Bitcoin hasn't yet managed to break $20,000 and my prediction made on Monday on twitter, in this regard, is clearly failing. BTC seems to have hit a quite strong psychological resistance at the $20k level and not even renowned analysts don't seem to be knowing where it's heading. Kind of hard to predict it I guess, but at least they're trying...

You don't have to be a genius though to realize that the number one cryptocurrency by market capitalization is gaining exposure and that we're certainly in the middle of a bull market, that started quite soon after the halving, as it usually does. It all makes sense when you set the puzzle pieces right. What's more obvious also is that the large financial institutions such as Grayscale are accumulating Bitcoin, even at the current levels which are close to its ATH, like there's no tomorrow.

542,880.4 BTC is now sitting in the Grayscale bitcoin Trust Treasury, making it the largest BTC whale in existence. Well, kind of, as I remember Satoshi setting asides some 1 million BTC for himself as well, but taking Nakamoto out of the equation, it's the above mentioned Bitcoin Trust that owns the most BTC from the current existent supply. Quite a large portion of the whole mined pool seems to have been lost forever making BTC even scarcer.

What's Grayscale, that everybody's talking about?

Grayscale's Bitcoin Trust is a public Bitcoin fund built for investors who want Bitcoin exposure in the form of a security, without the challenges of buying, and storing BTC directly.

Accredited investors give Grayscale cash to buy Bitcoin with (or give Bitcoin directly) in exchange for Grayscale's Bitcoin Trust shares. These shares are backed by a set amount of Bitcoin, and their underlying value tracks the performance of Bitcoin less a 2% annual fee.

Grayscale's Bitcoin Trust is publicly traded under the ticker GBTC.

source

Just on Friday, this week, Grayscale itself has bought 7,188 BTC which is eight times the amount of BTC that's been mined on a daily basis. They might be knowing something, right? I'd say yes, otherwise such an investment fund wouldn't jump into buying the bubble of the bubbles, or the modern times tulip. My take is that they either bet on the aggressive price appreciation that BTC is doomed to experience in 2021, some 500 days after the halving, or on the constant devaluation of fiat money, or both. Otherwise they wouldn't buy lately, as they do, at an average price of $19,430. It's clear though that Grayscale is not for a scalp...

Taking all this into account we can say that thus far, fatty institutional bulls have taken BTC close to $20,000, and not the plebs, and they seemed to have already fomoed into the crypto world. They're not stupid you know, they enter the marlet when the price is low and don't ring too much bells around that. Well, it's in the news that MicroStrategy is buying Bitcoin as well, same as PayPal does, who's planning to offer its customers the option to do so as well, while keeping the coins in their custody instead of handing the private keys to the plebs, but not much buzz in the mainstream media in this regard.

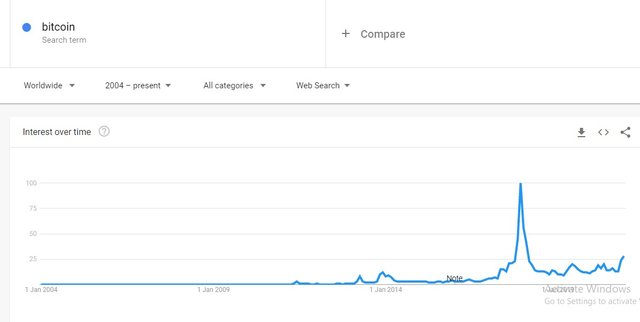

The retail bull seems to have awoken though, or we could say it's gradually opening its eyes, and google trends is here to prove that. In the above screenshot you have the chart of the bitcoin google search term world wide, on a 2004-present time frame, showing clear signs of an uptrend. It is obvious that retail investors interest strength according to google trends, towards Bitcoin, is still at the September-October 2017 levels, which is a sign of a quite early bull market currently.

I call retail investors dumb money, as most of them really act as such in this market, and am not the only one calling them as such, and I won't be surprised for the interest towards Bitcoin reflected by the google trends search to peak by the time BTC's price will also peak. Predictable, right. It is though encouraging to see that even at the current price level, there is a strong buying power and interest for Bitcoin, and although it might dip in the near future, which I honestly don't expect to happen, we're still far away from the peak.

Many more experienced crypto folks in here, and on twitter as well, @edicted included are expecting December to be a hot month for crypto and that's what my gut feeling tells me as well. We might probably see a longs squeeze soon, to make the show even funnier, but it's only up we go from here. Remember, there's no overbought in a bull market, and we still have almost one year left till the forecasted peak for BTC, so have fun and use this time wise.

Thanks for attention,

Adrian

lol, are there any ways to know for sure if grayscale actually bought these amount of bitcoin? I'd really love to know.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit