Hello, this is team ZPER!

Today, we will take a look at the problems in the traditional financial system that drove us to create ZPER.

The traditional financial system was laden with oligopoly, with corporations taking advantage of the financial market’s closed and exclusive nature. This led to difficulties and complications in the actual process of investing and getting loans through the banks. Their strict and conservative credit rating policies alienated people with little financial experience (such as freshly graduated students) by rejecting their loan applications, or at best, acceptance with much disadvantages including high interest rates and low credit limit.

In this environment that seemed unchangeable, P2P lending companies have grown furiously along with the fast development of technology. Research and Market, a leading global market research store, predicted 53.06% growth of the global P2P financial market in 2016. Also according to Morgan Stanley’s 2015 report, they predicted the P2P market to grow and reach 4,900 million dollars in size by 2020.

The driving force behind the fast growth of the P2P market is the technology that directly connects the investors and borrowers online. It reduces all costs related to the mediating party for the borrower and allows investors to expect

much higher profit previously impossible with the bank’s low interest rates. P2P finance has opened a new era of financial system that incorporates and connects even the most alienated financial agents.

P2P financial environment resulted in many positive outcomes, but also carries unavoidable limitations.

But as always, limitations and discomfort leads to innovation.

ZPER was also created as a breakthrough to the limitations of P2P finance!

Problem #1 ::

Difficulties in Selecting P2P Lending Companies

Compared to the financial institutions under the supervision of the financial authorities, more lenient regulations apply to P2P finance. This is not a surprise given the size and social influence of the current P2P finance industry. In addition, even though the way that they use digital alternative data to assign credit ratings is considered revolutionary compared to the way of the existing financial institutions, such method has not been fully proven due to the limited access to data necessary to analyze risks. Therefore, it is all the more important for investors to take into account the risks of P2P lending companies who formulate and manage products.

In 2016, the online financial scan by Ezubao, a Chinese P2P lending company, resulted in a major damage of around 8.6 trillion KRW and reminded people of the importance of selecting reliable P2P lending companies. Nevertheless, it is not easy for investors to analyze risks of P2P finance companies and select reliable companies. Individual investors have to depend solely on P2P lending companies from when they explore investment opportunities to the time when the are paid back. However, most P2P lending is carried out online on a non-face-to-face basis, and the only source of information about P2P lending companies available to the investors is their websites or news. Therefore, it is difficult for individual investors to get detailed information, including the level of risk management ability of the company, whether the company has enough funds, or whether the company is currently facing any problems that may affect its business.

ZPER’s Solution ::

Designing Various Investment Products through a Global P2P Finance Alliance

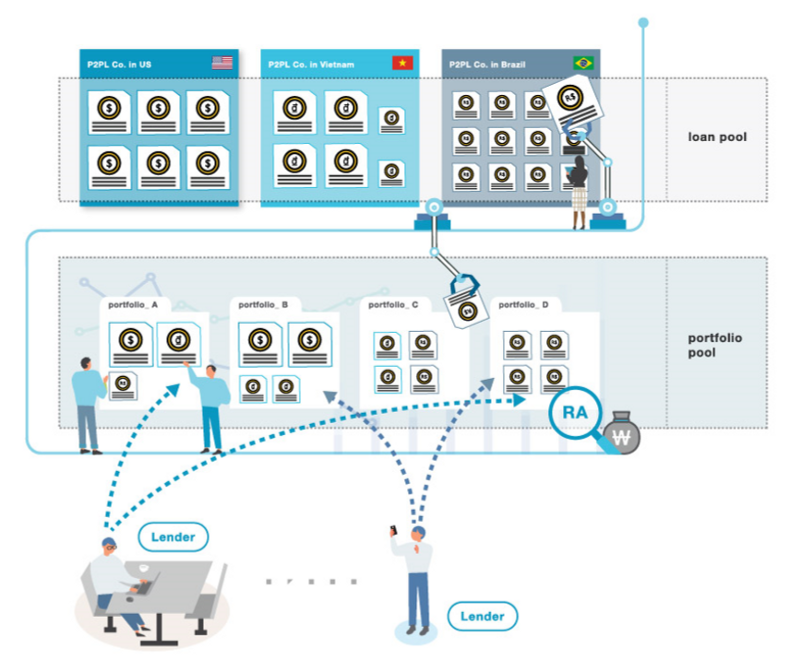

ZPER is an open ecosystem that any P2P lending companies and related services companies around the world can take part in, where reliable P2P lending companies in the world provide a range of P2P investment products.

But, how can we know this is reliable?

ZPER Council carries out thorough evaluation of the P2P lending companies, and also manages and supervises ZPER ecosystem to keep it healthy by selecting participants for each sector. The Council consists of experts of P2P lending companies, Robo-Advisor companies, and pledgers to buy NPLs, etc.

As the regulations and characteristics related to those companies in each sector may differ by country, ZPER Council consists of two to five companies from each country and in each sector.

Robo-Advisor companies analyze investment products that exist in ZPER ecosystem with their own algorithms and build portfolios in a way that allows investors to effectively diversify their investments.

Investment in global loan portfolio through ZPER

As we locate more problems of the traditional and P2P finance, ZPER will come up with better and better solutions and improvements.

Stay tuned for more information!

Sincerely,

Team ZPER