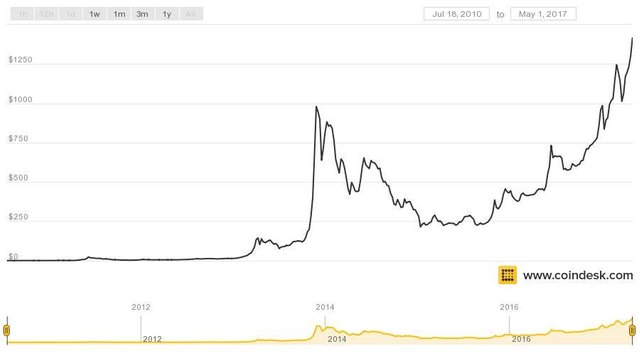

In mid-2016 the price of bitcoin was about $580. Fast-forward to December 2017 and the cryptocurrency has roared past the $17,000 mark. To put that in perspective, had an investor anted up roughly $6,000, those 10 bitcoins today would be worth $175,000. Not bad for an 18-month wait.

And so comes the temptation that any level-headed market maven will ignore: Is it time to buy into bitcoin – or any soaring commodity, for that matter – when the price hits an unprecedented, giddy peak?

The answer any seasoned value investor or buy-and-hold guru will give is an unequivocal "no." But the same financial market that brought you the term "irrational exuberance" oft chases fantasies of a bottomless punchbowl. Bitcoin marks the latest example. Buying on margin in the U.S. stock market just before the crash of October 1929 certainly ranks as the costliest.

Historically speaking, few, if any, asset classes have outperformed the stock market over the long term. Including dividend reinvestment and inflation, the stock market has returned an average of 7% annually. It has run circles around other assets like gold, bonds, oil, and even home prices.

But 2017 has been a year like no other. It has introduced the world, loud and clear, to cryptocurrencies. When the year began, the aggregate market cap of all digital currencies combined equaled just $17.7 billion. Earlier this month, the aggregate value of these cryptocurrencies soared past $225 billion. This represents almost a 1,200% return in less than 11 months, which the broad-based S&P 500 has taken decades to accomplish.

Warren Buffett

When it comes to Wall Street, the man that everyone knows is Warren Buffett. Buffett has been so successful in his storied investing career that his name has become synonymous with value investing. Buffett began at age 11 by buying six shares of oil services company Cities Services in 1941. Twenty-one years later, he was a millionaire. Buffett's net worth now is roughly $73.7 billion, making him the third-richest person in the world.

Buffett's investing strategy throughout the years has been remarkably consistent: invest in stocks that present long-term value and companies that have a durable competitive advantage. The central principle of Buffett's philosophy is patience. Buffett has routinely waited 10 years or longer before cashing out of his positions.

Buffett has served as an inspiration, a calming voice and a leader by example throughout his career as an investor. Unfortunately, that career will not go on forever. Buffett is currently 86. While the investing community loves having Buffett around, the "Oracle of Omaha" isn't immortal.

BUT what does BUffet says about BITCOIN?

On CNBC in 2014 Buffett said:

“Stay away from it. It’s a mirage basically,” The idea that it [bitcoin] has some huge intrinsic value is just a joke in my view. You can’t value bitcoin because it’s not a value-producing asset. People get excited from big price movements, and Wall Street accommodates, he was quoted as saying. Describing bitcoin as a “real bubble”. A check is a way of transmitting money, too. Are checks worth a whole lot of money just because they can transmit money? He said it wasn’t possible to determine how high it will trade for. According to him, there’s “a real bubble in that sort of thing.”

What are the risks to Bitcoin>?

First Bitcoin's blockchain loses its appeal

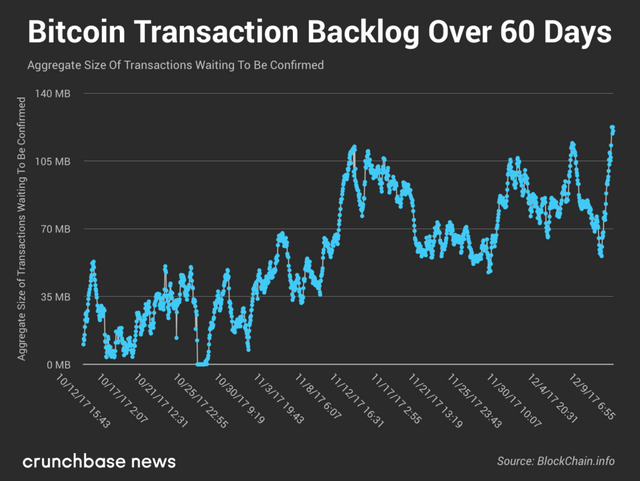

The real value with cryptocurrencies lies with their blockchains. At the beginning of August, following a soft fork that saw bitcoin separate into two separate currencies (bitcoin and bitcoin cash), bitcoin's blockchain was upgraded. This upgrade moved some information off of bitcoin's blockchain in order to boost capacity and transaction settlement times, as well as reduce transaction fees, in an effort to attract enterprises.

Second brand-name businesses stop accepting bitcoin

Since 2014, a handful of brand-name businesses have accepted bitcoin as a form of payment, with smaller merchants latching on in recent years. Some investors view this growth in bitcoin's payment platform as a good reason to buy.

However, it could also be a source of investor frustration. If bitcoin remains volatile (remember, it's had three declines of at least 29% in a very short period of time over the past five months), there's the real possibility that merchants could bow out of accepting the virtual currency. A potentially lengthy settlement period gives bitcoin time to move against the grain, which could mean converting bitcoin into a lot less cash than when a transaction was completed. If brand-name merchants bail on the virtual currency, bitcoin's price could tumble

third: A double-edged sword of regulation

In some ways the regulatory environment for bitcoin has been a positive in 2017. Japan began accepting the currency as legal tender earlier this year, and the CME Group (NASDAQ:CME) -- operator of the world's biggest derivatives marketplace -- recently announced that it would begin carrying bitcoin futures by the end of the year. These moves help to validate bitcoin as an investment and a form of tender.

Fourth, A cyber attack hits Bitfinex (or another cryptocurrency exchange)

Another critical risk for bitcoin -- and all cryptocurrencies, for that matter -- is the potential for a cyberattack. Four years ago, Mt. Gox, which was handling about 70% of bitcoin's trading volume at the time, was hit by a crippling cyberattack. In the bankruptcy filing from Mt. Gox just months later, it cited the theft of 850,000 bitcoin (worth $6.8 billion today) and cash. In the two years following this cyberattack, bitcoin wound up losing more than 80% of its value.

So, what would you say?