SWIFT

Traditionally cross-border interbank financial transfer operations are carried out under the SWIFT code system (Society for Worldwide Interbank Financial Telecommunication).

This code is part of a Belgian System and was designed so that its structure contains the essential data necessary to identify banking entities worldwide.

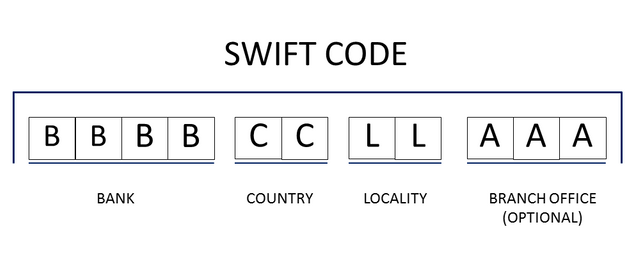

This is a schematic representation of the SWIFT code:

The SWIFT system is very safe since the coding system was implemented for this, but it is also cheaper than remittances.

In the case of migrants who already have time in the country where they are and are entitled to open a bank account, this is a very practical alternative since it significantly reduces the costs of sending money.

The great weakness of this international transfer system results in waiting periods which usually take between 2 and 5 business days, although they may take longer.

Image Source

SEPA

In 2008, SEPA (Single Euro Payments Area) entered into force is a payment initiative that simplifies bank transfers in cross-border Euros (EUR) in European participating countries.

The European Commission Regulation (EC) 924/2009 provides that banks in any EU country apply the same rates that apply to transfers in Euros within the same country to transfers in Euros (EUR) to other countries of the EU.

In other words, SEPA aims to ensure that cross-border transfers in Euros within the EU have the same costs as a domestic transfer within the country itself.

These transfers take between 1 and 2 business days.

DeFi introduces disruptive changes in the world of international bank transfers.

In this current era we can assume that every person could have access to the full range of modern financial services. However, a World Bank report describes evidence that more than 1.7 billion people do not have access to banking services.

When we talk about corporate or business transfers that involve large amounts, commissions tend to rise and when you want to place an investment of millions of dollars, a five-day wait is not a profitable option.

Currently, certain banking entities in the world are taking the lead in adopting Blockchain technology as a liberating tool and taking advantage of its potential, flexibility and the ability to expedite procedures and reduce costs once third parties and intermediary figures cease to be part of the ecosystem.

DeFi: Real Use Cases

The Spanish banking giant, Santander, which accumulated $ 99,000 in interest during the first quarter for the liquidation of a tokenized bond in the Ethereum Blockchain for an amount of $ 20 million, settled for the first time in September 2019.

Image Source

Thanks to Ethereum technology, the one-year expiration bonus has reduced the number of intermediaries required in the process, making the transaction faster, more efficient and simple, unequivocally demonstrating that the entire life cycle of a business can be managed. debt guarantee, in a blockchain.

These actions of this Spanish consortium and their promise to invest € 20 billion to digitize their information technology in the future, contribute to the increase in the rate of issuance of traditional assets on decentralized platforms.

ODL & DeFi

Image Source

On Demand Liquidity of Ripple (ODL) significantly reduces transaction fees.

Money transfers with the ODL application can be made by an operator in just minutes and almost in real time, reducing costs by almost 75%. This contrasts strongly with the traditional methods of sending remittances, which often take days to process and carry large expenses.

As for people who still remain outside traditional banking finances and who are not involved with blockchain technology, but who have the need to make transnational transfers this system can help them obtain a new sense of financial independence which could represent a great impact on the changing global financial system.

Banking entities are implementing this ODL technology to offer their customers remittance delivery services.

Many customers do not want to interact with a digital environment, nor know how a Front-End works, they only expect speed, transparency and low costs, so they leave the responsibility of cross-border transfers to their banks, who have found the best in ODL way to give immediate response to the needs of their customers.

Summary

It would be a mistake to declare that blockchain technology is taking over traditional finance.

On the contrary, the evolution of finance is currently supported on the basis of a large Blockchain.

All the financial operations that we know would be empowered when they are carried out under the concept and vision of DeFi. A simple cross-border money transfer, strategic partnership between companies, trade agreements, bond settlement, trusts.

Currently when we talk about DeFi many think of Ethereum, but for me this is a universal concept that cannot be restricted to a single blockchain.

Soon with the implementation of interoperability between blockchains, the DeFi phenomenon will be again catapulted to unsuspected limits so far and that can only translate into well-being for people.

Human evolution in progress.

You can also benefit from the experience of using the Brave browser.

Here I leave my personal link so you can download it: https://brave.com/jua900

Check out the full list of features here: https://brave.com/features/

FAQ: https://basicattentiontoken.org/faq/#meaning

@juanmolina

Partners supporting my work:

Project Hope Venezuela is an initiative created to grow.

You See more about it at:

@project.hope - INCREASE BY 50% YOUR WEEEKLY PAYOUT

@project.hope - PROJECT HOPE in SWITZERLAND

Please Visit Our Website

Join Our Telegram Channel

Join Our Discord Channel

I invite you to visit Publishx0 a platform where you can publish and earn cryptography.

LA NOTA VIRTUAL

Opinión sobre Tecnología, Finanzas y Emprendimiento.

Venezuela, Colombia y Latinoamérica

Cripto en Español

Posted via Steemleo | A Decentralized Community for Investors

Here I leave my personal link so you can download it: https://brave.com/jua900

Check out the full list of features here: https://brave.com/features/

FAQ: https://basicattentiontoken.org/faq/#meaning

@juanmolina

Partners supporting my work:

|  |

|---|

You See more about it at:

I invite you to visit Publishx0 a platform where you can publish and earn cryptography.

LA NOTA VIRTUAL

Venezuela, Colombia y Latinoamérica

Cripto en Español

Wow! This seems to be cheap and affordable for money transfer. I actually love this initiative and it really sounds cool since it's somehow related to blockchain technology.

I will love to ask how secure or safe it is? Like what's the exact grade you can give it when it comes to the level of security.

Thanks for sharing this great post with love from @hardaeborla ❤️💕❤️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow ... I don't know the exact degree of security, but so far there have been no reports of fraud with this system. There is also the guarantee of an entire company such as Ripple. The XRP token is used as the GAS of all transfer operations. Very few adverse opinions can be heard, as it is reliable, fast, transparent and safe. What more could you want?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is crazy how slow and dated the SWIFT network is!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It´s insane.

Blockchain is superior in all aspects.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's good to see more people writing about DeFi. I believe it is going to be one of the greatest topic as we move into this new decade.

I also fully agree that DeFi is not just about Ethereum, it can also be driven by other blockchains.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Brother, how are you?

I think I told you once that I became interested in DeFi after reading some of your publications that I liked very much.

This is definitely an extensive field of infinite possibilities. And as you say, it is not limited exclusively to Ethereum.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @juanmolina

Definitely all banks have to point to this type of financial scheme, where both banks and people are winning, banks with their commissions and people with the service.

I recently made a post where the whole JPMorgan theme launched its first hybrid blockchain.

That information points to the future of blockchain and banking finance.

Saludos, mi pana

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is that blockchain technology is like a ring to the finger, to the banks. I don't understand why they resist adopting it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting post @juanmolina

I think the swift is quite safe but the fees charged to use it are too high and this prevents many people from using the system.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nobody wants to pay fees.

With blockchain technology and P2P transactions, user mentality has changed a lot.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @juanmolina your post was in the category of finance/business and was submitted in a HoboDAO contest. In the future if you use the tag "int" we can reward you in INT tokens and help you reach high visibility on the Intrepreneur.life website.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh!

Thank you very much friends.

I really appreciate it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @juanmolina

Finally I had chance to read your old publication about DeFi. Thx for sharing link with me.

I sometimes wonder if there isn't currently to much hype around DeFi. Just like we've seen hype around ICO and then STO.

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

DeFi is the current financial phenomenon brother.

The figures confirm this.

Source

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm still trying to understand DeFi @juanmolina

I've read post about DeFi by @hash-tag ( https://hive.blog/hive-175254/@hash-tag/what-is-defi-and-how-is-it-different-from-traditional-finance-is-it-another-scam-that-i-should-know-about) and it got me so interested. I'm still not sure how does it work. It seem that DeFi allows to "borrow" fiat currency and use crypto as a collateral?

Cheers,

Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

DeFi allows you to do many things. Broadly speaking, there are two main aspects:

As you can see, it is a totally disruptive new technology.

An example that I always include:

The Spanish financial group "Santander" is one of the pioneering banks in the foray into DeFi. In 2019 they used the Ethereum platform for the liquidation of the interests of a trust bond of 20 million dollars.

Here is the link for you to learn about it:

https://cointelegraph.com/news/santander-redeems-20m-bond-using-ethereum-blockchain?_ga=2.210247893.1960222452.1593710805-1353565757.1592980920

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit