Spikes in crypto-related Google search queries have historically occurred at major market tops, validating legendary investor Warren Buffet's mantra of buying in doom and selling in boom.

Top coins supposedly associated with artificial intelligence (AI) have dropped over 20% in seven days.

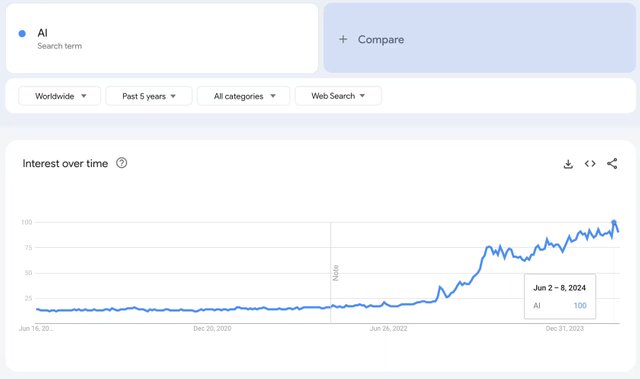

Google Trends shows peak public interest in AI.

Spikes in crypto-related Google search queries have historically occurred at major market tops, validating legendary investor Warren Buffet's mantra of buying in doom and selling in boom. A similar dynamic now seems to be playing out in the market for tokens supposedly related to artificial intelligence (AI).

The so-called AI coins like FET, RNDR, TAO and GRT have seen their market value slide by as much as 30% in the past seven days, according to data source Coingecko, just as Google Trends indicates search interest in artificial intelligence may have peaked.

FET is the fourth-worst performing of the top 100 cryptocurrencies of the past seven days. Market leader bitcoin (BTC) is down just 2.8% during the same period while the CoinDesk 20 Index (CD20), a measure of the broader crypto market, has lost 6%.

Google Trends is widely used to gauge general or retail investor interest in trending topics. It shows the value for the search query "AI" over the past 12 months reached a peak of 100 last week. That's the same as the value of the past five years. A score of 100 represents peak popularity – the maximum number of searches observed for the query during a given time frame.

Search interest for AI. (Google Trends)

In other words, the excitement about artificial intelligence has hit the main street, and an increasing number of existing and potential retail investors are looking for information about it and Nasdaq-listed chipmaker Nvidia (NVDA), a bellwether for all things AI.

Though only indicative, the tool may be a good indicator to watch as the masses are often driven by emotions and frequently the last to enter a bull market and exit a bear market. For instance, spikes in searches for BTC and Solana's SOL occurred at the respective price tops in May 2021 and November 2021, respectively.

It's crucial to note that bitcoin, known to have a strong positive correlation with NVDA, bottomed out with technology stocks in late 2022 after the debut of ChatGPT raised general awareness about artificial intelligence. According to GMO's Chief Investment Strategist Jeremy Grantham, the AI rally represents a potential bubble within a bubble that could soon deflate.

That's an insight that might prompt caution in people considering investment decisions.