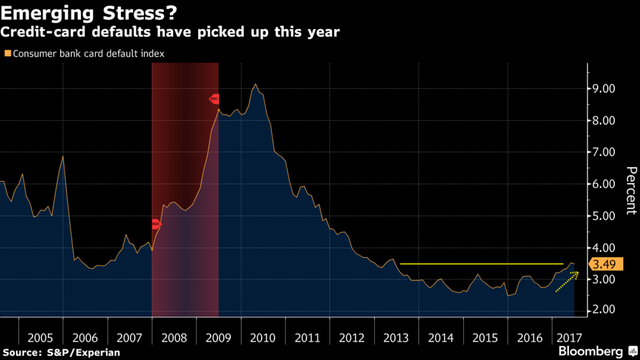

US credit card debt is at the highest that it has been since the end of 2008.

The recent holidays helped to push the total over the $1.02 trillion mark, though this isn't the first time that consumer credit card debt is said to have passed the $1 trillion dollar threshold. And despite the holidays now being over, millions will still be paying for it for many months yet to come.

Over the holiday, consumers on average were spending about $1,054 on their expenses with their credit card. And this is on top of the average household US credit card debt that's estimated for Americans, the median debt is roughly $15,654 on credit cards.

Around the end of September 2017, credit card debt allegedly stood around $808 billion, according to the Federal Reserve and the Fed has said that it plans to have 2-3 quarter point hikes this year. With each hike, it's estimated that about $1.5 billion will be added to credit card interest charges.

Along with the debt from credit cards, there is about $1.36 trillion in student loan debt, another $1.21 trillion in auto loan debt, and more than $8 trillion in mortgage debt.

Previous survey's have found that about 17 percent of those currently struggling with debt say that it's because they had to put unexpected medical costs on credit. And it might be even higher numbers than that. A separate survey found that it was about 37 percent of respondents who said they were in debt because of medical bills.

It's estimated that only about 1 in 5 Americans are able to pay off their credit card balance in full every month.

Most of the debt allegedly belongs to men, but that's because they are said to make more expensive purchases, while women make smaller but more frequent purchases.

Millions of people are facing a black hole of debt that they'd like to get rid of and one of the most popular resolutions for many people this new year is the goal to get their finances in order: save more, spend less, and pay off debt.

Financial experts have been seizing the opportunity to suggest that this news could play as a reminder for many that perhaps it's time to focus on their debt and try to get it paid off. Having debt limits the ability to save and really limits a persons ability to deal with any emergency that might come up.

It Can Also Provide An Inflated Sense Of Purchasing Power...

Others insist that it's terrible news for the future and a sign that there's a need for change. And for those who are already struggling to pay down their debts, they might find it surprisingly more difficult to reach their goal of being debt-free if interest rates go up.

Pics:

Pixabay

S&P/Experian via Bloomberg

Sources:

http://www.businessinsider.com/consumer-credit-debt-rises-in-november-2018-1

https://www.marketwatch.com/story/us-households-will-soon-have-as-much-debt-as-they-had-in-2008-2017-04-03

http://www.washingtonexaminer.com/us-banks-buoy-reserves-as-credit-card-debt-hits-102-trillion-record/article/2645320

https://www.cnbc.com/2017/07/11/credit-card-users-rack-up-over-1-trillion-in-debt.html

https://finance.yahoo.com/news/average-us-household-owes-15654-credit-card-debt-171830579.html

https://finance.yahoo.com/news/enjoy-life-fullest-2018-top-100414863.html

https://www.cnbc.com/2017/11/06/many-gift-givers-wont-spend-more-than-50-this-holiday-season.html

https://www.bankrate.com/credit-cards/total-us-credit-card-debt/

https://www.cnbc.com/2018/01/05/how-to-knock-out-holiday-credit-card-debt.html

https://www.bloomberg.com/news/articles/2017-08-10/in-debt-we-trust-for-u-s-consumers-with-12-7-trillion-burden

https://www.usatoday.com/story/money/2018/01/08/credit-card-debt-hits-new-record-raising-warning-sign/1014921001/

https://www.cnbc.com/2018/01/02/americans-racked-up-more-than-1000-in-holiday-debt.html

https://www.wsj.com/articles/the-nations-credit-card-tab-hits-1-trillion-1491593929

Related Posts:

Study: Spending Money On Others Promotes Happiness

https://steemit.com/money/@doitvoluntarily/study-spending-money-on-others-promotes-happiness

Mixing Money With Friendship

https://steemit.com/money/@doitvoluntarily/mixing-money-with-friendship

Is Your Coffee Costing You More Than You Realize?

https://steemit.com/writing/@doitvoluntarily/is-your-coffee-costing-you-more-than-you-realize

And these so-called analysts have the nerve to call cryptos a bubble. LOL Student loans are the biggest debt bubble on the planet! Naive kids with useless, overpriced degrees, graduating into the worst job market in decades. What could possible go wrong?

The defaults are coming!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have realized after the new year people really don’t shop anymore and I have realized the sales are not up to where they are and sometimes people even sell what they get for the holidays

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What could possibly go wrong?

The yield curve is flattening. When it goes negative, there will be a bloodbath in the debt space.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, the reason why the Fed is unwilling to raise interest rate is because the stock market is booming and debt obligation are largely kicked off to the sidelines. Why care too much about the debt when there's no urgency to pay short term obligation? Our inflation based economy will effectively reduce all those real value of debt obligation to nothingness.

However, when consumption machine stops to work, that's when we'll see a real disaster. People will then realized the lies they have been fed with by the government. The only way to be prepared is to diversify into cryptos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@doitvoluntarily, the world is awash in debt and this trend will continue as all fiat currency comes into existence as debt. This is just personal debt, if you add in the debt/deficit the gov't has created on behalf of its citizens, we can easily add a 5-10 time multiple to individual debt levels. This system is not sustainable and will collapse under it's own weight, or we enter a hyperinflationary period where debts get paid by inflated fiat currency. This is setting up to be a very ugly period in the financial markets again, look for 2019 and 2020 to be the worst part of what is coming down the road. It's best to get your financial house in order, trade the cryptos and own physical precious metals.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

wonder if its even significant.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The debt is significant at a personal level, the gov't debt is pretty much insignificant until the creditors put a stop to it. The creditors to gov't debt and bonds are stuck and can't call in the loan or the whole system collapses, so they just diversify and take real assets as payment. This is why gold and silver will start to gain traction again this year, I wouldn't doubt if we see new highs in the precious metals within a couple of years or sooner.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

even at a personal level though i think it depends what you use the money for.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ah, the Consumermas holiday. Family time and good food is all we need to celebrate. Credit card interest is an absolute rip off. If you don't have the physical money to buy something, you probably don't need it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

is use of the credit card requires a good education and administration of those who use them, however are the least, these people are few conveneintes for banking agencies

excellent report dear friend @doitvoluntarily, thank you very much for sharing this information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't know if this debt really matters...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Damn never knew it was the highest it’s been. Thanks for sharing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Debt is definitely something that everyone should take care of. The habit of spending money on useless stuff is a big deal for most people. A lot of people tend to buy things they don't even need. In my opinion, these signs of massive debts are quite scary!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah but does it really matter?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Fell into the fire myself. Wanting to show appreciation to some of my peeps, I did the expeditious thing and CHARGED IT! Intend to pay off immediately but I still feel stupid. Gonna start knitting scarves for next year right now! Thank you for the post. Be safe, be well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Life on credit, a terribly bad habit. And an evil of the western world.......

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Credit cards are the worst!!! I built a huge debt (20k ish) spending money stupidly when I was younger. I ended up declaring bankruptcy after a few years. Should've declared sooner but I was prideful and thought I could pay it down. Now my wife and I only use debit. We are thinking about moving to a credit card and paying everything down each month so we can earn points, but are hesitant due to learning from past mistakes. We shall see, but good article.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

haha but what if you use it to start a business?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

its called digital era, awesome post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing!!! Who owns all this debt?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the post. God bless

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm trying so hard to not spend on my credit cards I owe thousands on them I told my husband of we can't buy something with cash then we don't buy it at all, then we need new tires we don't have the cash for, can't live with them can't live without them, is the American way unfortunately how have you been? I've been very ill with cognitive I'm getting better day by day I don't know if you saw the post where I have brain degeneration and I do and say some crazy things, but not bad though lol hope all is well 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I can definitely realate @doitvoluntarily ! upped and resteemed ! good night 😴😴😴👍👍💳💳💳💳💲💲💲💲💲😭😭😭😭

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello dear. I am someone from the Philippines and I view credit cards as luxury. I feel pretty bad spending and not being able to pay back. And the inflation rate here is pretty bad too

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If credit card companies stopped ripping people off with high interest. People would be able to pay down more of there debt. It’s time to change this outrageous interest rates or cut them off completely and don’t use there useless scams.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's so easy to spend money I don't have, with a credit card.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for sharing with us dear @doitvoluntarily Resteemed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hmmm.... I wonder if it's because there are no incentives to save

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh the debt problem isn't a problem. I mean if Uncle Sam go go in as deep as they are why can't we. Unless it's more for you and I'm the problem. Ok I'll pay mine. The media told me before Christmass it was ok now it's not. Darn should have stayed out of that crypto stuff too. No the boat is sinking and they have to blame someone. Might as well be us. Going to be crashing down soon. Faits always fail. It by desingn.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

always saying that the best economy is yours, the government always tries to offer a better economy for its people

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received gratitude of 0.52 % from @appreciator thanks to: @doitvoluntarily.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit