If you’ve been trading cryptocurrencies for a while, you’ve probably got a handle on how to navigate exchanges and avoid the various “gotchas,” that nibble away at your gains. You know which coins are available on various exchanges, and you’re able to monitor several simultaneously. Perhaps you even find differences in liquidity and take advantage of the arbitrage opportunities. But, it’s work. GUI problems are a source of simple mistakes or delays in the timing of a trade which can result in a missed opportunity or worse – a crushing loss. Exchange interfaces are clunky, and you can’t customize them much. They’re slow!

Shouldn’t there be a single point of entry to all these markets? Traditional securities and equities traders have had them for decades. Enter XTRADE, which is already hard at work on its goal to bring global cryptocurrency trading up to speed with the high-quality experience available in more traditional markets.

So how will XTRADE do it?

XTRADE will act purely as a technology provider which generates connectivity between exchanges – each of which uses its own API. As it stands today, the exchanges operate not as a whole but as distinct entities. Significant connectivity is not possible (funds may be sent to another exchange’s wallet on your account, but that’s about it).

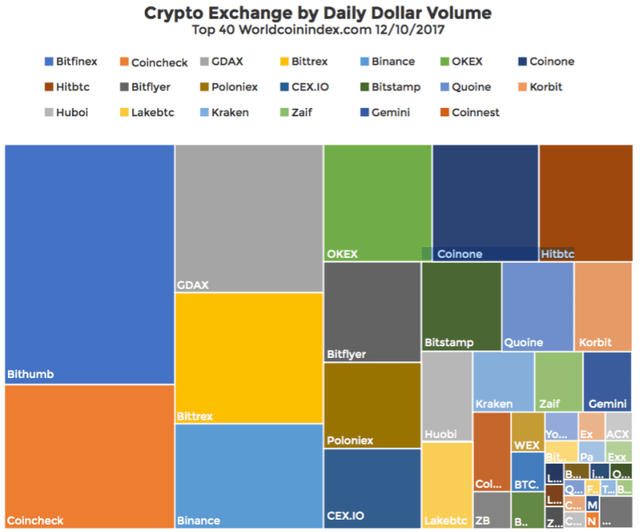

Each exchange has its own level of liquidity, and for some of the newer or decentralized exchanges these levels are remarkably low. Wild price jumps are the norm in low-liquidity markets. For institutional investors making large purchases, the problem of slippage occurs even in the most liquid markets. The net effect is unfavorable and discourages trading – not conducive to the growth of the market as a whole.

Early adopters have shown a willingness to deal with these cirucmstances, but for mainstream adoption – forget it!

XTRADE is poised to remedy these issues by replicating what is already battle-tested in the traditional trading markets: a multi-market interface. Throughout 2018, a series of products will be implemented and build a foundation for each subsequent level:

The FIX API

Firstly, XTRADE will unify the exchanges allowing activity to become coordinated through a common API. Liquidity will become shared, and orders can be spread out among multiple exchanges to ensure the best purchase prices and avoid slippage. Why would any particular exchange abandon their current API in favor of FIX? The shared benefits of one common market are clearly in their best interest.

XTRADE Pro

Next, the implementation of the trading interface (informed by experience both in the use and design of trading systems) XTRADE Pro will dramatically expand the current web-based trading platforms’ capabilities. A robust view of order books, more efficiently executed trades and the ability to handle heavier traffic will foster an accurate and orderly marketplace. A highly customizable trading interface which includes advanced charting, scanning systems (to identify assets with the highest profitability) and user-assignable hotkey functions will facilitate a less frustrating and more profitable trading experience.

Security is also enhanced as access will no longer be through the internet (and therefore avoids DDoS and MITM attacks as well as phishing).

SPA (single point of access)

Through joint venture agreements, XTRADE will facilitate the handling of buy and sell orders, but never hold your funds. Currently XTRADE is partnered only with CEX.io, but anticipates many more exchanges will join them. XTRADE’s service and interface is the trader’s single point of access to multiple exchanges.

XTRD token

XTRADE will lastly be launching an ERC20 token to facilitate additional revenue for the platform itself, and discounts on trading fees and will be incentivize by users staking the XTRD token.

It’s an exciting time for the cryptosphere, and nascent services like XTRADE hold great promise in bolstering mainstream adoption. The lynchpin will be those joint venture partnership with the exchanges. Hopefully a close eye on those agreements and the debut of the XTRADE Pro platform will signal an entry to a new and more expedient cryptoasset trading experience. Fingers crossed!

For more information, check out their white paper: https://xtrade1-9649.kxcdn.com/wp-content/uploads/2017/09/xtrade-whitepaper.pdf

or join their discussion on Telegram: https://t.me/xtradecommunity

Accredited investors may have their Ethereum wallet address whitelisted and participate in the pre-sale for the XTRD token. https://xtrade.io/whitelist/

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://crypto101site.wordpress.com/2018/02/14/xtrade-io/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit