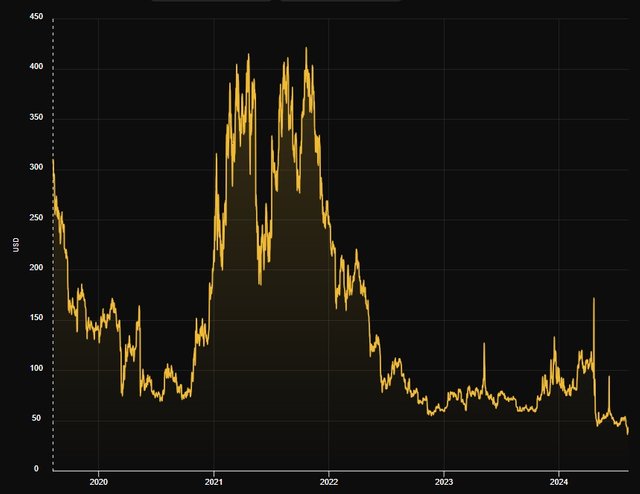

Bitcoin has fallen by more than 30% from its record-high price, with mining difficulty jumping by 10.5% during the last correction. Publicly traded mining companies have found themselves in a hard spot.

Mining difficulty is adjusted every fortnight, depending on the total power of the rigs involved in mining. Adjustments are necessary to maintain the mining rate of one block every 10 minutes. On 31 July, difficulty rose by 10.5% in one go, the biggest jump since October 2022.

Image source: coinwarz.com

At the same time, Bitcoin's price began to correct, collapsing to $49,000 on 5 August.

Image source: StormGain Cryptocurrency Exchange

Even after the price partially recovered, yields from petahesh capacity are still near an all-time low and now stand at $41/day.

Image source: hashrateindex.com

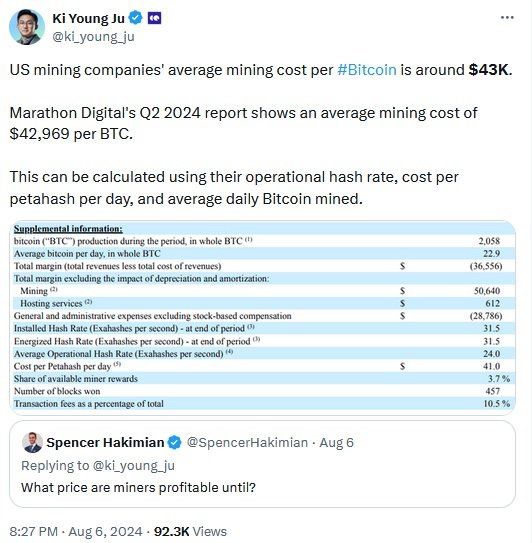

According to the head of the analytical firm CryptoQuant, Ki Young Ju, with such profitability, the average cost of mining one coin is $43,000. The calculation is based on the performance of leading mining company Marathon Digital for Q2 2024.

Image Source: x.com/ki_young_ju

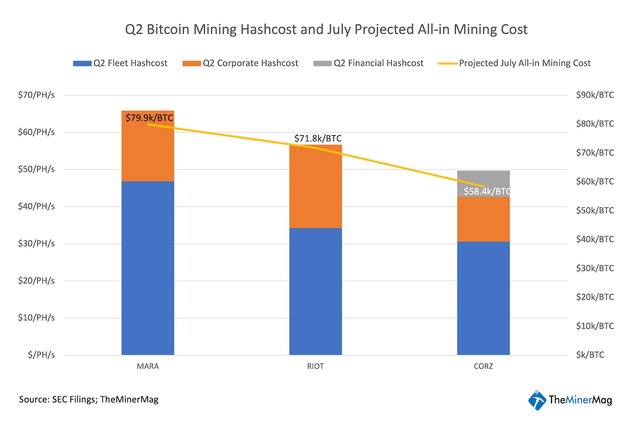

It may not seem that bad, but these calculations don't take into account payments on loans taken out earlier to build mining centres and purchase ASICs, as well as all sorts of administrative costs. TheMinerMag has calculated the cost of Bitcoin mined in July for the largest mining companies, including associated costs.

Image source: theminermag.com

It turns out Marathon and Riot are operating at a loss, which is reflected in their financial reports for the past quarter. This is a consequence of both increasing difficulty and falling revenues as a result of the halving.

Image source: investing.com

Both companies continue to accumulate coins in anticipation that Bitcoin's price will rise significantly and return net profits in the future. Core Scientific followed the same vision until 2022, but the subsequent bear phase drove the company into Chapter 11 bankruptcy (business reorganisation).

The above metrics help answer the simple question of whether to invest in mining companies or buy Bitcoin directly.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)