A Fly in the Globalist Ointment: Local Currencies

by Joseph P. Farrell, Giza Death Star

July 22, 2020

As you might have gathered, much of my email this past week included articles about what’s going on in the world of finance, and hence, my focus on it the past two days, and today is no different, because there’s an intriguing little story out of the little town of Tenino in the American state of Washington, that just so happened to make the Reuters news service. In fact, quite a few people spotted this story and shared it, so thanks to you all who did so, because I suspect we’ll be seeing more and more of this sort of thing:

Money talks: U.S. town prints own currency to boost coronavirus relief

There’s something in this article – in fact, two things – that caught my eye:

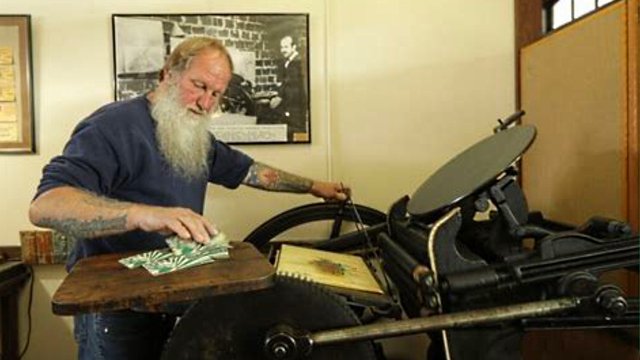

Tucked away under lock and key in a former railroad depot turned small-town museum in the U.S. state of Washington, a wooden printing press cranked back to life to mint currency after nearly 90 dormant years.

The end product: $25 wooden bills bearing the town’s name – Tenino – with the words “COVID Relief” superimposed on the image of a bat and the Latin phrase “Habemus autem sub potestate” (We have it under control) printed in cursive.

With the coronavirus pandemic plunging the United States into a recession, decimating small businesses and causing job losses across the country, some local governments are looking for innovative ways to help residents weather the storm.

For Tenino, the answer was the revival of the local currency that had bolstered the town’s economy in 1931 in the wake of the Great Depression.

“It was kind of an epiphany: Why don’t we do that again?” Mayor Wayne Fournier told the Thomson Reuters Foundation. “It only made sense.”

So, that’s the background. But why did tiny Tenino do this? The answer is an eye-opener (but it still isn’t what caught my eye):

Mayor Fournier noted that, for long-time Tenino residents, the wooden notes are nothing new.

The tiny town founded around a sandstone quarry achieved national prominence in 1931 when civic leaders printed a wooden local currency to restore consumer confidence after the town’s bank failed during the Great Depression.

…

Fournier views the project as the kind of initiative towns and small cities must take upon themselves to survive the coronavirus outbreak amid what he views as an inadequate federal response.

He pointed out that the federal Paycheck Protection Program (PPP), a fund of forgivable loans designed to keep businesses afloat through the pandemic, is not scaled for the businesses in Tenino that have just a handful of employees.

“A federal program dumps money from the top and these blue-chip companies steal it all,” Fournier said. “If we do it from the ground up, there’s no stealing. It’s a direct ballast to Main Street.”

In other words, the local currency arose because the federal programs simply were not fitting local circumstances (no doubt this is one reason Reuters-Mr. Globaloney took note). But how did they do it? This is where it gets very very interesting and suggestive:

Fournier said he has already fielded queries from towns across the country looking to emulate Tenino’s effort.

“What if 5,000 other small cities did that same thing and took it upon themselves to put $10,000 into Main Street?” he asked.

“That’s $50 million directly into small businesses. It totally hacks the system.”

So far, however, Tenino’s currency does not appear to be circulating much among local businesses.

At the grocery and hardware store that anchors Main Street, manager Chris Hamilton said that by mid-June customers had spent $150 in the local bills to buy necessities like groceries and a new faucet to replace a broken tap.

“I’ll redeem it for cash at city hall,” he said. “I hadn’t thought about recirculating it.”

…

Witt cautions that notes backed by U.S. dollars are only a halfway measure, because the amount of local currency available is limited by the amount of federal dollars the town has on hand to exchange it with.

“A truly independent currency would allow for issuing currency as needed,” she said.

That “new” money would circulate through the local economy and then eventually go toward paying property taxes over the course of several years, she added.

So, note what we have: (1) a local currency, backed by (2) a reserve, which in this case, are the available federal reserve notes that locality has on hand, say, in its “rainy day fund,” and (3) the currency is exchangeable at city hall for the federal reserve notes constituting its “reserve,” and (4) because of this, the currency is not generally circulating.

And that’s precisely where my high octane speculation comes in. And we may get to that speculation by asking a very simple question: What happens when the nature of the reserve is changed? Let’s say a local community decides to go to a more permanent solution, and takes some of its budget to buy, say, gold or silver bullion (the real stuff, and not just paper), or for that matter, to monetize abandoned or seized property, from automobiles, or houses, or other types of hard assets sitting in its impound lots or auction warehouses? With this, the nature of the “reserve” changes from fiat currency (federal reserve notes) to hard assets. Once this decision is taken, the local currency would have material backing, and would probably begin to circulate more generally. Of course, this would instantly require protection (think police), and a thorough and accurate accounting of public assets. Over time, such currencies may consolidate, as localities pool reserves to create more regional solutions and currencies, and to widen circulation…

…well, you get the idea. In a central bankster world increasingly fraudulent, and “going dark”, it’s an inevitability.

So, how long do you think it will take before cities, counties, even states or provinces, wake up and start making unusual purchases, and monetizing hard assets? Tenino has shown the way. The only missing, and essential, step is changing the nature of the backing… and that, I suggest, is very easily done… and if you think it’s impossible, as yourself a very simple question: would you rather do business with Tenino? Or with non-agreement-capable Swampington, D.C.?

Oh… and one more thing… what happens when pension funds jump into this?

See you on the flip side…

https://truthcomestolight.com/2020/07/22/a-fly-in-the-globalist-ointment-local-currencies/