The blockchain network welcomes new decentralized projects on a monthly basis. The trend is encouraging, given the fact that these projects tend to reposition the use of cryptocurrencies and further drive adoptions for digital assets and blockchain technology.

Now, there are myriad of problems that kick against the success of these operations. Top on the list is the inability to transact with cryptocurrencies. The use of these assets would not have only reduced transactions fees but will also facilitate transactions and reduce third-party interference.

The Core Problem

It’s true that fiat transactions are not anywhere close to the huge prospects of crypto coins. However, the major problem is the inability of transacting parties to have full control. A clear scenario is the lending approach. Banks and many other financial institutions are in full control of these transactions. In terms of loans, borrowers tend to pay high replace rates at short intervals. This, in addition to the monopoly of the central bank, lays credence to the fact that the current system is not favorable for borrowers.

What is VIAZ all about?

This project has at its core, the implementation of decentralization in the lending process. This is in tandem with the dictates of the blockchain technology, which seeks to disrupt the current financial model. To that end, VIAZ is a revolution in the making, which will change how borrowers and lenders interact.

Furthermore, this project is unique in its way. It’s a Decentralized Application (DApp) that takes advantage of the Tezos network to introduce Peer-to-Peer (P2P) for the transacting parties. The implication of this is that borrowers won’t have to depend on banks for loans, because individuals on VIAZ can lend them funds in real-time and at favorable interest rates.

How it Works

It’s worth mentioning that the essence of the blockchain technology is to reduce third party interference, provide security to transactions and transacting parties, and connect involved parties over the network.

VIAZ replicates these goals but also adds an improved feature –

¶ Crypto-backed loan.

This means that a borrower won’t have to put up his house or any other physical asset as collateral for a loan. Instead, a specific amount of crypto coins (digital assets) in his possession can serve as collateral. All the borrower needs to do is to put up the digital assets when bidding for a loan, and interested lenders can make contacts to finalize the deal.

¶ Improving Crypto-to-Fiat Interactions

In addition to the effective lending and borrowing process, VIAZ also instituted dual digital wallets. On sign up, a user gets access to fiat and crypto digital wallets. This facilitates interoperability in the transfer of fiat currencies to the crypto wallet, and vice versa.

On the other hand, this approach is VIAZ’s way of improving the fortunes of cryptographic currencies. This notion takes basis on the project’s strides to introduce branded debit cards to ease transactions.

Expected to function the same way as VISA and MasterCard debit cards, the VIAZ branded crypto debit cards allow users to convert crypto coins to fiat equivalents and withdraw from supported ATM and PoS terminals worldwide.

¶ #Viaz promotes Efficient Repayment Process.

The Banks make use of amortization methods in loan repayment. This shortchanges the borrower because he has to pay high interest rates throughout the duration of the loan. In contrast to this, #VIAZ makes use of linear repayments.

The implication is that borrowers can pay lower interest rates within the timeframe for the loan repayment. In addition, it affords borrowers the opportunity to make even distribution of the repayment plan and build equity in real-time.

Token Distribution

Crowd-Sales: 50%

Team: 15%

Founders: 5%

Early Contributors: 25%

Marketing/Bounty: 5%

View of #Viaz Card

Token Specifications

Ticker: VIAZ

Platform: Tezos

Token Type: Utility

Token Supply: 1,500,000,000

Soft Cap: $5 million USD

Hard Cap: $30 million USD

Accepted Currencies: ETH, XTZ, BTC

Exchange Rate: 1 VIAZ = $0.065 USD

Country of Registration: Cayman Islands

Not Participating: The United States

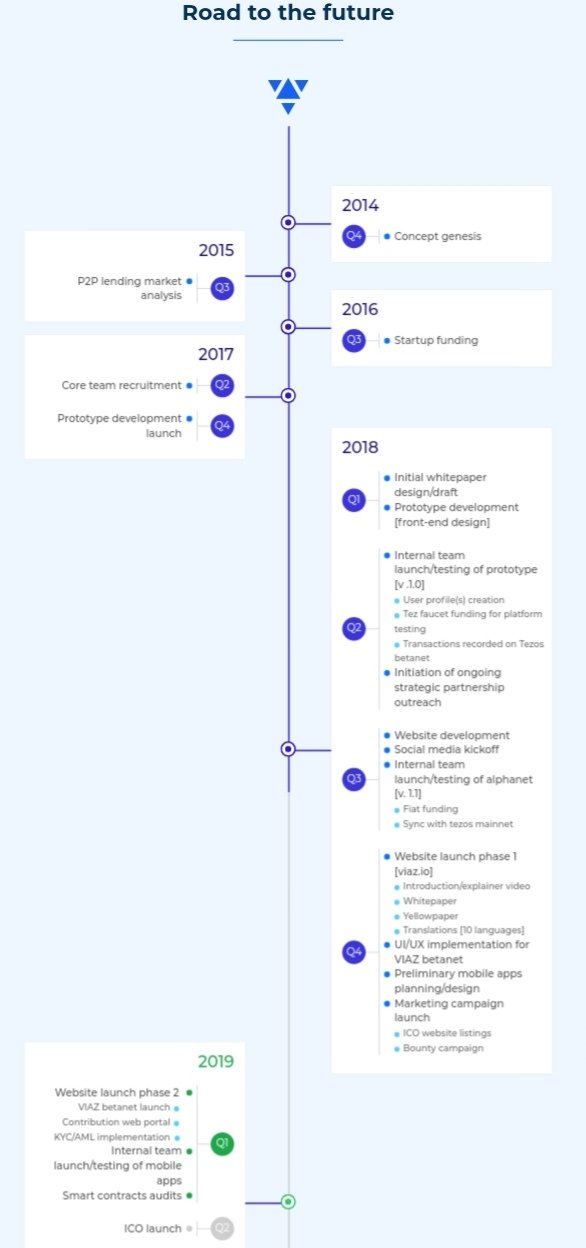

ROADMAP

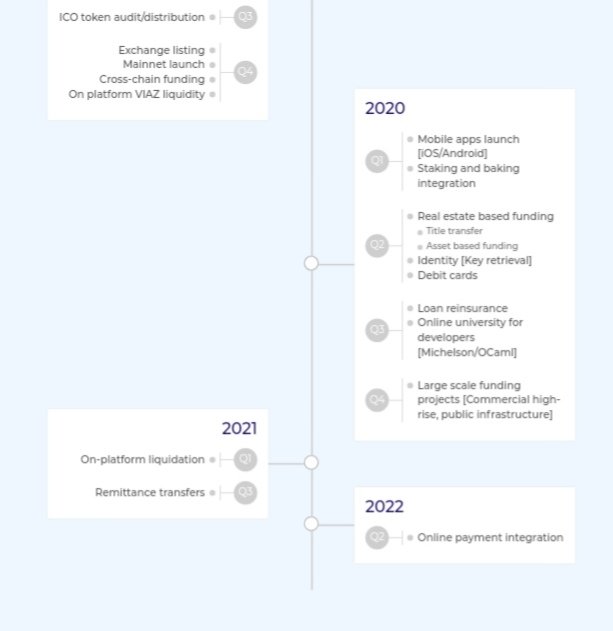

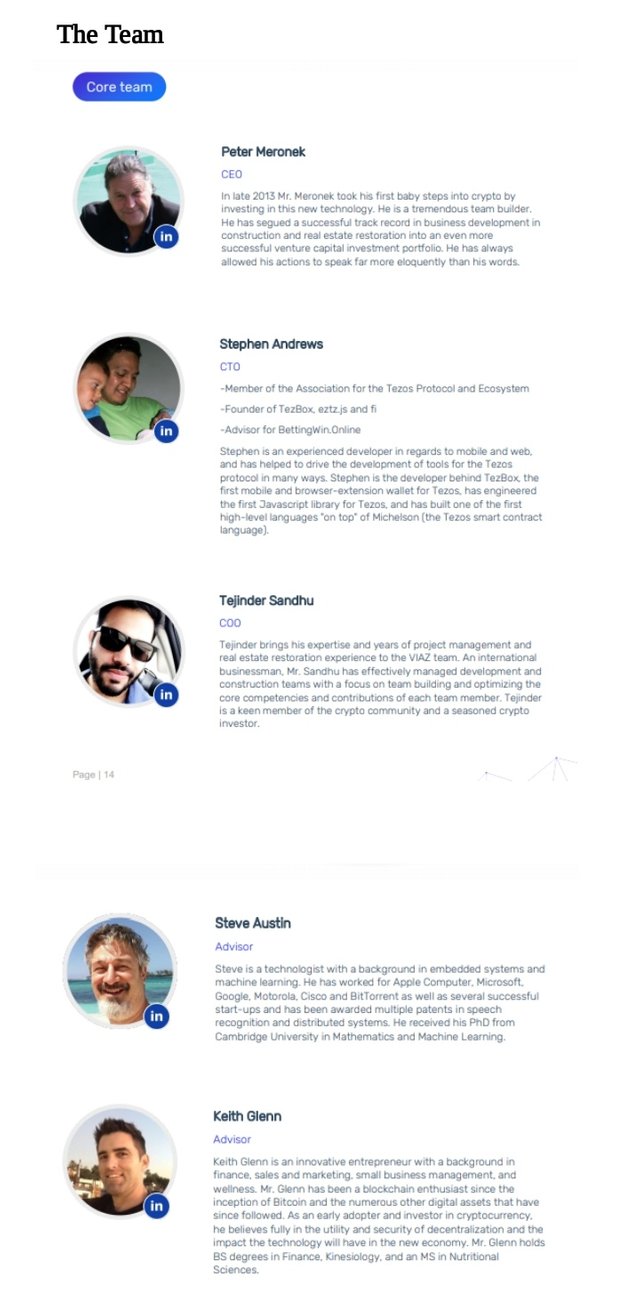

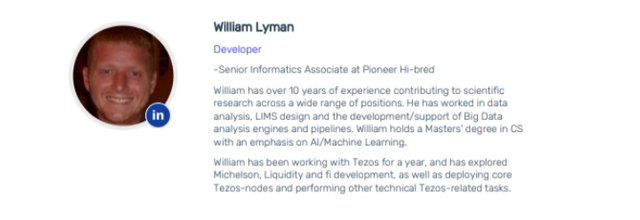

The Team

Wrapping Up

The blockchain technology and cryptocurrencies are here to stay. Viable projects such as VIAZ tend to drive the cause of this impressive technology and the underlying digital asset. After the Initial Coin Offering (ICO) and subsequent launch of the Beta and Main networks, VIAZ, all things being equal, will be a standard for decentralized P2P lending using the Tezos-backed native token – Tezzies (XTZ).

To Learn progressively about Viaz, look at the connections beneath

Website : https://viaz.io/

Whitepaper: https://viaz.io/documents/Viaz-Whitepaper_EN.pdf

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=5090552.0

Twitter : https://twitter.com/ViazOfficial

Facebook : https://www.facebook.com/viazofficial

Medium: https://medium.com/@ViazOfficial

Authored by Ericks1