There are a plethora of ways to manage your money. The problem is not many people actively research and learn to manage their money, even fewer people stay consistent with it. Everyone should spend at least an hour to plan out their budget. It wasn't until recently I started budgeting my own money.

I came upon a book called "The Millionaire Next Door," by Thomas J. Stanley. It was a book that emphasized on setting a budget and saving the rest of your money. It certainly taught me to be more thrifty with my money and it changed my paradigm on money in general. Instead of purchasing a brand new car, I settled with a used 2010 Nissan Altima less than $15,000, and I plan to drive this car to the ground before purchasing another used car. One of the quotes from the book I think it's important is this, "If you're not yet wealthy but want to be someday, never purchase a home that requires a mortgage that is more than twice your household's total annual realized income." Now I know this could be difficult even impossible for some of you, you could always adjust the math to 2.5x your annual income. The point is not to have so much financial burden in your life. After all many people are paying 30 years of their lives for their mortgage!

Another interesting book that provided me with insights is called "Money: Master the Game," by Tony Robbins. This book has lots of information on how to save for you retirement as well as talk about a variety of ways to invest for your retirement. I didn't even know Jack Bogle is the man who created the index fund as well as Vanguard. Mind you I only started saving and investing starting 2013.

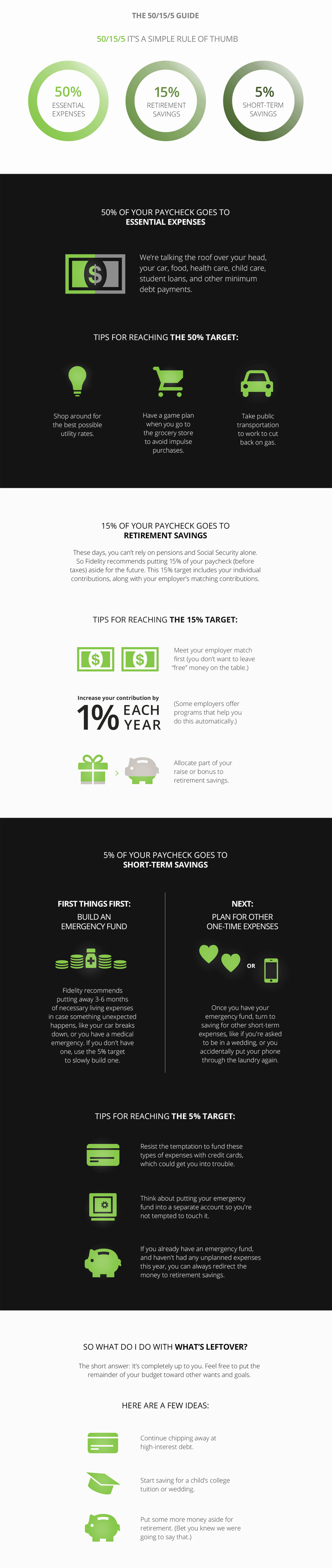

Anyways the image below provides you some ideas to budget your money and I hope you will do your own research and find out the best possible financial planning that suits you. I have come up with my own simple budgeting plan:

50% / 30% / 20%

50% goes to paying essential bills and necessities like groceries, gas, insurance, phone bill, etc.

30% goes to your wants, meaning dining out, entertainment like movies, going to Disneyland, etc.

20% goes to savings and investing.

I came up with this simple budget plan and obviously I'm probably not the first one to conjure up this plan. But I've been consistent with this budget since 2013 and it's worked great for me and hopefully for you if you decide to follow this plan.

Anyways enough of my blabbering. Take what you can from this and apply it to your life. Cheers!

b