I just completed my part-time masters in Dec, and ever since then, have been spending quite a great deal of time exploring new ICO projects online. Personal opinion on the markets is that the big guys (bitcoin, ethereum etc.) are gonna take a breather for a while; they have already benefitted tremendously from the spike in mainstream recognition of cryptocurrency and more importantly, the blockchain technology underlying the tokens. So comparatively, the ICO space likely has a higher growth potential, returns-wise, for say the next 6-12 months.

It is on that note that I would like to share my views on the Credits ICO project. I found the ICO ard mid-Jan, and was already relatively interested in what they had to offer. The rapid rise in popularity (currently 15k telegram users, 6.6k twitter follower) made me decide to take a much closer look at the project. [Disclaimer: I'm performing a content bounty for the project, but i guarantee that I will not be shilling untruths. What I'm presenting is my honest interpretation of the Credits' site, whitepaper and other materials, in a simplistic fashion for ease of reading.]

First of all, WHAT is Credits?

Credits, is at its core, a BLOCKCHAIN PLATFORM, aiming to bring all users and providers of financial services (to transact) together on the same locus. While at first, this seems like a daunting goal, a closer examination of the various types of common financial services (domestic payments, offshore payments, loans and deposits, securities exchange and trading) reveals to us a key truth, i.e., the value add that intermediaries such as banks provide in ALL these activities is essentially just verification of transactions/ownership and settlement. And blockchain tech's ability to (i) execute smart contracts and (ii) provide a secured record of all transactions on distributed ledgers, powered by cryptocurrency tokens (in this case the Credits token), is essentially a perfect fit for the conduct of financial services. This too, is why Fintech, or the faciliating of fin svcs provision/development with new tech protocols, is often associated with blockchains.

WHY Credits?

Why then, would credits be superior to legacy internet banking and trading platforms, or other existing blockchain platforms. It would be easier to answer the former first. Legacy banking/fin services platforms suffer from high commissions, fraud and in some occasions such as offshore payments, long transaction times, which blockchain tech aims to resolve.

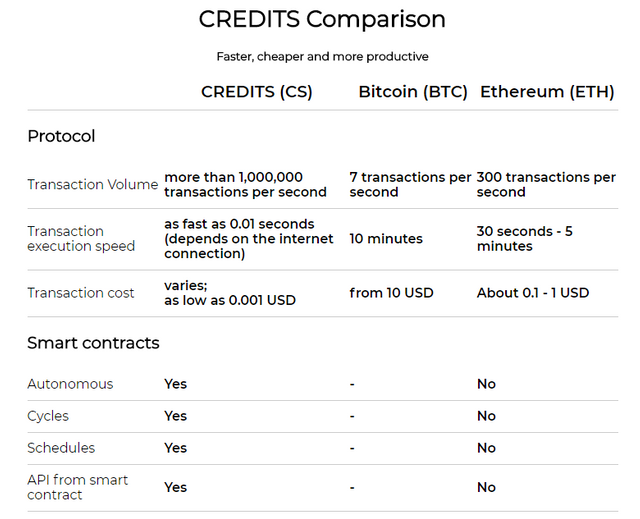

However, the current state of blockchain platforms, even for big names like ethereum, leaves much to be desired. The eth network for instance, is almost always busy ever since transaction or smart contract execution volumes shot up in late 2017, and transactions fees can sometimes range from 5 to 20 usd (personal experience), especially if high gas fees needs to be paid in times of urgency. I still remember when the recent cryptokitty craze (i myself own a few digital cats) clogged up the network and caused fees to skyrocket. Despite high fees, transaction times can take anywhere from a few minutes to a few hours, depending on ur position in the transactional queue. While such issues associated with inherent low transactional capacity, long processing time/high latency in smart contract execution and high costs came to be accepted by many as a fact of life, I've often wondered if there was another way. (see comparison table below)

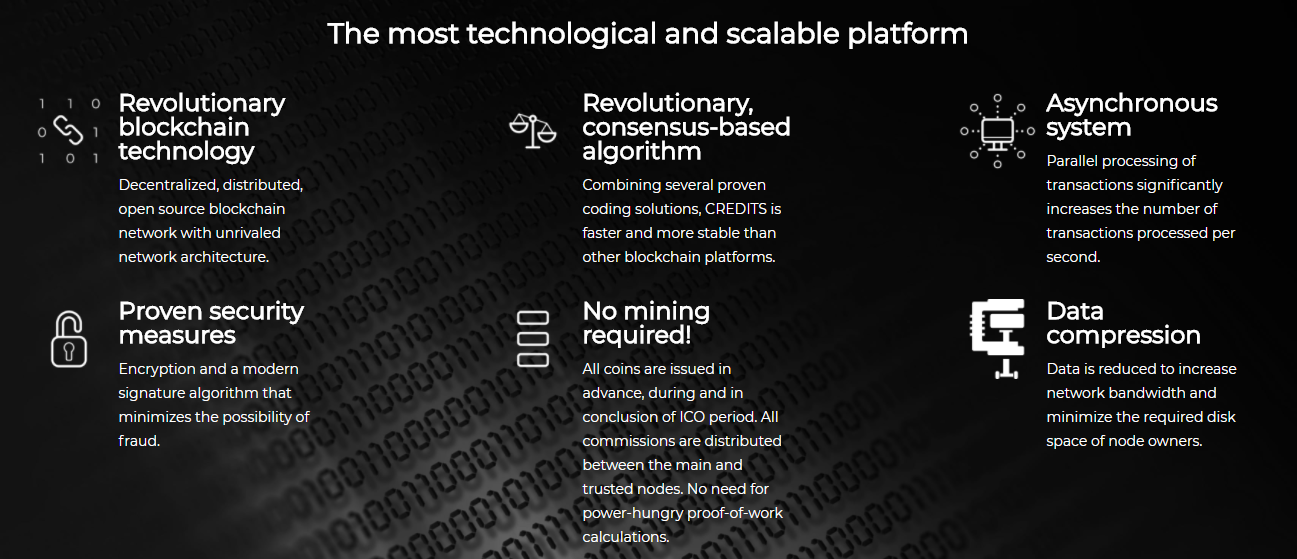

And here comes Credits. Admittedly, it was beyond my technical capability to fully comprehend the full tech design and specs, but here's what I gathered. Credits was a blockchain protocol that was going to be fundamentally different in design from say ethereum, bitcoin or other cryptos out there now, with a structurally different approach with regards to how different node roles were assigned, and in how the transaction ledger was maintained. For the technical details, and in the DYOR spirit, pls do visit the following two links listed, but the quick graphic captures the salient tech features of the credits platform.

whitepaper: https://credits.com/Content/Docs/TechnicalWhitePaperCREDITSEng.pdf

technical paper: https://credits.com/Content/Docs/TechnicalPaperENG.pdf

The main notable utility and efficiency gains from the blockchain revamp is also summarised in this cool graphic copied from the main credits.com site. Basically, never-before seen blockchain capacity, speeds and (low) fees, even while the credits team tried their best to incorporate advanced customisable smart contract design and execution functionality onto their platform.

Other ++s

The team's incredible focus on doing 1 thing (simple, user-friendly, scalable, quick, trustless fin svcs platform), and 1 thing well alone was more than enough to make me fall in love with the project. It was repeatedly emphasised that the Credits platform will be all-in-one and self-sustaining, i.e., no further third party services will be required, to ensure that fin svcs providers and users can transact on the platform.

But here's just to throw in a few more plus-points.

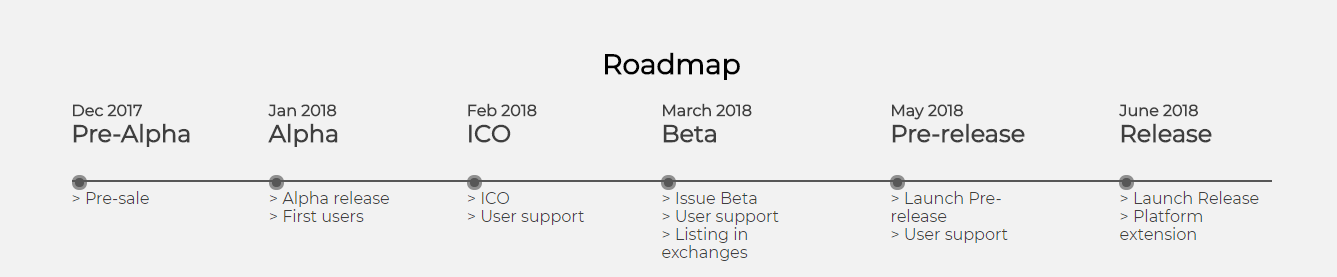

Given the robustness of the white/technical paper, the team could have came out much earlier on and "asked for" money. But no, they waited till they had a minimum viable product (MVP), available on their site for testing. The roadmap is also one of the clearest among all the ICO projects I've seen, with key technical and operational milestones flagged out over the next several months.

Besides having an air of solid responsibility ard them, the team is also obviously not greedy. I would say 20 mn hardcap for 60% of the tokens, would be among the lower end of valuations in terms of what other ICOs are asking for, especially when they have an almost-ready product to introduce to the market. Notably, up to 50% of the funds collected will be locked in escrow until the alpha version and the Full product release, so investors can have an added sense of confidence that technical milestones will be met.

Compared to skeleton teams of 4-5 members, the Credits project has up to 25 experienced members working on the platform. Notably, 10 of these are developers, again signalling how tech-heavy and robust this project is. Almost half of the advisory board are hardcore blockchain tech experts, while the others are leaders in their respective fields (business development etc.).

It is possible that the credits platform will eventually be a big player in the Internet of Things (IoT) market as well, due to its fast processing speed and low fees, which is ideal for micro-transactions in IoT related applications in the fields of logistics, smart homes, infrastructure management, healthcare etc.

I've tried to highlight the salient features of the credits project (tech, team, financials) which attracted me to it. If this post caught ur attention and u wish to find out more, pls visit https://credits.com/en/Home. Forum comments and discussions can be found at https://bitcointalk.org/index.php?topic=2401248.0. Excellent presentation deck at https://credits.com/Content/Docs/PresentationENG.pdf.

Latest info is that the ICO date is on 15 Feb, open to whitelisted investors only. Join the whitelist after DYOR!

@originalworks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

can US citizens participate in the ICO ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yes, i dun think there are any restrictions, although there's this phrase on their website "Legal opinion on utility token for the United States. Coming soon" u might wanna check their telegram (link on their main site above) and ask the admins

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

“Federation Credits” is a prophecy of Gene Roddenberry .... and that’s no small thing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit