by James Corbett

corbettreport.com

January 29, 2017

Congratulations, America! The Dow Jones Industrial Average has just rolled past 20,000 for the first time ever! Let the fireworks fly, because the ticker tape parade is about to begin!

The Trump administration, wasting no time in chalking this up to "the Trump effect," celebrated.

Asian markets, which lifted as much as 1.8% on the news, celebrated.

European markets, which edged up across the board on the news, celebrated.

Global markets in general, which hit a 19-month high on the news, celebrated.

And why not? Such a momentous event must indicate that the global economic recovery is right on track, right? Surely we can now rest easy in the knowledge that the coming years will bring prosperity and security for all, right?

Except...

If the crossing of a nice big round number on the DJIA doesn't fill your heart with joy or make your pocketbook feel any heavier, then good for you. You're right to be wary.

It's not just that we live in a different world now, one where stock markets have become completely meaningless to the majority of Americans who now own precisely $0 worth of stocks. The problem is even more fundamental than that.

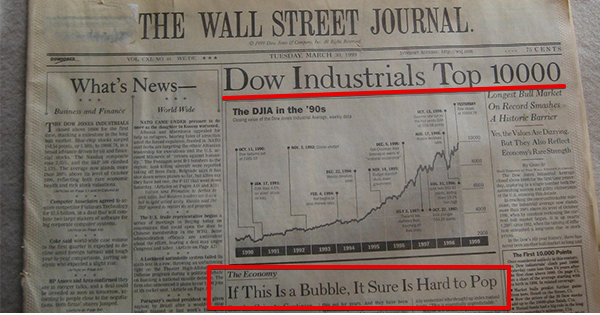

Remember Dow 10,000 back in 1999?

Of course you do. It was right before the bottom fell out of the dot-com bubble, and Greenspan inflated the housing bubble, which popped in 2007 and led to this current asset bubble, which led to Dow 20,000.

In short: Don't be fooled. This is just another bubble.

But don't take my word for it. Take Donald Trump's. No, not President Trump's word. Not President-elect Trump's word. Candidate Trump's word: "Believe me, we are in a bubble right now, and the only thing that looks good is the stock market, but if you raise interest rates even a little bit, that's going to come crashing down," he said during the first presidential debate (right before the Fed raised interest rates). "We are in a big, fat, ugly bubble."

To get a sense of how meaningless Dow 20,000 is in the face of a general asset bubble, look at this comparison of prices, compiled by The Motley Fool, showing the difference between Dow 10,000 in 1999 and Dow 20,000 in 2017:

- Price for a gallon of gas: $1.12 (1999) vs. $2.44 (2017)

- Price for a barrel of oil: $14.36 (March 1999) vs. $53.18 (2017)

- Price per MMBtu of natural gas: $1.85 (1999) vs. $3.34 (2017)

- Average U.S. home price: $119,600 (1999) vs. approx. $204,500 (end of 2016)

- Gold price per ounce: $280.10 (1999) vs. $1,200.50 (2017)

- Silver price per ounce: $5.10 (1999) vs. $16.97 (2017)

- Movie ticket price (adjusted for inflation): $5.08 (1999) vs. $8.65 (2016)

Even if you were heavily invested in the DJIA over this unprecedented eight-year-long QE heroin bull run, you would still be worse off when you tried to buy anything with your returns.

Indeed, as Tim Price of SovereignMan.com explains in his own piece on this Dow Jones "milestone":

"The price of a stock alone doesn’t tell you much. It’s important to look at the price of the stock relative to other important metrics, like cash flow, book value, sales, earnings, etc."

So what do these metrics say?

They tell us that the Dow is currently at its highest price-to-sales ratio since the 1999 bubble.

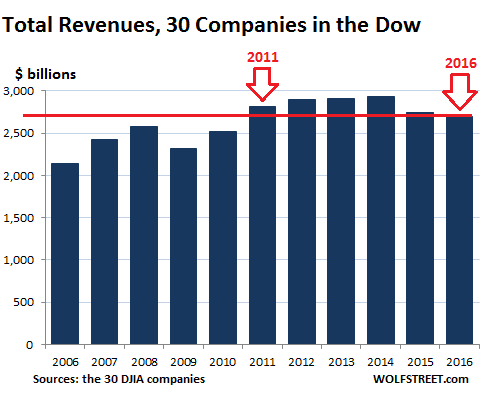

They tell us that the Dow is reaching all-time highs even as the companies that make up the Dow are reporting their worst revenues this decade.

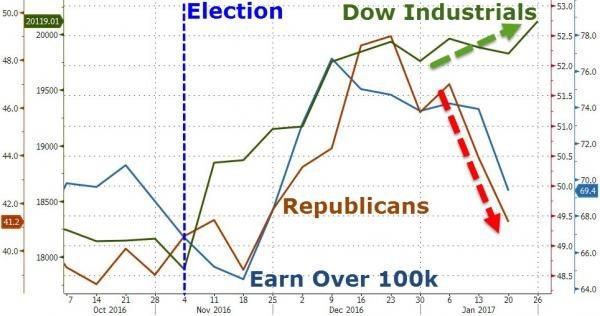

They tell us that consumer confidence is radically diverging from the DJIA index.

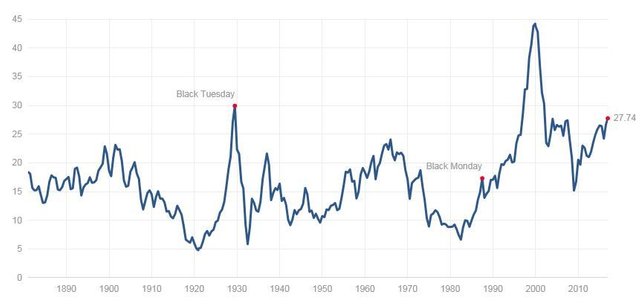

They tell us that the cyclically adjusted price-to-earnings ratio is at levels not seen since the dot-com bust.

Too much financial gobbledygook? Then let me put this as simply as I can: The central banks have spent most of the last decade "saving the world" from the subprime meltdown they helped to create by blowing yet another bubble. Or, in the memorable words of the Bank of England's "director of financial stability":

"Let's be clear. We've intentionally blown the biggest government bond bubble in history. We need to be vigilant to the consequences of that bubble deflating more quickly than [we] might otherwise have wanted."

So President Trump might want to be very careful before attempting to own Dow 20,000. Because if he wants to claim credit for the last expansion of the bubble then he will undoubtedly be forced to own its inevitable pop.

But don't worry, everyone, the wizards of Wall Street are currently positioning themselves for one last melt-up before the whole thing goes down, so there may yet be time to squeeze another few meaningless points out of this stock market rally...assuming you can get out just in time.

So the question, as always, is: Are you feeling lucky, punk?

GREAT ANALYSIS! Thanks again for reporting on this madness. Let's brace ourselves...

All for one and one for all! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you show me 19+ trillion and i'll show you a good time too! lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Let's pop the Champagne and DOW goes to the Moon! 30,000 baby!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I love bubbles they're so pretty until they pop.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent text, James. Resteemed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So the question is, what will digital currencies like Bitcoin do when the bubble pops? I think the answer to that is related more to how China reacts to the pop or the Trump administration's handling of it.

With China's Yuan denominated settlements in decline despite it being added to the SDR basket they make look at a bubble pop as an aggressive economic sanction that puts them in a corner where they can no longer prop up the value of the Yuan by buying US treasury debt.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you think Gold is in a bubble?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

if it was, I'm pretty sure it would've crashed back down to 500 or so. It WAS in a bubble, short term went to 1900 or so, but settled to a 1050 - 1200 range. Seems that 1100 or so is its mean price, for real, given the demand/production rate. But then the ETF traders keep the price down, THAT is a fact.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What's really bad about this bubble is that unlike the others (that were based on actual things like housing, tech, etc.) this bubble is based on debt. Our biggest product is debt. One indicator in Europe is "negative yield bonds" which started in the corporate sector but spread into sovereign bonds. We don't put it in the same terms here...But- watch out!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

well written James.

Thanks for the reminders, keep up the cool work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit