Although most contract traders are familiar with the long-short ratio, few of them know how to tap into this concept in real-world scenarios. That said, what is the specific use of this indicator? How can one get more returns from contract trading by leveraging the long-short ratio?

Let’s begin with the definition of the term. The long-short ratio refers to the number of traders going short on a crypto contract compared to the number of traders selling the contract within a certain period. Given that the ratio of the total value of long orders to that of short orders is always 1:1, there are more long traders than short traders when the long-short ratio exceeds 1 and vice versa. As such, the indicator reflects the sentiment of most retail traders.

Some of you may wonder what is the connection between the long-short ratio and retail investors. The answer has already been given in the definition above — It is about the number of traders, not the amount of money they invested. Despite this, we can still improve our trading strategies and earn more profits by studying the long-short ratio.

Here, we can refer to the long-short ratio and candlestick patterns in the past:

For example, the BTC price surged by over 20% from February 28 to March 1, growing from the lowest point of $37,444 to about $45,000. As the value of short positions in the entire BTC network hit $257 million on March 1, short traders grumbled. According to figures on the CoinEx website, the long-short ratio was as low as 52% on March 1, which means that the number of short traders is almost twice that of long traders.

Here is another figure. The CoinEx website shows that the long-short ratio of Bitcoin stood at 185% on March 6, which indicates that the number of long traders is 1.85 times that of short traders. At 12:00 on the same day, the candlestick trend of Bitcoin (15M chart) suddenly dipped and soon rebounded.

Therefore, we can draw the first conclusion about the long-short ratios: when the number of long traders approaches the two extremes (too high/low), the market is likely to fluctuate drastically.

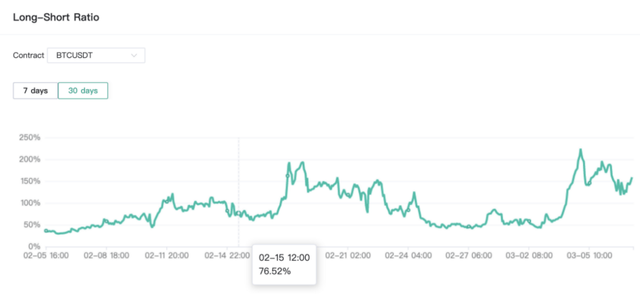

Let’s look at the last figure. The BTC price stayed high on February 15, and the long-short ratio on the same day stood at 76.52%, according to the CoinEx website. Over the following days, the ratio surged, while the BTC plummeted, which depressed the long traders.

From the above case, we can draw our second conclusion about the long-short ratio: If the number of long traders significantly grows when the crypto price stays high, it is then likely that the market trend will be reversed. However, if the long-short ratio is close to 1:1 when the crypto price stays high, then the market trend is likely to continue.

You might have noticed that when everyone is excited about going long in a thriving market, the market price often stands at its peak; when everybody is yelling “go short” in a depressed market, the crypto is probably already bottomed out.

Therefore, our last conclusion is that the number of long traders is negatively correlated with the market trend. In other words, if the number of long traders grows when the market trends downward, or if the number of long traders drops when the market trends upwards, the previous market trend is likely to continue.

As the legend investor Warren Buffett put it: “be greedy when others are fearful, and be fearful when others are greedy”. Regardless of which field you are in, the profit is always earned by a few players. You can never predict the market outcome 100% accurately, and the long-short ratio also only serves as a little tactic. Though it can improve your returns, whether you will beat the market depends on many other factors.

The above content cannot be relied on as any investment advice.