As we close out another year and another decade, it's often a time to reflect on the previous year/decade and a time to think about what we want to improve in the subsequent year/decade. Over the last couple of weeks, I have talked about the best / worst stocks and sectors. For example,

So the worst stocks of the decade go to:

- Apache. Ten-year performance: -78%

- Freeport-McMoRan. Ten-year performance: -68%

- Devon Energy. Ten-year performance: -66%

- The Mosaic Company. Ten-year performance: -65%

- CenturyLink. Ten-year performance: -63%

- Kraft Heinz. Ten-year performance: -56%

- Perrigo. Ten-year performance: -54%

- Under Armour. Ten-year performance: -54%

- Occidental Petroleum. Ten-year performance: - 51%

- Schlumberger. Ten-year performance: -31%

The worst stocks of the decade go to:

- Abiomed: -48%

- Macy's: -44.7%

- Occidental Petroleum: -34.4%

- Gap: -31%

- DXC Technology: -31.1%

- L Brands: -28.9%

- Mylan: -28.1%

- The Mosaic Company: -27.2%

- Kraft Heinz: - 26.6%

- Alliance Data Systems: -25.9%

But it's only right I give some love to the ETFs. An exchange-traded fund (ETF) is an investment fund traded on stock exchanges, much like stocks. An ETF holds assets such as stocks, commodities, or bonds. An ETF invests in a portfolio of separate companies, typically linked by a common sector or theme.

The best ETFs of this past decade are:

- iShares PHLX Semiconductor ETF SOXX – Up 412.5%

- First Trust Dow Jones Internet Index Fund FDN – Up 456.6%

- SPDR S&P Biotech ETF XBI – Up 438.3%

- iShares U.S. Medical Devices ETF IHI – Up 400.1%

- Invesco QQQ Trust QQQ – Up 366.9%

- iShares U.S. Aerospace & Defense ETF ITA – Up 340.2%

- Consumer Discretionary Select Sector SPDR Fund XLY – Up 323.4%

- iShares U.S. Healthcare Providers ETF IHF – Up 316.4%

- First Trust U.S. Equity Opportunities ETF FPX – up 302.9%

- Fidelity NASDAQ Composite Index Tracking Stock ONEQ – Up 291.1%

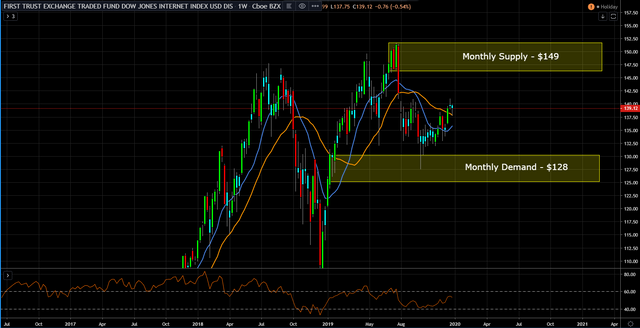

First Trust Dow Jones Internet Index Fund FDN

The Dow Jones Internet Composite Index is a float-adjusted market capitalization weighted index designed to represent the largest and most actively traded stocks of U.S. companies in the Internet industry. The exchange-traded fund, FDN, seeks investment results that correspond to the Dow Jones Internet Composite Index. Top 10 holding include...you guessed it the FANG stocks.

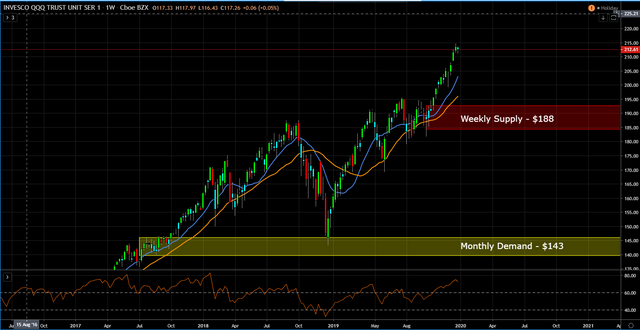

Invesco QQQ Trust QQQ

Invesco QQQ is an exchange-traded fund based on the Nasdaq-100 Index. QQQs is one of the most traded ETFs in the world and includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization.

The Invesco QQQ ETF first hit the markets on March 10, 1999. After 20 years, QQQ is now the sixth largest U.S.-listed ETF with $66.4 billion in assets under management.

QQQ’s the top three sectors are: 60% technology, 22% cyclicals and 9% healthcare.

Top components include are Microsoft (NasdaqGS: MSFT) 10%, Apple (NasdaqGS: AAPL) 10%, Amazon.com (NasdaqGS: AMZN) 9% and Facebook (NasdaqGS: FB) 5%.

The beauty of ETFs is that they offer diversification, very liquid and easy to trade, low expense ratios and no minimum dollar amount compared to mutual funds, they offer dividend yields and if you are bearish on the Markets, some ETFs offer options.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.