The cryptocurrency industry is developing at a fast pace, with new and exciting ventures emerging every day. While some of these ventures have brought the people behind them into the spotlight, several of them are created by well-known people in the industry. When Bitcoin was first created, it didn’t gain immediate popularity and only a handful of people understood its true value. This meant that such people had a headstart on Bitcoin investments which were cheap at the time.

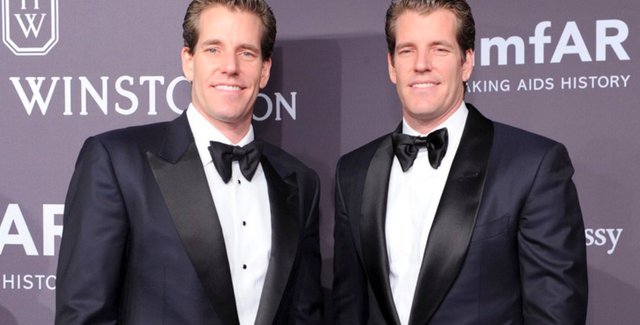

Although BTC now hovers slightly above $7,000 and hit an all-time high of almost $20,000 in December 2017, it was once lower than $1 in value. Those who invested early have become Bitcoin millionaires and experts in their own right. Among them are the Winklevoss twins — Cameron and Tyler — who made headlines in 2017 for becoming billionaires when the price of Bitcoin skyrocketed.

Since then, they have dedicated their time and effort to several projects in the industry including a proposal for a Bitcoin Exchange-Traded Fund (ETF), a nonprofit regulatory body known as the Virtual Currency Association and Gemini, their Bitcoin exchange.

Who are the Winklevoss Twins?

Cameron and Tyler Winklevoss are internet businessmen who were born in Southampton, NY and raised in posh Greenwich, Ct. Although the twins became extremely popular in the cryptocurrency world by accumulating an enviable Bitcoin fortune, it was not their first taste of fame.

The brothers first made headlines in 2004 for suing Facebook co-founder and CEO, Mark Zuckerberg. They claimed that Zuckerberg stole the idea for Facebook from them, about a social networking site known as ConnectU. During their Harvard days, the brothers, along with Divya Narendra, a fellow student, founded the social networking site for Harvard students to connect with each other.

The lawsuit ended in a $65 million cash and stock deal settlement from which they invested $11 million in Bitcoin at a value of $120 per BTC. Currently, the value of that investment is well worth over $600 million and surpassed $1 billion during the BTC price peak of 2017.

In October 2015, following a formal hearing, they received approval from the New York State Department of Financial Services (NYSDFS) to launch Gemini, their Bitcoin exchange.

What is Project Gemini?

According to the Winklevoss brothers, Gemini is a next-generation Bitcoin exchange due to the fact that it is fully regulated and compliant. The twins started the Gemini journey with the simple goal of building a world-class digital asset exchange and custodian in the United States.

Based in New York, the exchange was created with consideration for both new and experienced cryptocurrency investors.

The idea for project Gemini emerged when the brothers noticed the increasing number of people, businesses, financial institutions and organizations interested in Bitcoin investments. Being seasoned investors themselves, they understood the difficulty that investors faced, with the limited number of available exchanges in the U.S. and the issue of security. These interested parties are forced to wait on the sidelines or look to foreign exchanges to avoid missing out on potential profit.

Soon, they began looking into a US-based Bitcoin exchange and even testified at a public hearing at the New York State Department of Financial Services about the potential of cryptocurrency to bring about positive change. After the hearing, the NYSDFS officials were convinced and expressed their willingness to commit to building a regulatory framework that would protect consumers and foster financial and technological innovation in New York.

Shortly after, the brothers gathered a small team composed of the country’s top technology professionals, including security experts and financial engineers to build the Gemini exchange. Their top priority was to ensure that investors’ funds are as safe on the platform as they are in a traditional bank account.

To achieve this, the exchange partnered with a New York State-chartered bank to ensure that investors’ funds are held in the country. Due to the partnership, US dollars on the platform are eligible for FDIC insurance. The exchange, which started with only Bitcoin and Ethereum support, recently added 3 new cryptocurrencies — ZCash, Litecoin and Bitcoin Cash — to their trading lineup.

Why Name it Gemini?

According to the Winklevoss brothers, the name Gemini which is Latin for “twins” was chosen to represent the concept of duality. This falls directly in line with the functionality of their exchange which caters to the two worlds of money: new and old. It also represents the two-way trade function of the Gemini platform.

After picking the name, they discovered that NASA’s Project Gemini was a spaceflight program that focused on laying the groundwork for Apollo’s later mission to land a man on the moon. Similarly, the brothers are building a strong foundation to bridge the gap between cryptocurrency and mainstream adoption. This influenced the Gemini slogan which reads: “Your bridge to the future of money.”

**Other Winklevoss Contributions to the Cryptocurrency Industry **

Although the Winklevoss brothers have seen extreme success in their careers and lives, they prefer to invest their money rather than spend it on lavish items.

In 2013, the twins invested in Bitinstant, a Bitcoin payment processor for which they led a $1.5 million seed funding round. Unfortunately, the investment was compromised when Charlie Shrem, the company’s CEO was arrested and charged with money laundering during the investigation of the Silk Road online black market. The Winklevoss brothers, however, were not involved in the scandal and stated that they were only passive investors in the company.

In 2014, the brothers founded Winkdex, a financial index that tracks the price of Bitcoin using data from up to seven exchanges. Following the launch of Winkdex, the twins continued to work towards further investment in the cryptocurrency field. Shortly after, they launched Gemini, their New York-regulated exchange.

In addition to the exchange, they filed a proposal for a Bitcoin Exchange-Traded Fund (ETF) with the U.S Securities and Exchange Commission in 2017. They planned to create the ETF as a way for people who do not know much about Bitcoin but want to invest in it. Unfortunately, the proposal has been rejected by the SEC twice, in 2017 and 2018. Despite this setback, the brothers won a patent for settling Exchange-Traded Products (ETPs) with cryptocurrencies like Bitcoin, Ripple, Dogecoin, and Ethereum in May 2018.

In August 2018, the Winklevoss brothers' Gemini exchange and three other exchanges including Bittrex, Bitstamp, and Bitflyer USA, announced the formation of the Virtual Commodity Association Working Group. The group will serve as a foundation for the possible formation of a self-regulatory cryptocurrency organization. It will also mirror the functionality of the securities exchanges’ organizations and lay the groundwork for the creation of standards and regulations within the industry.

Final Thoughts

Since its creation, the Gemini exchange has continued to see steady growth and competes with other major exchanges like Coinbase and Binance. In June 2016, it became the first licensed ether exchange in the world and the world's first Zcash exchange in 2018. Currently, it has operations in several locations including the United States, South Korea, Canada, UK, Singapore, and Hong Kong. Apart from their shared success of the Gemini exchange, the Winklevoss twins have continued to push for cryptocurrency adoption.

There has been mounting fear in the industry over the lack of regulation, and the brothers have created the Virtual Currency Association Group as a way to address it. They will focus on the development of best practices to ensure security within the industry, a boost in liquidity, elimination of market manipulation, and address other pressing issues. This could bring about industry standards that make investors and partners more willing to adopt business models that integrate cryptocurrency. Hopefully, the organization will serve as a link between the cryptocurrency community and the financial regulators.

Article brought to you by the MintDice Plinko Game. Originally posted on MintDice.

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the upvote, always a welcome surprise.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the pic Jaz lol, pretty sick cartoon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Lol, not exactly sure what's going on here but good enough.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha, why is the Bitcoin holding milk?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Amazing working

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, you're welcome, takes us some time but in the end gets good content.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Resteem your posting by 3000+follower

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great, thanks for sharing the article with your followers ak.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent working

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks sherkhan, glad you enjoyed the post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Resteem your post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing the article with your fanbase taimoor, glad to have the added awareness.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Resteem it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit