NET WORTH UPDATE FOR THE FIRST QUARTER OF 2017

It was an eventful first quarter!

In January I came home from my 6-month job overseas. There was a lot to do. Chores were one thing, building up my side hustles was another, and preparing for the birth of our second child was a major use of my time.

A windstorm a week before I came home left our resident backyard dead tree on its side! Luckily the house was fine and the only damage was to a metal shed. I mostly cut it up with handsaws as I thought the exercise would be worth it. It is now piled up in my backyard to be used for outdoor fires in the firepit. Well, most of it is, the trunk was ridiculously difficult to saw, so that piece of the tree is still lying there where it fell in the yard.

With our second child on the way (born on March 19th!), it was decided that we would buy a larger vehicle. We could have made our current family vehicle work, a Mazda3, but the increased utility of a minivan would be useful for both of our side hustles as well. I have made a rule that I don’t spend more than 10% of my gross annual income. That left the budget at $6,500. After some shopping around, we ended up picking up a 2007 Honda Odyssey with 137,500 miles from a private party for $4,600.

It was dirty, but that was cheaply remedied. I also, with the help of my father-in-law, replaced both sliding door center rollers. The rollers were worn out, causing the automatic doors to intermittently stop opening and return to the closed position. Each door roller was about $45 new on eBay and it took about 45 minutes each side. Those doors slide very nicely now. I think both the cleaning and the replacement of the door rollers have increased the value of the vehicle by $1000. To be conservative I have only listed it in my asset column as $5,200.

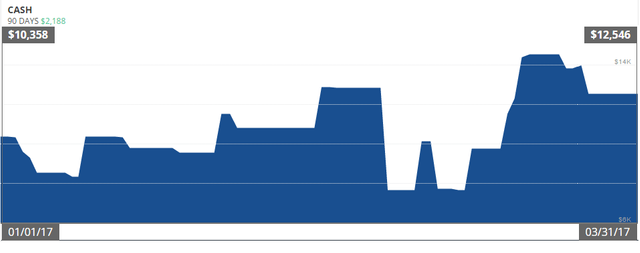

CASH Starting $10,358 Ending $12,546 [+$2188]

I try to have at least $10,000 in liquid cash in my accounts. It is not a firm limit, but a level I feel comfortable with. The exact amount fluctuates of course.

INVESTMENTS Starting $52,721 Ending $57,241 [+$4520]

I toned down my investments as I was building up funds to buy the family vehicle. My retirement contributions through work continued, but my Robinhood brokerage account investments were toned down. Investments go up and they go down. Just have to hold the course because investments are for the long haul.

If you have not tried Robinhood yet, I highly recommend it. There are no commissions for buying or selling a stock.

MORTGAGE Starting $65,345 Ending $64,600 [+$745]

Not much to talk about here, just the normal monthly payment without any additional principle contributions. This is my only loan. No personal loans. No student loans. No car loans. Nothing but this.

What a blessing it is to only owe on a small mortgage.

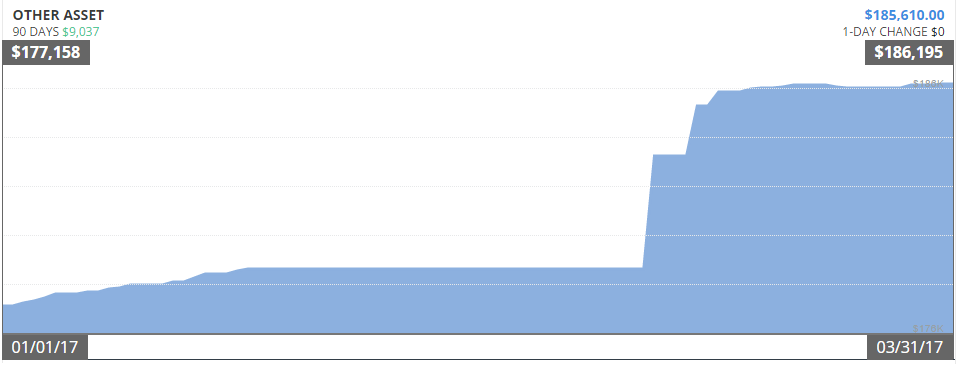

ASSETS Starting $177,158 Ending $186,195 [+$9,037]

The large jump you see in the graph is accompanied by an equally large drop in my cash reserves. This is the purchase of the Honda Odyssey with slight adjustments upward in value as I increased the value of it by a deep clean and minor repairs.

The rest is home appreciation. I really scored a great deal with this house, in 2014 I purchased it for under $100K – now it is worth at least 50% more! It was a huge driver of my total 2016 net worth, but I expect the price growth to slow down to normal levels now.

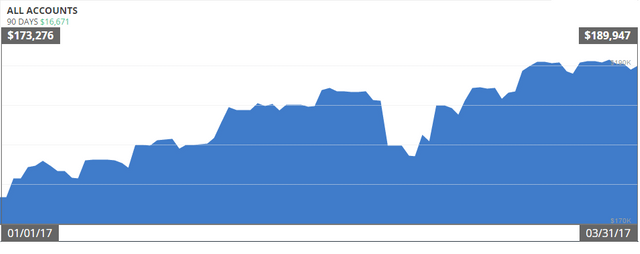

A NET WORTH OF $189,947!

A TOTAL INCREASE OF $16,671!

It is a 9.6% increase from the start of the year.

Any minor discrepancy in the total increase is just some money owed to credit cards, which is paid off in full every month.

To me, this is an amazing achievement for a gross annual income in the area of $65k and supporting my spouse and now two children.

While the side hustle snowball was just getting started, the wife scored an amazing deal at a local thrift store. We turned the $50 we paid for the lot into $1000 with some eBay and FB buying/selling page hustling. It more than paid for the monthly mortgage.

I could have just gone down to the car dealership and signed up for a monthly payment in excess of $500 for a slightly used minivan. How many people do just that when they want another vehicle? Not me. I also looked at private party sellers as that way there would be no tax, tags, and document fees. In my area, Honda Odysseys and the Toyota Sienna are high demand vehicles. This means they normally sell for above KBB or Edmunds say they are worth. By shopping around and buying a visually unappealing interior I saved thousands. This reminds me of the people that don’t purchase a house because of the color of the walls. Paint is one of the easiest things to fix, and dirty carpets in a car is something similar.

This reminds me of the people that don’t purchase a house because of the color of the walls. Paint is one of the easiest things to fix, and dirty carpets in a car are the equivalent.These two actions, finding a big score thrifting and buying a vehicle under the common price of the area I live in, swung the net worth at least $2000 higher in my favor. That is 3% of my gross yearly salary, or about 11 days of the year – a week and a half of work. You add these big movements to dozens of smaller ones and you can really see the net worth jumping, even if you support a family on one average income.

These two actions, finding a big score thrifting and buying a vehicle under the common price of the area I live in, swung the net worth at least $2000 higher in my favor. That is 3% of my gross yearly salary, or about 11 days of the year – a week and a half of work. You add these big movements to dozens of smaller ones and you can really see the net worth jumping, even if you support a family on one average income.

People, it IS possible. It isn’t even that difficult. You just have to stop being a consumer and start thinking about ways to get what you want or need at discounted prices. Most of the time all you lose is the convenience, a service that so many people pay bookoo dollars for. Then find and work on ways to bring you more money.

By flexing my frugal muscles I double my available dollars and every little green soldier will fight to bring my family towards the freedom from money worries.

How do you work towards increasing your wealth?

Your well-paying job, frugality, and index funds?

A side business or hustle?

Something else? Let me know in a comment below.

Ah, there are my #personalfinance peeps! I'm new to steemit and exploring. Found your post. Love it! Keep up the great work!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey thanks @nickelnerds - There are a few of us early adapter personal finance writers here. :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@getonthetrain

Hey buddy,

I have chatted to you before over this hope your doing well over in the US :)

over here in Ireland the weather is great at the moment believe it or not :)

I got some great info of you regarding some stocks before on this and didn't know how to send you this as a direct email through steam . am hoping to get some help on ticker LYCOS.NS , I can't understand the balance sheet maybe you can shed some light hopefully..

link to yahoo finance below

https://finance.yahoo.com/quote/LYCOS.NS/balance-sheet?p=LYCOS.NS

Question is how can total assets be 23967 as stated on yahoo

if total current assets is only14706+long term investments of 1085 +goodwill 1569=17360

Even still with the net income & if asset figure is correct looks oversold maybe your thoughts

Much appreciated

Kind rgds

g

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, the numbers on Yahoo don't seem to add up. From what I read it is that the company is submitting unaudited earnings reports.

Seems like they have been doing well in the past but are transitioning into the "Internet of things" and investors don't seem to believe that they can do it. That appears to be why they are priced near lows .

Still, I agree with you that they appear to be oversold. Their normal business seems to be doing well enough that they should be priced higher. Could be a nice find.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good to see you back! Always love reading your posts :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha, thanks! You don't realize how busy I have been. Trying to get back into it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey , better then not being busy! :P lol

I've started to do a lot of what you are doing. Some minor hiccups in doing so that I'm working out ,but I'm being smarter about everything I do because of our posts!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's great! Just working towards something puts you way ahead of most people.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome back. I don't think many have work out to a level as detail as you. Myself included. I have quite some investments in shares and unit trust which you call mutual funds but I couldn't tell how much it's worth altogether.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I get all these graphs from a site called Personal Capital. You link your financials to it and it consolidates all the data. I don't know if they do it for people not in the USA though.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the info. Seems they take 10 digit telephone number for registration only.

So, i think it's for US.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I love reading posts like this, keep it going.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea, with the name @rdollarsign I think you just might. :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I own a record label named R$ Records (pronounced R Money), and plan on making my own coin one day called Our Money that I have high hopes for.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Make it in silver or gold and I would buy one or more!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's going to be a crypto, but if you want to stay updated with that just follow me and there will be news down the road. I might even throw you a tiny bit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been ranked within the top 10 most undervalued posts in the first half of Apr 21. We estimate that this post is undervalued by $7.29 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Apr 21 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post! Followed and will be looking forward to your progress! Congrats!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks so much!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

jag älskar alltid dina inläg thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit