Foreword:

This is part 2 of the mini-series on "What Cryptocurrencies Represent". It is important to note that whenever I talk about cryptocurrencies in my articles, I am always referring to open and decentralized cryptocurrencies. These cryptocurrencies are those that have the important traits of being permissionless and censorship-resistant. Here goes...

The traditional financial system has through the use of easy credit (low interest rates and quantitative easing) created a huge bubble. Some coined it the "Everything Bubble". Here is a page with a nice infographic on the "Everything Bubble". It was created 2 years ago but it is even more relevant now as all of the markets have inflated much further over the last 2 years (with the exception of cryptocurrencies market).

Source

I recently watched a video by George Gammon which goes even further to say that the ridiculous valuations of loss-making companies like Uber and WeWork are a result of excess and easy credit in the world. Ultimately, our generation or future generations will have to pay for all these. One way or another. Link to video below,

A vote of no confidence

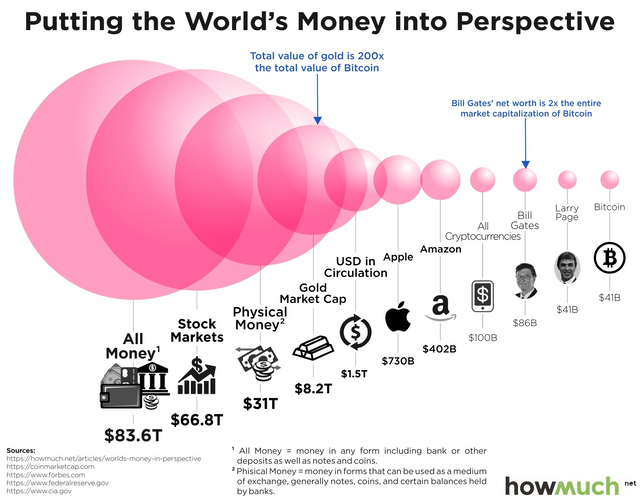

To put things into perspective, the total value stored in cryptocurrencies in this world is miniature compared to the total money in the current system. The infographic below says it all.

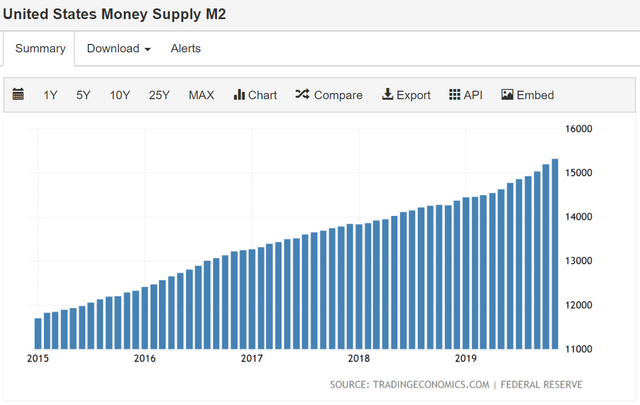

Again, this information was from 2 years ago, and though the total cryptocurrencies market cap has almost doubled, it is still nothing compared to the other markets. It is also important to note that the total amount of M2 money supply had also increased substantially. Just in the USA alone, the M2 money supply had increased from $13 trillion to $15 trillion, hitting a all-time high. Yes, it is with a "T".

The excess credit in the current system was meant to grow the economy fundamentally. However, because money was not allocated efficiently to the right hands, it is causing more harm than good. Again, you should watch this video by George Gammon to understand why.

As a result of the artificially propping up of asset prices, we are seeing the wealth gap widening. This is going to lead to more social issues as we cross over to a new decade. The excess credit has to be wiped out eventually. Some possible bad scenarios are an epic market crash or the US dollar collapse. A likelier scenario as described by Ray Dalio is excessive printing of money by the Federal Reserves to pay for future obligations (maturing of bonds, healthcare and pension liabilities etc). This is going to lead to devaluation of the USD making it a bad store of value over the next decade or 2.

Every dollar converted to a cryptocurrency is one dollar worth of value now stored in an alternative system to the current one. If you choose to buy $1 of Bitcoin, your $1 worth is now stored in Bitcoin. Likewise if you opt to buy Ethereum or even STEEM. It is one way of saying f**k the the current system, I am moving to another one. So if every dollar is a vote, each dollar you convert into a cryptocurrency is a vote of no confidence to the current system.

10% of post rewards goes to @ph-fund and 5% goes to @leo.voter to support these amazing projects.

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

- What is Steem? - My Interpretation

- Steem Thoughts - Traditional Apps vs Steem Apps

- Steem Thoughts - A Fat or Thin Protocol?

- Steem Thoughts - There is Inequitable Value Between Users and Apps

- Make my votes count! Use Dustsweeper!

- What caused STEEM to get dumped? Why I think the worst might be over

- Steem 2020 is about having a "SMART U"

Your posts are great!

Keep them coming.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the post, having the source of that bubble chart about the amount of money in the world is useful to me for a job that I am reviewing elsewhere.

For decades I have heard about the imminent collapse of the US dollar as currency, so far I am still waiting to see ... I do not deny that it is in a very bad situation and that the policies taken in this regard do not help to improve the prospects, but I have learned Because it is a very difficult entity to kill or make it collapse.

Anyway, when the Fall happens, that will be a catastrophic event for much of the world, as it is still a very high-use commercial exchange currency and I think I remember that the international reserves of several countries are specifically carried in that currency.

In part, the diversification of the reserves has been a security measure that great nations have taken for an eventual fall of the dollar, but even with these forecasts, it is a little scary to think about the extent of the disaster ... would it be something like The Great Recession? Or could the economy of various countries in the world recover quickly enough to give way to a new world with a different redistribution of economic power?...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A sudden collapse of USD is unlikely but there is a fair chance for a sustained period of high inflation. A good period for reference is US in the 1970s. Coined as the period of great inflation, the USD lost over 50% of purchasing power over 10 years and I think that might happen again in this decade

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congrats, on winning the writing contest! Upvoted!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your support! 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Love this perspective on crypto. I don’t think there are enough people out there who have this kind of grip on the fundamental idea of what crypto is and what it means to invest time/resources into it.

100% vote. Congrats on your win in the writing contest 🦁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congrats! on your upvotes from the IBT Community

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit