Liquidity pools are the favorite investment product of the DEFI era as the APRs are way higher than other investment alternatives.

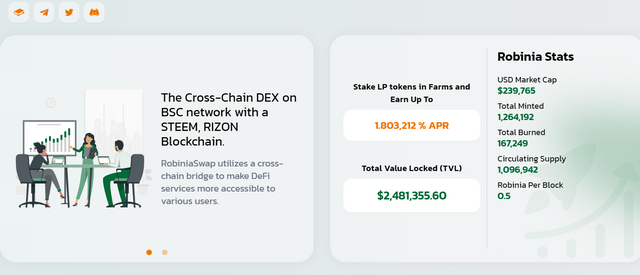

The APR of a liquidity pool is determined by several factors. Coins produced per block, the price of the reward coin, and the coefficient allocated for the relevant pool. The Robinia price has been stabilized at around 0.21 USD for some time now. Robinia coin production has recently dropped to 0.5 units per block and will remain at this level if no extra regulation is made.

I thought it would be appropriate to make a comparison with Pancakeswap when the level of return on Robinia pools and farms has stabilized.

For those who are unfamiliar with liquidity pools and Robinia, I would like to leave two links below.

Liquidity Pools Explained

An Important Milestone For Steem: Robiniaswap Launch

Low-Risk Farms

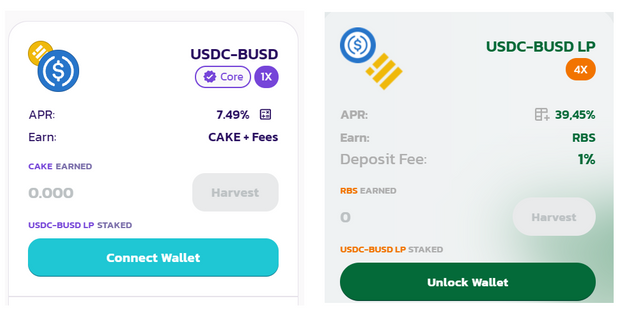

Investors who do not want to take the risk of price volatility prefer to invest in stable coin pairs through DEFI applications. Thus, they can get an annual return of more than 5 percent on the American dollar. Below you can see the Pancakeswap Robiniaswap USDC-BUSD farm comparison.

1 percent commission is paid for investing in Robinia pools. Under the assumption that the price of Robinia will not change, it is possible to gain this commission in 10 days and then enjoy a high return. There are also alternative stable coin pairs in Robiniaswap and Pancakeswap.

Medium Risk Pools

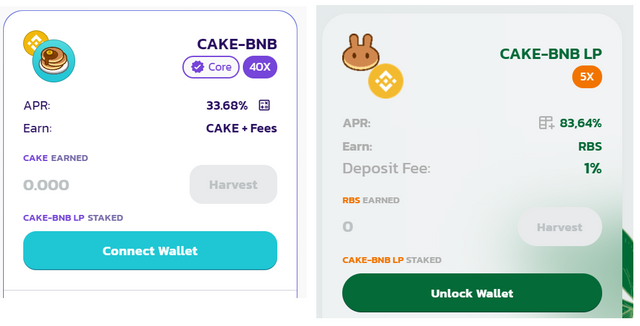

The picture in terms of the pool consisting of Cake, the cryptocurrency of the Pancakeswap application, and Binance's cryptocurrency BNB is as follows.

We also see that Robiniaswap provides a significantly higher return in this pool. Assuming that the Robinia price will not change, the amount equivalent to the 1 percent commission can be earned from the pool in 4 days. Then a fairly high-yield investment remains in the hands of the investor.

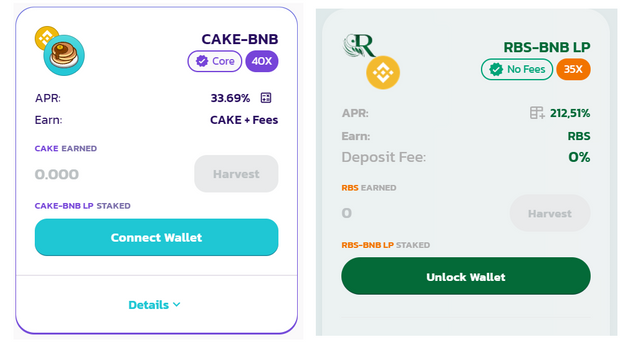

High Risk-High Return Pools

This time, the difference is much greater in favor of RBS, since it comes to RBS investment, which has a relatively high price fluctuation risk. Moreover, there is no commission in this pool.

The critical question here is whether the RBS price can stabilize. With the latest arrangement, the number of RBS produced per day fell to 15,500 units. Currently, an average of about 8-10 thousand RBS is burned per day. The income of the 500k Steem owned by Robinia is currently being used to burn RBS coins. The project team announced that the Steem delegation would be accepted in a week and the extra revenue generation would begin. In this case, it will be possible to burn a larger portion of the generated RBS tokens.

I don't know if these arrangements will be enough to stabilize the RBS price. There may also be a strong price increase.

In this article, I tried to figure out whether it would make sense to invest in Robiniaswap. I suggest you do your own research before making any investment decisions. And I want to point out that I am not an investment expert.

Thank you for reading.

Robinia Website: https://robiniaswap.com/

Robinia Official Documantation: https://blokfield.gitbook.io/robinia/

Robinia Discord Channel: https://discord.gg/wGv4UjER2f

Image Source:https://undraw.co/illustrations

Dear @muratkbesiroglu

Dont you have an impression, that most LP providers do not understand risks behind being a liqudity pool provider?

Thanks for another publication which is bringing up topic of RobiniaSwap and explaining it all in more details.

Upvote on the way :)

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @crypto.piotr,

People have to consider impermanent loss and smart contract risks before investing in any liquidity pool. I have posted an article explaining the risks and benefits last week: Investing In Liquidity Pools: Opportunities & Pitfalls

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 1/6) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit