In 2021, the whole Bitcoin network assumingly accounted for around 105 TWh of consumed electricity. Put into perspective, the whole country of Germany produced around 518 TWh of electricity in 2021.

So it’s rather fair to say that Bitcoin needs a staggering amount of electrical energy for its operations, and it has indeed raised the (governmental) interest of climate-concerned parties. A recent study estimated the climate impact of Bitcoin mining and concluded that Bitcoin it is roughly on the same level as global beef production and burning crude oil as fuel regarding the negative climate impact.

Another often-used angle in this discussion is the comparison between the energy usage of a single Bitcoin transaction and a VISA transaction. It's rather easy to publish a figure where one Bitcoin transaction comes at an energy consumption of around 1.4mn times higher than the consumption of a VISA transaction (as Statista did here) and then mock the un-fitness of the network in general.

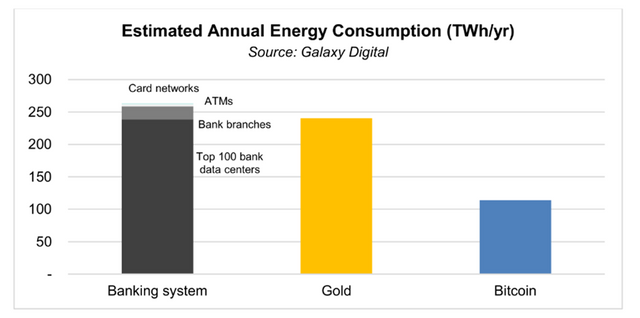

This was never a fitting comparison, as we must acknowledge that a Bitcoin transaction in itself is all set and done regarding settlements, whereas VISA is just one of multiple settlement layers needed to actually transfer money. Therefore, a comparison of the energy usage of Bitcoin and the worldwide traditional banking system is much more fitting. Galaxy Digital researched this topic and came up with a factor of roughly 2.5 of energy used by the traditional banking system compared to Bitcoin.

This article is not about starting up a blame game of which industry is more energy-intensive than another, as it always comes down to the question of which industry is more valued or needed by a certain individual than by another. Paraphrased, the discussion always has the subtext on which product “it’s okay” to spend energy on.

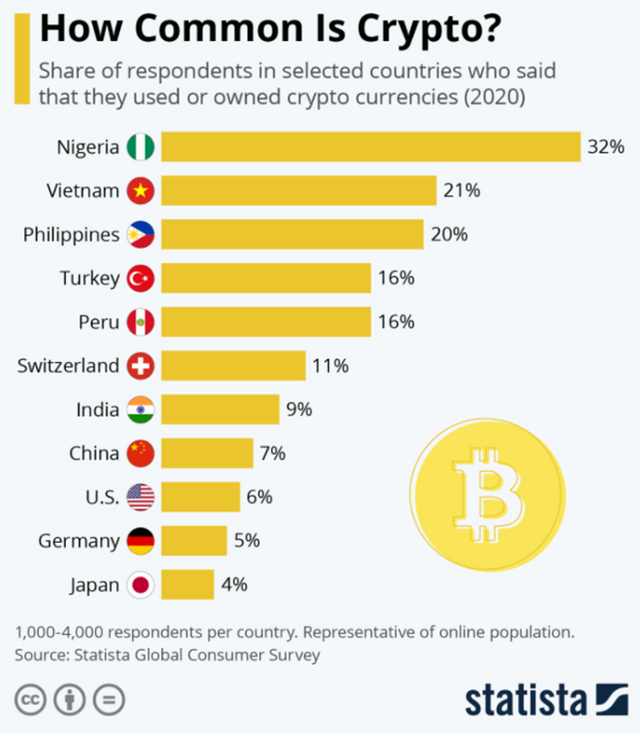

It’s easy for a human living in a metro area with great public transport to determine the energy use of fossil-fueled cars as a “waste of energy,” whereas for people in rural areas it is a necessary means to manage life, as the next grocery store may be miles away from home. The same goes for people who have easy and cheap access to the worldwide finance system through their stable and reliable banks in developed countries, whereas people from other countries without affordable access to banking services might value access to international money sending-and-receiving through a smartphone-based crypto wallet.

See this figure for example, as it is underlining the point from before:

So, let’s assume for a moment that the fiat currency system in total and the Bitcoin network as well have a real-world use case for some people and focus on what the electricity is needed for in the Bitcoin network in the first place.

Why does Bitcoin need electrical energy?

As found in the original whitepaper of Bitcoin, the proof-of-work (POW) consensus system is used to add new blocks to the blockchain that contain transactions in the network. Nodes are solving complex mathematical calculations in competition with other nodes whereas the network node which found the solution is allowed to add the latest block to the chain and gets a reward in Bitcoin for doing so.

The POW approach is widely understood as mining, whereas the nodes trying to add new blocks are referred to as miners. These miners will have to invest a certain amount of CPU power by setting up rigs capable of performing the calculations and a certain amount of electrical energy to run these rigs, so they are investing upfront for the chance of adding a new block to the network and gaining the reward in Bitcoin. This is classic entrepreneurship: Investing upfront in promising chances of reward, with the ideal case of rewards over-compensating the initial investments and making revenue.

This factor must not be underestimated, as it is a hard-wired governance system inside the Bitcoin network system that needs no third party thanks to the high energy costs of mining. As each participant of the network (node) has to invest valuable resources (electricity and hardware) to create new blocks and get rewarded with freshly-minted coins, the nodes are economically incentivized to maintain the network in good health to gain a positive ROI on their investments. Even if one player in the market would be able to accumulate 51% of the CPU power and therefore would be in the power of reverting transactions and actually use the same coins twice for paying, it would still be much more profitable to use the CPU power in the sense of the network and mine new blocks with valid transactions and get more rewards than all other nodes combined.

Some people say the energy is wasted for every miner who doesn’t happen to find the block and get rewarded the reward, but this isn’t actually true: The network and its users get a real value-add in exchange for all this work performed and energy consumed. This is the complete governance and law-enforcement process built-in, which must be taken out by third-party authorities in the fiat system.

This article is making the case for regarding the energy usage of Bitcoin as the cost of governance, understood by maintaining the network stable and safe. Not only is comparing the costs of governance and upkeep of a currency system much more suitable, but it also works so much better in understanding why this amount of energy is needed.

So, for all the energy that is put into the network by the miners, the users get a valid service: This is governance and maintenance of Bitcoin as a currency without having to rely on third parties.

Just because we don’t pay it directly as a tax or see it working, it would be wrong the assume the governance for fiat currencies is delivered for free. The Federal Reserve System of the USA had net operating expenses of about USD 5.7bn in 2021. Yes, you read that right: 5.7 Billions of Dollars in one year. Also, they employ ~21k people in this system. (Source)

Final Thoughts

This article intended not to compare energy usage with a regard to the importance of several industries, but more in a way that is comparable to fiat currencies by understanding energy usage as the costs of governance and maintenance.

Acknowledging this line of thought might be controversial, but this article is proposing a narrative to understand the high energy usage of the Bitcoin network not as a bug, but as a feature instead.

Originally published on Diamond App, a decentralized social media platform powered by the DESO Blockchain. DESO is the new standard for social media on web3, so give yourself a head start in the upcoming revolution and sign up here.

Congratulations @tango-mike that´s a real good post about this topic of energy consumption, which constantly comes up in discussions and is usually misrepresented.

Good to see that there are some out there who had the view from above on that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much, @don-t! I'm glad this post is of value to you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Google is paying $27485 to $29658 consistently for taking a shot at the web from home. I joined this action 2 months back and I have earned $31547 in my first month from this action. I can say my life has improved completely! Take a gander at what I do...

http://career42.tk/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit