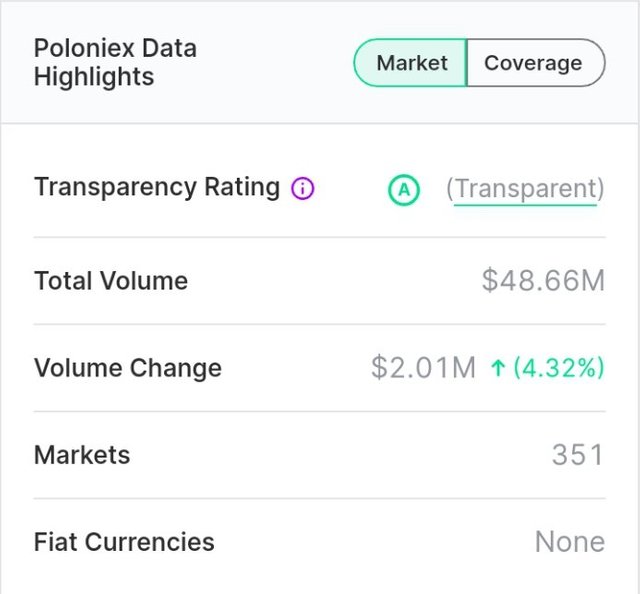

Poloniex Daily Performance

Poloniex is a cryptoasset exchange located in United States. Their volume over the last 24 hours is $48.66M. They have 351 markets, with the most popular markets (trading pairs) being BTC/USDT, ETH/USDT, and USDJ/USDT. The exchange is rated “A” which means “Transparent.” Out of 401 exchanges, they are ranked #14 by transparency and volume. Poloniex accounts for <1% total volume in the cryptosphere indexed by us. They've executed 156,004 trades over the last day, which accounts for 1% of trades indexed by our platform. They are a crypto-only exchange.

(

Crypto Quote Dominance

1TetherUSDT

77%

2BitcoinBTC

15%

3USD CoinUSDC

8%

4TRONTRX

<1%

5JUST StablecoinUSDJ

<1%

Fiat Quote Dominance

N/A

Overall Quote Dominance

1TetherUSDT

77%

2BitcoinBTC

15%

3USD CoinUSDC

8%

4TRONTRX

<1%

5JUST StablecoinUSDJ

<1%

Volume Gainers/Losers

1ETH/BTC

BTC_ETH

$1.40M

68.67%

2ETH/USDT

USDT_ETH

$1.39M

27.21%

3BTC/USDT

USDT_BTC

$391,669

2.13%

4TRUMPLOSE/USDT

USDT_TRUMPLOSE

$180,547

45.53%

5INJ/BTC

BTC_INJ

$180,517

1,172.00%

Volume (Δ)

1GAS/BTC

BTC_GAS

$3,118

5,811.99%

2BTC/PAX

PAX_BTC

$3,103

4,821.44%

3PEARL/USDT

USDT_PEARL

$130

4,313.91%

4WNXM/USDT

USDT_WNXM

$275

4,226.27%

5MDT/BTC

BTC_MDT

$312

3,999.10%

About Poloniex

Poloniex is a centralized cryptocurrency exchange that was founded in the US in 2014. The founder of the platform is Tristan D’Agosta, who previously worked in the music industry and established Polonius Sheet Music company in 2010. The Boston-based exchange became the first trading platform that reached 1 billion USD in trading volume.

The platform calls itself a legendary crypto assets exchange and though it’s popularity is not as high as it was before, it offers a reliable trading service and affordable fees. The exchange suits the needs of individuals and institutional traders.

The company behind the platform is Polo Digital Assets Ltd. The platform is often chosen for low fees, margin trading support, and a good selection of supported cryptocurrencies. However, it doesn’t offer fiat exchange.

The history of Poloniex

The popularity of the trading platform has increased rapidly after its launch in 2014. However, 2 months later, on March 4, 2014, the exchange was hacked and lost approximately 12% of its assets. The reaction of the company was fast as it offered full compensation of the lost funds to its users. The company had to increase its fees after that incident. In 2016, it enlisted Ethereum and its popularity started rising along with its liquidity.In 2018, the exchange was purchased by the financial company Circle for 400 million USD that wanted to turn it into the first American fully-regulated platform. To be regulatory compliant, the platform had to delist half of its assets, in particular, those that could be classified as securities. Then it introduced strict KYC checks to comply with the requirements of regulators. But the uncertainty of the US regulatory environment didn’t let the company continue its strategy. It had to reduce the list of available coins repeatedly. Then it encountered the problems associated with the CLAM crash on May 26, 2019, when its numerous investors lost their funds. Poloniex agreed to reimburse 13.5 million USD loss to its users.

As a result, Circle rejected its plan to make Poloniex a first American regulated company. It was announced that the company faced problems and decided to develop a competitive international exchange. Thus, it relocated the project to Bermuda under the name of Polo Digital Assets Ltd. which was announced on October 18, 2019. In this way, the focus of the platform switched to the needs of global crypto traders. The platform started adding new features, services, and assets to increase its competitiveness again. However, the company had to sacrifice the US market. It actually shut down its operations in the US. Since November 1, 2019, the platform is not available for US traders.

In 2019, the company changed its owners and relocated to Seychelles. The location is known for its favorable cryptocurrency regulation. Many trading platforms such as Binance are also registered there for this reason. After relocation, the platform has expanded the assortment of traded cryptocurrencies and now tries to regain its lost position. A new owner is an Asian-backed investment group with TRON’s founder, Justin Sun, being one of its members.

The Poloniex platform

At the time of writing, Poloniex offers over 100 spot trading pairs and over 25 margin trading pairs. The availability of some assets depends upon the location due to various regulatory restrictions. The platform offers users to earn money without trading via lending crypto for regular rewards. The lending rates depend on a rolling average 7-day volume-weighted APR rate for each asset. Ethereum has the highest APR rate.

It is possible to automate trading with the help of trading tools provided by Poloniex. Highly efficient HTTP APIs and flexible websocket of the platform help traders to stay efficient regardless of the circumstances.

The company offers Poloni DEX and IEO launchpad letting users invest in the hottest cryptocurrency projects and take advantage of the opportunities provided by Poloniex decentralized counterpart.

Additionally, Poloniex Plus Silver, Gold, or Market Maker accounts are available for large volume traders offering different benefits. For instance, holders of the Plus Silver account get a 60% fee reduction while holders of the Plus Gold account can take advantage of a 70% discount. The amount of allowed withdrawal also depends upon the type of account.

The interface may seem a little confusing for inexperienced traders, though its logic is clear and everything is positioned in its place. The platform offers a convenient mobile app for traders on the go. It’s also worth noting robust trading tools and convenient OTC trading desk for institutional traders.

Poloniex security and support

The security problems that the exchange experienced in the past made the company pay special attention to this issue. It employs such security features as 2-factor authentication, reliable API Key security, air-gapped cold storage keeping the majority of customers’ assets offline, and self-freeze email. The latter implies notifications when login from a new IP takes place. The automated email includes a link to freeze the account to automatically stop all activities.

Customers get access to the first verification level after the registration which is provided to them by default. It’s possible to be verified to level 2 after providing a residential address, phone number, date of birth, ID, and proof of address.

The exchange activity is monitored by special programs round-the-clock with the goal to report and block any suspicious activity on the platform. Despite the advanced security measures, the platform experienced some technical problems in February 2020, when it had to delete 12 minutes of trading history after a bug was revealed.

Customers complain much of the slow Poloniex support which is a common problem among popular trading platforms. According to reviews, it has considerably improved after the company changed its owners.

Poloniex fees

The platform doesn’t have deposit fees. There is a fixed fee for withdrawal that depends upon the asset. The platform charges different rates for makers and takers. The fee depends upon the tier that in its turn depends upon the volume traded. The holders of VIP accounts can enjoy lower fees with a discount that reaches 70%. The platform accepts debit and credit bank cards. It’s possible to buy cryptocurrencies directly with fiat.

Exchange Name

Poloniex

Location

United States

Website

https://poloniex.com/

Fees

https://poloniex.com/fees/

Twitter

https://twitter.com/Poloniex

Facebook

https://www.facebook.com/poloniex/