Hello everybody, I am going to inform you about Lendroid today.

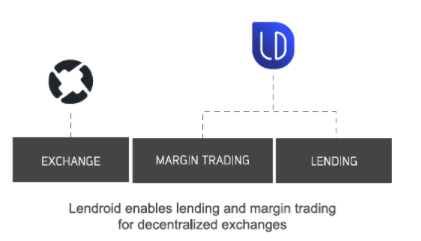

We are all aware that the need of decentralized digital asset exchanges is becoming a more serious issue day by day. Centralized exchanges that depend on an outsider administration to hold users assets have high risks for whole crypto market. That is why some decentralized exchange platform projects such as Øx platform started to run these last months . These projects could achieve to provide basic trading features on their platforms. But there was a missing point: Margin Trading. Lendroid project is going to make up the deficiency of margin trading on decentralized exchange platforms.

Introducing Lendroid

Lendroid is a decentralized digital asset lending platform based on blockchain technology. Lendroid’s main goal is providing an open protocol that enables Decentralized Lending and Margin Trading.

What is Margin Trading?

Margin trading refers to the practice of trading with borrowed funds instead of your own. So individual investors buy more stocks than they can afford to. If you pick the correct investment, margin trading can dramatically increase your profit. On the other hand margin trading can amplify gains as well as losses.

How Does Lendroid Work?

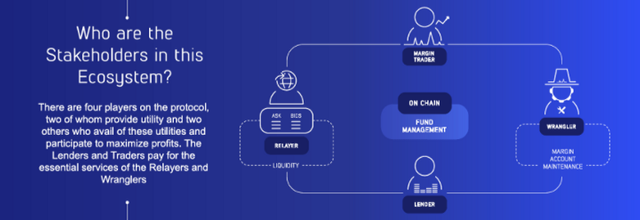

A trader (prospective borrower) decides to borrow from lending pool. The borrower put up digital assets as collateral in a smart contract. Automatic system determines if there is an initial match or not between borrower and lender. If the terms match up, smart contract is executed and funds are released for the borrower.

Lendroid creates a global shared lending pool as a supply for borrowers. Borrowers submit offers to this lending pool.

- If the trade ends with a profit, borrower can repay the lenders and take back his collateral.

- If the trade ends with a loss, borrower must compensate the losses and only after paying full amount of borrowed money, he can take back the collateral.

- If trader exceeds the limits of liquidation levels, Wranglers take over the trader account and trade positions.

The main duty of Wranglers is watching over Lenders’ interests and protecting the general process of Lendroid ecosystem.

Lendroid Support Token (LST) & Token Sale

Lendroid Support Tokens (LST) is the main element and payment currency of Lendroid Protocol.

As Lendroid Team described, LST is going to have 3 major roles in the ecosystem:

- To lubricate process and drive utility on the protocol

- To incentivize participation

- To empower governance

LST is an Ethereum based token. LST tokens are being issued with adhere to the ERC20 tokenstandard. They can be stored in any wallet that supports Ethereum based tokens such as Mist, MetaMask, MyEtherWallet.

See the details about token sale below:

Ticker Symbol: LST

Max Token Supply: 12 000 000 000 LST

Released in Public TGE: 240 000 000 LST

Price: 1 ETH= 48 000 LST (without bonus)

Hard Cap: 5000 ETH

Registration for the TGE: 11th February 2018

Public TGE: 19th February 2018

Accepted Payment Methods: ETH

For more information, please visit links below :

WEBSITE · WHITEPAPER · TWITTER · TELEGRAM · ANN

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Prepared by Stavri (Bitcointalk Profile) :

https://bitcointalk.org/index.php?action=profile;u=955201

ETH Wallet: 0xf263f99B27E37e97720b9DdaF525B565E18A89c2

The good ones are always ahead

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit