It is now proven that renewable energy is a viable energy source that can replace traditional fossil fuel-based energy sources. Over the last few years we have seen development and investment pick up at a impressive rate and as the future of the world depends on it, we should continue to see investments flow into renewable energy.

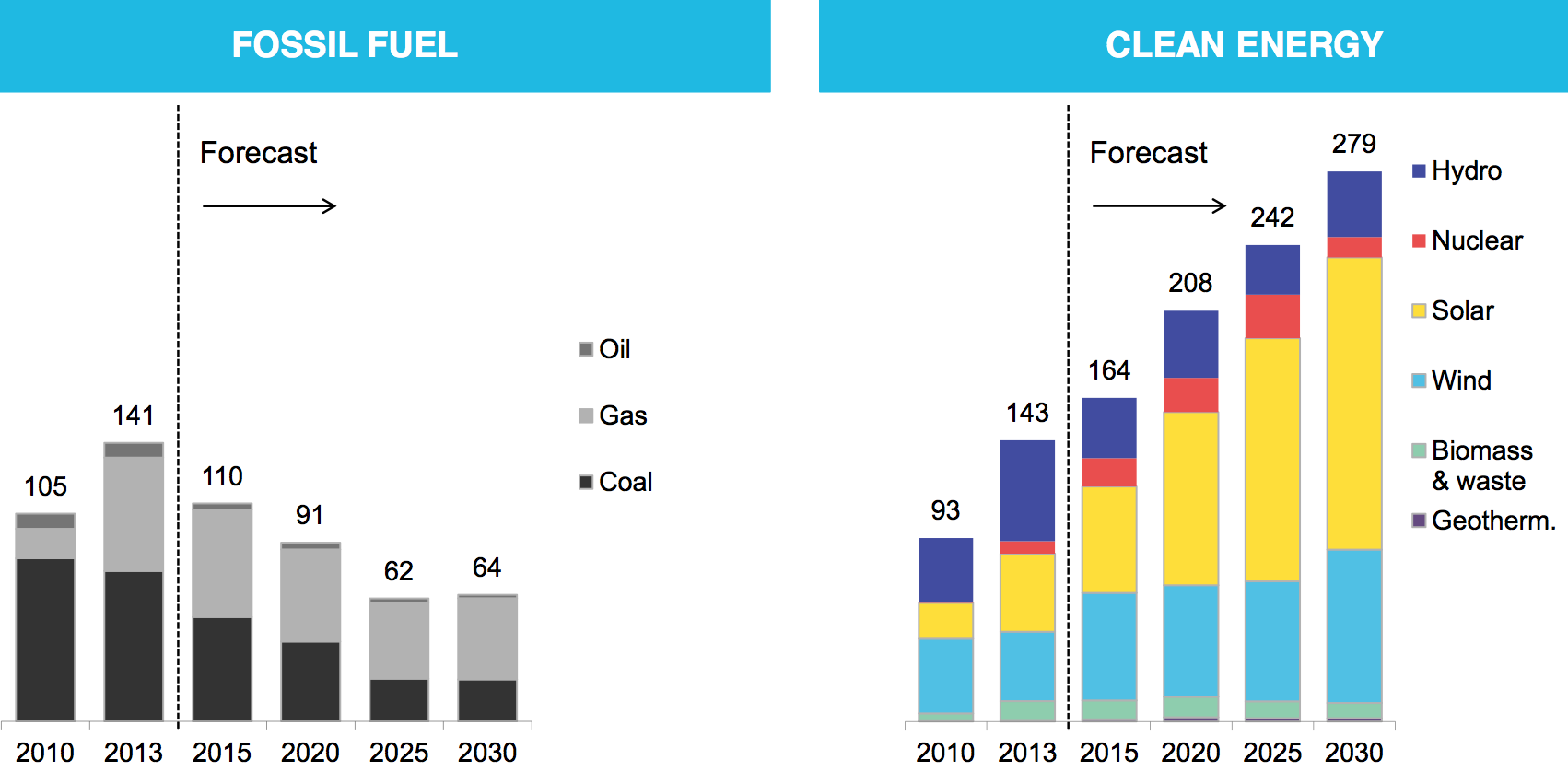

Take this forecast from bloomberg. Source: theenergycollective.com

It is not showing any signs of stopping, solar for example, is getting cheaper and is actually creating jobs at a rate of 12x in the US compared to the rest of the economy. Source: fastcompany.com

Investing in Renewable

For the average person, investments can be intimidating, however we believe that it does not need to be. With the introduction of crypto tokens and blockchain projects it has allowed people to be in complete control. Currently there are plenty of investment opportunities however there are only a few that are growing a such a rate. While it can be intimidating beginning your investment journey, it is becoming increasingly secure and safe to invest. Unlike the rise and fall of companies like Kodak, it is important to note that the need for energy will not go away and in the case of renewables, there is a lot of room to grow as the world moves to renewable energy sources. There are still hurdles to overcome regarding storage of energy but companies like Tesla (thanks again Elon) are solving this problem (Link to battery power)

Over the last couple of years, there has been an increase in crowdfunding and crowd investing as a good and viable alternative to traditional financing. The most popular platform being Kickstarter which ‘promises’ you goods in exchange for their financing. This is an important differentiation to make, these were mostly ‘pre sales’ of their product with no promise of a ROI, just a quality product. Despite this, projects continue to be funded and it has become a standard in project financing. The same holds true for projects based on more traditional financing models generating ROI on the money put into projects. These deals either take the form of Equity investments or loans. Either way, the deals are structured so that you get ROI of the money you put up front.

Platforms for investing

Platforms have been key to funding as they have acted as gatekeepers to ensure that projects go through a due diligence process and are found by potential investors. This has avoided the scene to become a Wild West, like the recent ICO bubble while ensuring a ‘safe -ish’ environment to invest it. It is important to note that it is always up to the investor to do their own personal due diligence and should have knowledge of the market he or she is investing in. This is the reason why returns are always represented as ‘estimated returns’.

While they have lead the way, there are a few issues that turn off investors:

- Lack of updates from the projects.

- This stems from a lack of transparency. At the end of the day being more transparent allows investors to become more involved (if managed in the right way).

- High fees associated with using the platform.

- Platforms take a fee either per investment or per successful project.

- The fees also have to pay the middlemen who ensure the transaction is legal, regulated and the agreed terms are met.

- They tend to be focused on certain project types

- To cater to certain audiences they are focused on, either real estate, new companies or new alternative forms of energy.

- Geographical focus

- Due to difficulties of going worldwide, platforms tend to be localised to regions that cap their growth and user base. This also limits the variety of projects that people can invest in.

The Future of investing - EcoChain

With the recent introduction of blockchain technology, we now have tools to remove some of the traditional barriers that have stopped people from investing in these projects. You guessed it right, we want to solve these problems and aim for the following:

- Transparency

- By storing things in a public ledger it leads to more transparency over the complete process, where did money go as you will be able to see entry and exit points.

- By using smart contracts, investors are able to clearly review the legal procedures that are controlling their funds.

- The tokens you invest act as an immutable records of your investment

- More control over funds

- By using tokens that people control, it removes the need for banks and clunky transactions. You want to invest, simply deposit tokens into your account (or purchase) and then

- Measureable impact that is traceable

- By being pro transparency and having a technology that can scale out of the box, per token that is issued we can also attribute extra information like carbon credits. This can, in the future, be tied in to create combinations of tokens

- Minimal

- Focus on the information matters, include simple, explorable layers of abstraction.

If you are interested in any of the above and want to learn how we are going to improve the way crowdfunding is done, check out our website or contact us to speak to a member of our team.

Read more on EcoChain or the complete BCDC whitepaper. Our Pre Sale is now open

Congratulations @bcdc.online! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @bcdc.online! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit