I'm reposting an interesting article by Mike "Mish" Shedlock, as follows:

Fed Chairs Ben Bernanke and Janet Yellen re-blew the Alan Greenspan initiated housing bubble.

However, the trend towards higher and higher home prices started well before that dynamic trio made a mess of everything.

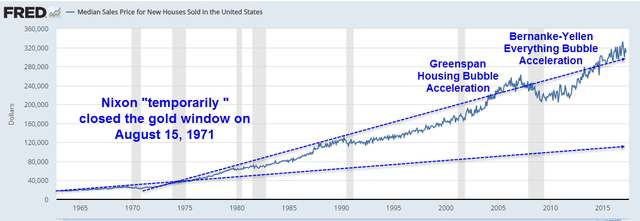

The following picture shows the true origin of escalating home prices.

Median Home Prices 1963-Present

To be fair, homes have gotten larger, with more features, better windows, etc.

However, it is safe to say the explosion in credit that started when Nixon closed the gold window, ending convertibility of dollars for gold accounts, coupled with inane policies of the last three Fed Chairs accounts for nearly all of the price acceleration.

Real Homes of Genius

Dr. Housing Bubble provides an excellent example in Real Homes of Genius, including pictures of tiny homes listed for close to $500,000 in the Los Angeles area.

Today we salute you Los Angeles with our Real Homes of Genius Award. When half a million dollars isn't worth moving a trash bin:

3525 Portola Ave, Los Angeles, CA 90032

2 beds 1 bath 572 sqft

This place is tiny. 572 square feet.I actually like the trash can being left in the picture overfilled with crap to show you a better perspective on how small this place is. The ad is written in beautiful prose that really makes your heart jump with joy:

"Why Rent when You Can Buy! This House Features 2 Bedrooms and 1 bathroom with lots of potential especially for a First Time Home Buyer. Great Location close to Downtown Los Angeles, centrally located near Schools, Parks and Shopping. This house has been nicely upgraded."

So let us take a Google Street View here:

More trash cans! One trash can looks like it is crossing the road or gearing up to strike a pose for another realtor's ad. Now some might say "hey, this is a working class neighborhood!" And to that I would say, of course it is! That is why it is so mind numbing to see this tiny place listed at $470,000.

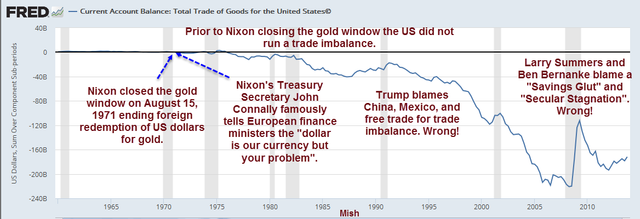

Explaining Balance of Trade

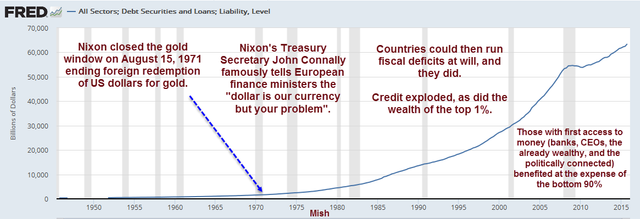

Total Credit Market Debt Owed

"Our Currency but Your Problem"

Starting in 1971, credit soared out of sight to the benefit of the banks, CEOs, the already wealthy, and the politically connected.

The source of global trading imbalances, soaring debt, escalating median home prices, declining real wages, and the massive rise of the 1% at the expense of the bottom 90% is Nixon closing the gold window.

At that time, Nixon's Treasury Secretary John Connally famously told a group of European finance ministers worried about the export of American inflation that the "dollar is our currency, but your problem."

Balance of trade issues, soaring debt, declining real wages, and the demise of the US middle class are now our problem.

The Fed, ECB, Larry Summers, Paul Krugman, Donald Trump, and economists in general cannot figure out the real problem.

Bernanke proposes a "savings glut", and Larry Summers proposes "secular stagnation".

My challenge to the Secular Stagnation Theory of Summers has gone unanswered.

Original story: mishtalk.com

Glad to have learned that I missed out this tiny home that I couldn't afford out in LA at the time that appears to almost be blocked out by trash cans.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

For anyone else curious about why the $ amount is in a lighter text colour :

Is there a convenient way to set this option yet ? I'd like to post more but don't wanna drain the pool, or reject payment on everything so being able to set a low cap would be nice :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No, not on steemit.com, anyway.

While steemit.com fails to offer a

max-payoutUI option, here are a few workarounds:Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice answer - I'd never explored the scheduled post feature on streemian thanks for the heads up :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Its sad how high the price of homes in SoCal. Sickening actually.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great read. I was constantly comparing the $470k house to where I live. Boy, we have it so cheap here in India.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article man. You got my vote. Whenever anyone reads this you'll get theirs too. That LA house doe.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting read while drinking my mornig coffee, thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is unbelievable... smh... It's sad how much they are getting over on people..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article. Although it's sad, the trash can story made me laugh.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice post although you rewrite it @inertia

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Rewrite?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think Ageel meant you reposted it... yet it's a good read! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit