ISO 20022 is a universal messaging standard for financial services that aims to standardize communication between financial institutions and systems. It covers a wide range of financial transactions, including payments, securities, trade finance, and more.

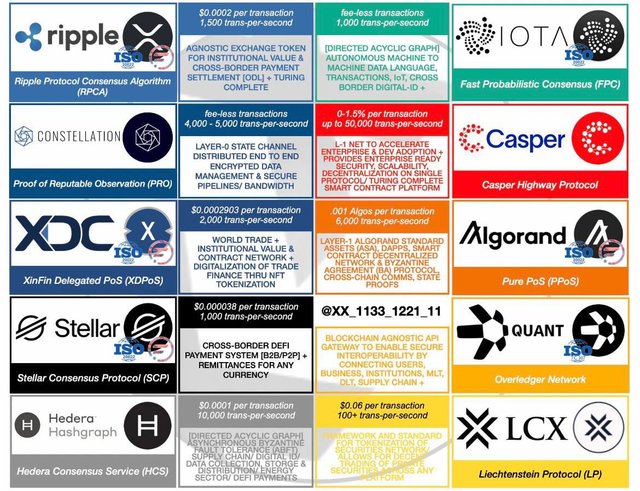

Within the ISO 20022 ecosystem, digital assets refer to any form of tokenized or blockchain-based assets that adhere to ISO 20022 messaging standards for their communication and interoperability within financial networks. These digital assets can include cryptocurrencies, security tokens, stablecoins, and other tokenized assets.

The ecosystem of digital assets within ISO 20022 compliance typically involves:

Standardized Messaging: ISO 20022 provides a common language and syntax for the exchange of information related to digital assets. This allows different entities, such as banks, payment systems, and fintech companies, to communicate and process transactions involving digital assets using standardized messages.

Interoperability: Digital assets conforming to ISO 20022 standards can be more easily integrated into existing financial systems and networks. This interoperability enables seamless transfer and reconciliation of digital asset transactions across different platforms and institutions.

Regulatory Compliance: ISO 20022 compliance helps digital asset providers adhere to regulatory requirements by ensuring transparent and standardized communication, which can facilitate compliance with anti-money laundering (AML), know your customer (KYC), and other regulatory frameworks.

Efficiency and Automation: By adopting ISO 20022 standards, digital asset transactions can benefit from increased efficiency and automation. This includes faster settlement times, reduced errors in processing, and improved straight-through processing (STP) capabilities.

Expanding Use Cases: The adoption of ISO 20022 in the digital asset ecosystem can pave the way for the development of new use cases and innovations. For instance, it could enable the integration of digital assets into traditional payment systems, cross-border transactions, and other financial services.

Overall, the integration of digital assets within the ISO 20022 framework contributes to creating a more standardized, transparent, and interoperable environment for the exchange and management of these assets within the broader financial ecosystem.

This is not in any way financial advice and please contact a financial advisor if you have any questions.