Source = original article

For me the funniest line in there is "...Overall, they view the Bitcoin market as something small, meaning it is subject to manipulation. .."

Unlike today and the past 15 years where the Stock market has been subject to massive manipulation due to quants? Or previously when a large institution (money that over shadows that of many small countries?

I worked on the trading floor for one of the larger investment banks in the mid 2000s when quants were introduced. And while our machines did not cause the slip, others on the street caused a massive sell off, forget the exact year and don't have time to look it up atm.

From my own perspective this all looks like "let's scare people" when it comes to crypto.

Ultimately, IMO it comes down to control. Centralized banks can control market manipulation and track where most dollars go. Until they can't of course. But that's ok. If they lose it all they will just wipe the slate clean, hold one idiot culpable and let the rest go #CDO

Agreed crypto-market is not that big atm. But what they should have stated is more people have the ability to manipulate the crypto market than the stock market.

I also watched as one trader in a hedgefund I worked for (I am in IT so am not well versed in trading itself), made a move @10am EST years ago and watched the market react his purchase or sell (forget which) caused a shift of a few points within minutes.

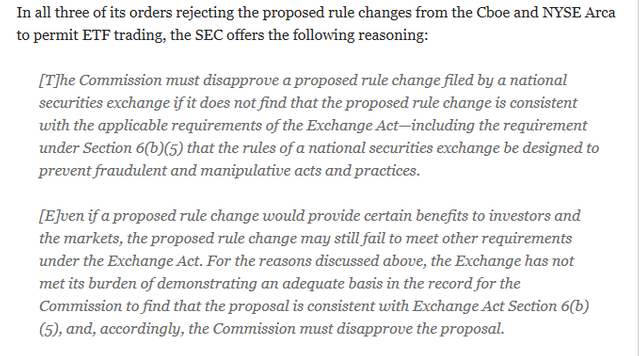

Back to my first sentence in this comment - what I find funny is the notion implied by the SEC statement is that the market is not susceptible to manipulation. Really? History shows a different story!

It's early and I only had one cup of coffee so if I missed the point of the above post my apologies I just love when the SEC acts all protective and shit, but in actuality has shown its teeth to be less than sharp.

A decent article on examples of market manipulation/misconduct

https://www.businessinsider.com/market-misconduct-report-the-26-ways-people-have-cheated-markets-over-200-years-2017-9