Injective chain is based on the Cosmos zone and is a decentralized protocol built on Layer-2, providing a high-speed Ethereum decentralized trading experience. It will use the Cosmos IBC protocol to achieve cross-chain transactions, VDF (Verifiable Delay Function) to simulate real time through Proof of Elapsed Time, and standardize order sequencing to eliminate early tradings. In addition, the Injective chain supports token staking and provides technical support for creating more services such as staking in the future.

As Injective Protocol makes arrangements to uncover its testnet prospects convention, entries are open for our first Market Idea Competition. The subordinates showcase and the DeFi space have both supposedly advanced exponentially over the previous year.With the emerging technological innovations, the public is now given a glimpse of the boundless potential of a derivatives market.

Moreover, the trading volume of decentralized exchanges reportedly grew 70% in the middle of 2020, setting a record high of $1.52 billion. In addition to this, the anticipated ETH 2.0 community testnet is likely to make waves in the DeFi space. This marks a momentous time of changes in the cryptocurrency world, yet this is only the beginning.Thusly, it is a significant open door for the network to draw in and trade thoughts and developments that would profit us as a whole.Participants are welcome to draft a proposition for an inventive market thought that could be acquainted later on with the DeFi space.

These proposals will be reviewed and critiqued by notable blockchain and cryptocurrency professionals as well as expert market makers. All members are available to make significant commitments to the DeFi people group by utilizing innovativeness through this Market Idea Competition. The best proposition will be chosen and conceivably be transformed into reality on the Injective Protocol trade.

TRANSPARENCY

Injective convention offers a decentralized plan and in this manner, offers a trade convention with freely open and accessible assets for invested individuals to affirm.Meaning, all transactions and orders placed on the platform are completely verifiable due to their timestamps as well as order IDs. This way, there is no fear of order manipulation and “wash trading” often associated with several other exchanges that tend to manipulate trade volumes just to attract users.The Injective Protocol Dex is worked to totally kill doubt among members and offer a straightforward, protected and obliging condition for a wide range of computerized resource brokers.

Injective protocol and Bianance Lab

Because of how improved the Injective convention is, the Binance lab which was made by the Binance framework, as a method of helping promising frameworks flourish, has likewise highlighted the Injective Protocol activity stage, in order to empower it come out as an extraordinary trade stage.

What's more, seeing how refined the Injective stage is, clearly it is now satisfying dreams for a great deal of advanced resources brokers.

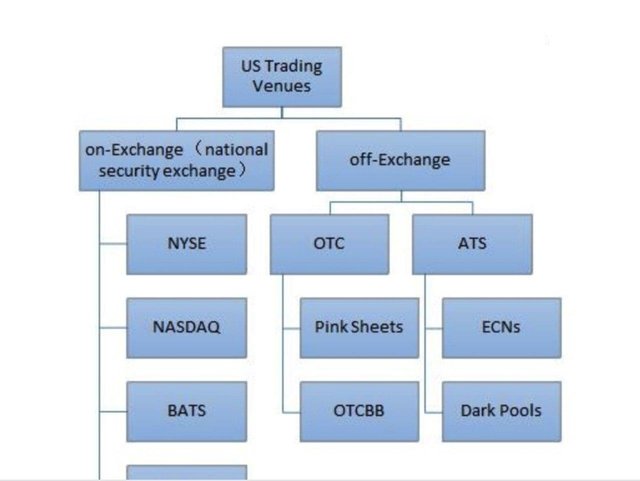

Path of Exchanges

An exchange is a trading platform with diverse products, which provides price discovery and liquidity for traded products.

Innovative headways have encouraged and affected likewise the plan of action and framework of the trades. Relatively few individuals remains in disconnected commercial centers and yell out the costs of their merchandise to draw in purchasers these days, however attempt to get their products sold through electronic exchanging frameworks.In terms of the business model, most exchanges in Europe and the United States have went from membership based to form for-profit companies.As the hub of the financial activities, the development of exchanges is heavily affected by regulatory policies. However as technology develops, regulations loosen, and business competitions carry on, Alternative Trading System (ATS) has emerged since 1990 in the US (Multilateral Trading Facility (MTF) in Europe), adding flexibility and diversity to the financial world.

Concentrated trades are the specific inverse of what has been referenced above — there is an immediate clash between what they speak to and blockchain values. An incorporated trade (ex. Coinbase, Kraken, Binance, and so forth.) is controlled by a benefit arranged organization that gets income from their foundation's charge structures. To lay it out plainly: both the entrance and leave focuses into the current blockchain biological system require charges — all of which go to unified trades. Not exceptionally reasonable or network arranged, right? This is the primary motivation behind why decentralization is required. Believe it or not, it merits referencing that brought together trades can do fiat (USD, EUR, and so forth.) to digital money exchanges while DEXs, then again, are just crypto this is expected to KYC and different guidelines.

DEXes can be further divided into two focuses: spot and derivative markets. Most of the DEXes in existence focuses on the spot markets, and are not many derivatives DEXes given the complexity of financial designs development workloads. However it has become palpably clear that derivatives markets have grown exponentially in digital asset domain, and we are already seeing the next boom coming from derivatives trading. Few strong contenders that have emerged in 2020 include Injective Protocol, DerivaDEX and Serum. Here let's explore Injective Protocol, which will be launched in August.

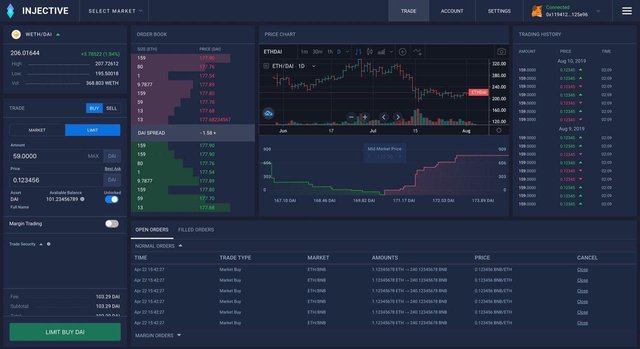

To resolve common issues faced by DEXes such as user friendliness, speed, and more, Injective Protocol proposes a global solution: Injective chain, Injective derivatives protocol, and Injective DEX.

A derivatives protocol is an important "weapon" of Injective. It is an open convention that bolsters the advancement of open subordinates markets. It is additionally the world's first completely decentralized P2P fates and unending trade contracts trade, which bolsters basic access to different markets.As per the group, contrasted and different results of a similar sort, Injective is the quickest, completely decentralized subsidiaries exchanging stage without gas expenses the DeFi showcase.

Based on the Injective chain, Injective's trading platform has also achieved a fully open source design, which allows it to be a completely decentralized network. It also provides a market-maker friendly API interface, which is close to the current mainstream exchange interface, allowing the user experience to be similar to that of a centralized exchange. Also, in the administration framework, the Injective exchanging stage has acquired the plan from the examining frameworks of incorporated trades, modularized structure, and the evaluated posting framework, however it depends on network the executives, not only one individuals.

In addition, Injective has introduced liquidity support for DEX from a considerable number of top global market makers, including QCP, CMS, Bitlink, Altonomy, etc. Together with a powerful incentive mechanism, Injective can ensure the liquidity of the trading platform.The future is coming, and the exchange, as the infrastructure of the digital age, is undergoing rapid and unprecedented development. In 2020, we will witness this change.

Find us on

Official Website: https://injectiveprotocol.com

Bounty Link : https://bitcointalk.org/index.php?topic=5256993

Telegram: https://t.me/joininjective

Whitepaper Link: https://docsend.com/view/zdj4n2d

Github: github.com/InjectiveLabs

Twitter: https://www.twitter.com/@InjectiveLabs

Reddit: https://www.reddit.com/r/injective