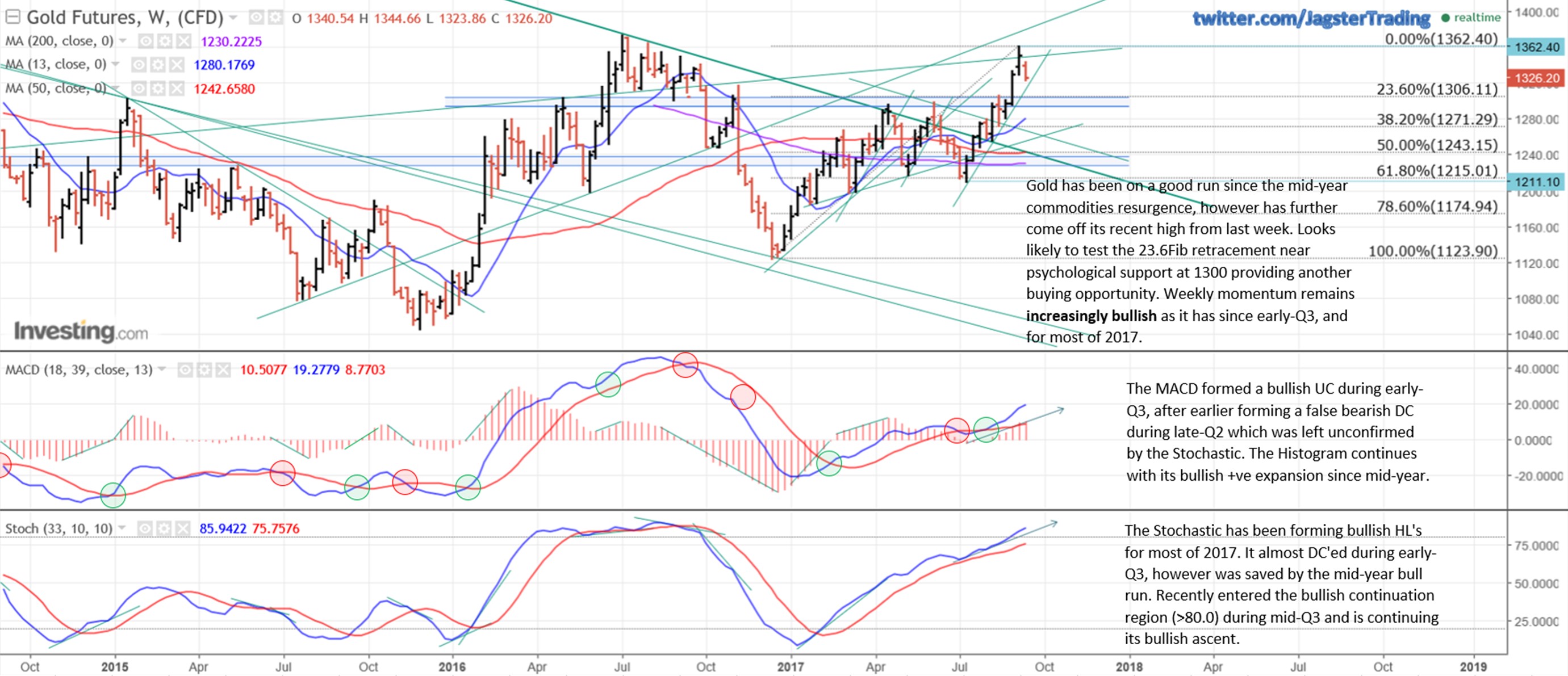

Gold has had a good run since the mid-year commodities resurgence, however has further come off its recent high from last week. Looks likely to test the 23.6Fib retracement near psychological support at 1300 providing another buying opportunity. Weekly momentum remains increasingly bullish as it has since early-Q3.

The MACD formed a bullish up-cross during early-Q3, after earlier forming a false bearish down-cross during late-Q2 which was left unconfirmed by the Stochastic. The Histogram continues with its bullish positive expansion since mid-year. The Stochastic has been forming bullish higher-low's for most of 2017. It almost down-crossed during early-Q3, however was saved by the mid-year bull run. Recently entered the bullish continuation region (>80.0) during mid-Q3 and is continuing its bullish ascent. http://bit.ly/2xlMuz6

Looks a little overbought in the short term, I was expecting a pullback, but I think we've definitely got a breakout my friend!

What time frame do you typically look to trade?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit