Introduction

Let's make no bones about it, cryptocurrency has been the best investment (or gamble) one could have done in the past 5 years. It personally lifted me up quite a bit and I think we haven't seen the end of it yet.

But, we have to be careful and learn from history.

High Risk / High Rewards

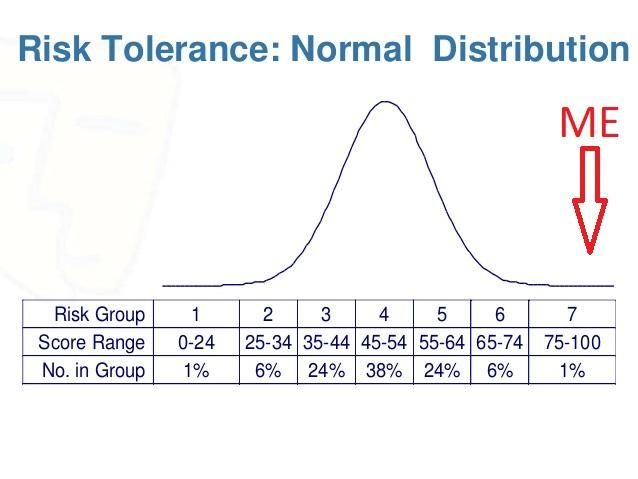

When I went to the financial planner, I was presented with the investor risk tolerance questionnaire. It's a standard operating procedure to understand how someone deals with the risk associated with investing. Then everyone is graded on a normal distribution scale.

If you are the kind of person that is able to deal with market swings of over 200%, you belong in that category. Not everyone can stomach that kind of volatility, that's for sure...but so far it has paid off.

Past Performance Are Not Indicative Of Future Results

That is where I (and people with a high-risk tolerance profile) have to be careful. It's easy to get cocky, believing that it can only keep going up and up. Only to realize 2 or 3 years later that you are back where you had started. I'm old enough to remember the 2000 Dot Com Boom and Bust.

Companies had crazy valuation without ever selling a thing or even having a product. Just having a cool name like "pets.com" was enough for people pore in over $300M dollars into it.

If that doesn't remind you of the current ICO situation, I don't know what is.

I was looking at a project called "BYTOM" that mooned yesterday. This project is now evaluated at over 1 Billion Dollars. That's a lot of money and the website seems have been done by a complete beginner. Tons of grammatical errors and I really don't see any real-life application on it.

Fortunately, I have a mentor who himself was one of those companies that went through the DOT COM Bubble. He told me the story of how he went from a valuation $1 per share to almost $60 and then back down. He is a very successful businessman, but he is truly helping put everything in perspective.

Good Ol' Diversification

I know you've probably heard that one a thousand time and to be honest, it's really not sexy. There is simply no market like cryptocurrency. Steem alone in the last month went up by 78.41%. That's the kind of gains that make your palm sweat.

So what am I doing? I personally do not liquidate my position in any cryptocurrencies BUT I'm shaving off the top every month. I hold on to my principal like grim death, but I generate some extra tokens via curation and authorship and move that into the kind of investment that makes sense to me...things such as land and other real tangible assets.

Conclusion

If you have nothing to lose, I would say cryptocurrencies are your best bet right now. It has a crazy upside potential. BUT if you are heavily invested in crypto with almost no real life assets, maybe it's time to think of purchasing something like stocks, bonds, lands, gold or whatever is more stable over the long term.

Tell me your thoughts below.