Lokum Finance is an automated market maker (AMM) —decentralized finance (DeFi) application that allows users to exchange tokens, providing liquidity via farming and earning fees in return. These tokens can later be used to reclaim their share of the pool, as well as a portion of the trading fees.

What is decentralized cryptocurrency?

A decentralized exchange ( DEX) is a cryptocurrency exchange that operates in a decentralized way, without a central authority. Decentralized exchanges allow peer-to-peer trading of cryptocurrencies.

What is AMM?

Automated market makers (AMMs) allow digital assets to be traded without permission and automatically by using liquidity pools instead of a traditional market of buyers and sellers. On a traditional exchange platform, buyers and sellers offer up different prices for an asset. When other users find a listed price to be acceptable, they execute a trade and that price becomes the asset’s market price. Stocks, gold, real estate, and most other assets rely on this traditional market structure for trading. However, AMMs have a different approach to trading assets.

AMM and Decentralized Exchange

AMMs are a financial tool unique to Ethereum and decentralized finance (DeFi). This new technology is decentralized, always available for trading, and does not rely on the traditional interaction between buyers and sellers. This new method of exchanging assets embodies the ideals of Ethereum, crypto, and blockchain technology in general: no one entity controls the system, and anyone can build new solutions and participate.

What is the qualification among checking and developing?

● STAKING: In solicitation to stake your LKM you needn't waste time with whatever else than LKM.

● FARMING: In solicitation to develop you need to offer liquidity to one of the pools on the developing page and thereafter stake your LP tokens. Both have their advantages and impediments. Which one to pick is up to your strategy.

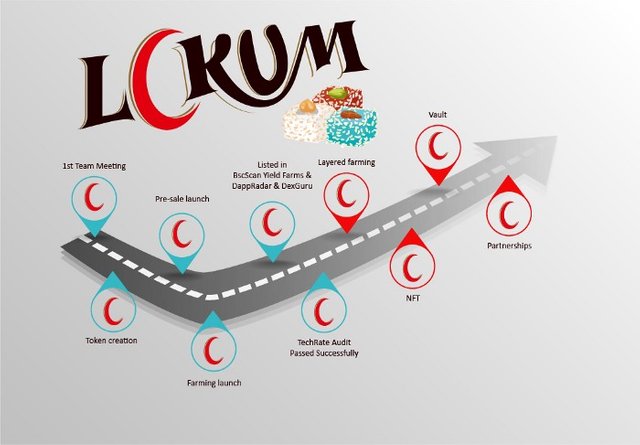

Roadmap

Date

1st Team Meeting 21/03/2021

Token creation 25/03/2021

Ask for social profile validation in BSCscan 30/03/2021

Pre-sale launch 30/03/2021

Farming launch 07/04/2021

Audit TechRate 14/04/2021

Ask for CoinMarketCapListing 14/04/2021

Lottery Q3

NFT Q4

Vault 2022

Autocompound 2022

Security

•Migrator code: In solicitation to guarantee full security, the migrator code has been taken out from our MasterChef contract.

•Transfer Ownership: In solicitation to fabricate independence, LKM owner would be moved to Farming Contract resulting in adding liquidity.

What is liquidity farming?

Liquidity mining, also known as yield farming, is the act of providing liquidity via cryptocurrencies to decentralized exchanges (DEXs). Since the primary goal of an exchange is to be liquid, DEXs seek to reward users willing to bring capital to their platform.

How do you farm?

In order to farm you first have to provide liquidity to one of the pools which you can find on the "Farms" page. After providing liquidity and receiving your LP tokens then select the pool you joined from the "Farms" page, approve the contract and then click on the little "+" sign, choose the amount you want to stake, and confirm.

Lokum Finance is the greatest crypto decentralized exchanging platform. This group is very strong. Very fascinating concept. Lokum Finance has been recorded workmanship DappRadar, the beginning stage for dapp revelation, and goes about as an appropriation channel for dapp engineers that are hoping to arrive at new purchasers.

For more information please visite us,

Website : https://lokum.finance

Whitepaper : https://docs.lokum.finance

Telegram : https://t.me/lokumswapfinance

Twitter: https://twitter.com/FinanceLokum

Instagram: https://instagram.com/lokumswapfinance

Medium : https://lokumswap-finance.medium.com

Authorship

BitcoinTalk username : ameliyaketty

My Bitcointalk Profile Link : https://bitcointalk.org/index.php?action=profile;u=2334838

BEP 20 address: 0x0aa75C53d8aF4B7b70B38D461d179941BFeBc2FF