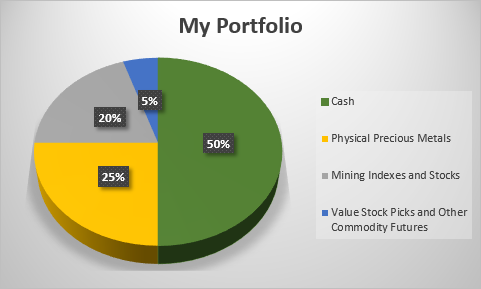

My Portfolio:

To those of you who are interested in the markets and managing your own capital:

Taking your investment portfolio into your hands is doable, but requires 3 virtues:

- Have a plan

- Pay attention

- Remove emotion

If you can't consistently maintain these three qualities with you portfolio, I recommend you sticking with a financial advisor.

I have no control over how you handle your emotions and how much effort you put into paying attention to market trends. But, I can help you with your plan by showing you my portfolio strategy. This is by no means a recommendation for all. This is a plan I created for myself alone. You, however, may find that it is also suitable to your goals.

Cash:

The majority of my portfolio will be held in cash. 40 percent of this cash will be used for short term trades (mostly options trades) as they present themselves. The other 60 percent of this cash is being held in preparation of entering a long term short position on the stock market. The tools I am using to short the market are a few different Inverse ETF's that I've talked about before:

- SDS

- SQQQ

- SOXS

Make sure you understand the risks of using inverse ETFs before putting your money into them.

I'm holding such as large portion of cash because I believe having liquid capital in the coming months will be extremely valuable as the stock market beings to fall and the sentiment in undervalued sectors become more bullish.

Physical Precious Metals:

A quarter of my portfolio is dedicated to physical precious metals. Precious metals, especially silver, are extremely undervalued, and at the very least maintain my purchasing power. I personally am only accumulating silver in the form of 1 oz coins and bullion:

- Generic Bullion (75%)

- US Mint Silver Eagles (12.5%)

- Silver Dollars (12.5%)

Mining Indexes and Stocks:

Another 20 percent of my portfolio will be going into mining stocks and indexes. These shares will give my portfolio more exposure to the price of precious metals as well as some income from dividends. The indexes I will be buying into are GDX, and SIL. So far, the only gold mining stock I have started to accumulate is Yamana Gold (AUY). A silver mining stock I have my eye on is Hecla Mining (HL). I am currently waiting for HL to break out of its severe downtrend that it seems to be trapped in.

Here's the composition of the Mining portion of my portfolio:

- GDX (33%)

- SIL (33%)

- Mining Stock Picks (33%)

I very much believe in the upside potential of precious metals and mining stocks. Take a look at the article I wrote, The Case for Precious Metals and Mining Stocks.

Value Stock Picks and Other Commodity Futures:

This part of my portfolio is not quite yet developed. I will be allocating capital to any undervalued stocks or commodity that present themselves.

Right now I have my eye on the uranium sector.

I don't know much about the uranium sector, so I am hesitant to jump right in.

From a technical standpoint, uranium futures are starting to trade in a horizontal manner. If they continue to trade this way, it may be an opportune time to start accumulating Uranium in the form of the ETF URA as well as picking up some related stocks.

I will continue to research this sector and write an article once I have developed more of an opinion on the sector as an investment.

Disclaimer: I am not a financial advisor. The articles that I write are for educational purposes only. Do your own research and hold yourself accountable for the investments that you choose to make.

Attention! If you're interested in receiving a free share of stock, sign up for an account on Robinhood using my referral link:

http://share.robinhood.com/micahm18

Robinhood is the first zero fee stock market broker that offers free option trading, crypto trading, and much more. I make all my trades on this platform and pay no commission. This is a zero obligation sign up. All you need is your personal information such as your ssn, birthdate, and your name. Robinhood is an SEC and FINRA regulated company. It's monitored by the federal government and is 100% safe. But don't believe me, just look it up for yourself.

1 in 150 chance of getting a Facebook, Microsoft, or Apple Stock

1 in 90 chance of getting Ford, snapchat, or AMD stock

100% chance of getting a free stock

Robinhood... Taking from the rich, giving to the poor...

Thanks for Reading!

Follow me on social media:

My portfolio is half empty and half debts, but hey, I'm not the kind of person who's always looking at the empty half.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Never too late to make a change!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's never late, is a bad advise. If it's never late, I'll do it later.😁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit