***Read the original article by Kerala Blockchain Academy at https://medium.com/@kbaiiitmk

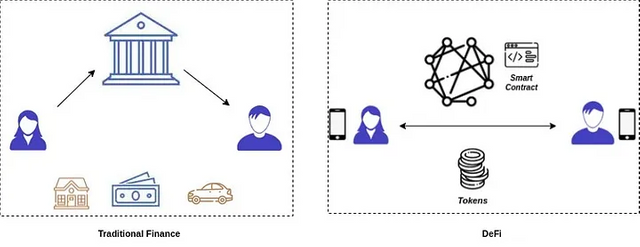

Conventional financial services are centralized systems involving intermediaries like banks, agents, brokers etc. The involvement of third parties has increased over the years to meet the complexities of emerging financial systems. But fewer setbacks limit its perspective.

For instance, your financial services choices are often regulated by local jurisdiction corresponding to your geographic location. The involvement of human intermediaries complicates the process by increasing cost and adding time delay. You are forced to trust the third party managing your funds and processing your transactions. More on, the lack of transparency in transactions increases the security risk.

So what’s the solution. How to be freed from third-party involvement.

The emerging financial technology Decentralized Finance, fondly called DeFi, promises the cure. DeFi, via adding de before the centralized finance envisions to create a financial system that is open for everyone. It promises to take the existing financial products to the blockchain.

Products??

Every product, such as loans, savings, payments, derivates, is moved to the blockchain that anyone with internet connectivity has open access to financial services. Meanwhile, DeFi also aims to minimize one’s need to trust and rely on central authorities by incorporating blockchain customs like distributed ledger mechanisms, cryptography, and peer-to-peer networking. DeFi simply takes the shape of financial services implemented as decentralized applications (DApp).

So before we head on the details, let us quickly stroll through some terms that are critical in understanding the rest part.

“Finance” covers the processes of creation, management, investment of money and financial assets.

“Financial assets” denote assets like stocks, bank deposits and loans which carry a monetary value.

“Financial Services” refers to the operations like banking, lending-borrowing, or insurance.

Nowadays, many financial services are built on top of a blockchain.

Now the question is, are all of these examples of DeFi?

The answer is no.

One cannot list all blockchain-based financial services as or under DeFi. A financial service can be considered DeFi only if the below conditions are met.

Financial assets controlled by the user (non-custodial)

Directly mediates the transfer of value.

Transactions settled on a public blockchain (permission-less)

Source code (contract) available. (openly auditable)

DeFi allows people to lend, borrow and trade digital assets in a peer to peer manner without depending on a trusted intermediary. Digital assets are the assets created, stored, and traded in a digital format. They are represented as data files that can be owned and transferred between people. For example, cryptocurrencies like Bitcoin are digital assets that substitute fiat currency. Tokens are digital assets representing values (other than cryptocurrency) that can be traded or transferred within a blockchain network. Tokens in blockchain networks can uniquely represent physical assets like vehicles or land. The creation and management of these digital assets are implemented by computer programs running in the blockchain called Smart Contracts.

As read above DeFi services is available to anyone having access to the internet. All you need is a wallet address to interact with these systems. KYC, credit checks and income verification are not on the checklist of a DeFi application. The self-executing smart contracts replace the trusted intermediaries, and the consumers have complete control of their funds.DeFi services typically run on public blockchain networks like Ethereum where the transactions are fully transparent. Since the processing part is done by smart contracts running 24/7, settlement of transactions has dropped from days to minutes and even seconds depending on the underlying blockchain. But the hysterical part is smart contracts aren’t entirely trustworthy as they are also prone to hacks on occasions.

Degree of Decentralization

Even though DeFi addresses many challenges of traditional finance services, it cannot be fully claimed as decentralized. Because DeFi service itself represents a third party — a company or community managing the service. DeFi governance systems operate according to the stakeholders’ decisions having voting rights. Most DeFi services use a token-based structure for governance where the token holders can vote on proposed changes to protocols. The final decisions will be executed as automated smart contracts.

DeFi replaces trusted intermediaries with smart contracts. The user has complete control over the assets accessed via wallet applications. However, if anyone gains access to your private key, the assets are theirs from then on( Check our previous blog on HD Wallets for more information ).

DeFi Projects

The majority of the DeFi applications are related to lending-borrowing cryptocurrency. MakerDAO , the lending application, is regarded as the first truly DeFi DApp. Aave and Compound provide borrowing-lending services. Uniswap is a decentralized exchange for Ethereum based tokens ( under Decentralized Exchanges (DEX), buyers and sellers conduct trade operations using their wallets).

Sythetix is an asset issuance protocol for assets like fiat currency, commodities, stock etc. Yearn Finance is an automated asset management platform. DeFi allows users to manage their assets, unlike traditional financial systems where intermediaries hold assets in custody.

Tether is a cryptocurrency whose value is pegged to US Dollar, 1 Tether = 1 US Dollar. Cryptocurrencies whose values are pegged to fiat currencies are called stable coins (More about stable coins in the next article)

The majority of the DeFi projects are built over Ethereum blockchain.

The basic idea of Decentralized Finance came right after bitcoin introduced the concept of decentralized money. However, DeFi is still in its infancy stage with a lot of opportunities and challenges in front.

***Read the original article by Kerala Blockchain Academy at https://medium.com/@kbaiiitmk