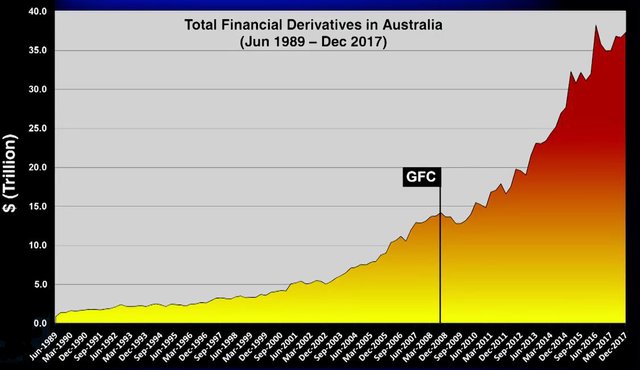

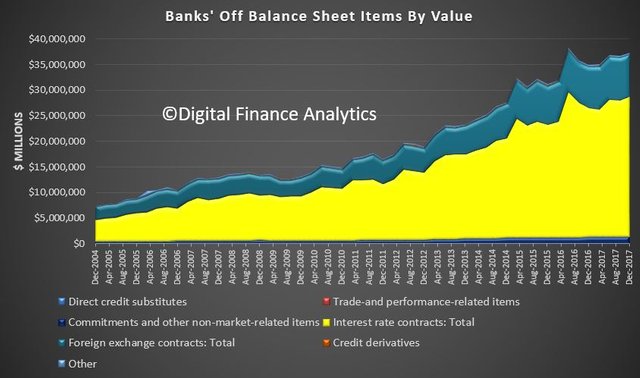

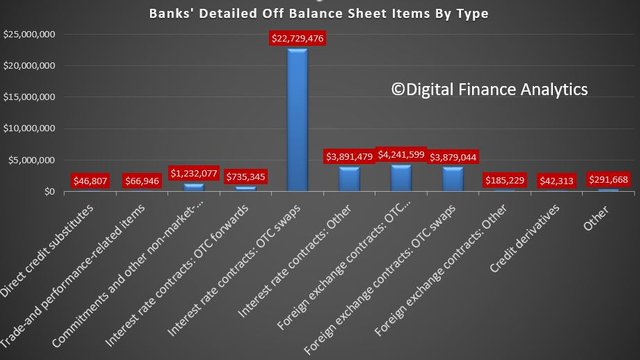

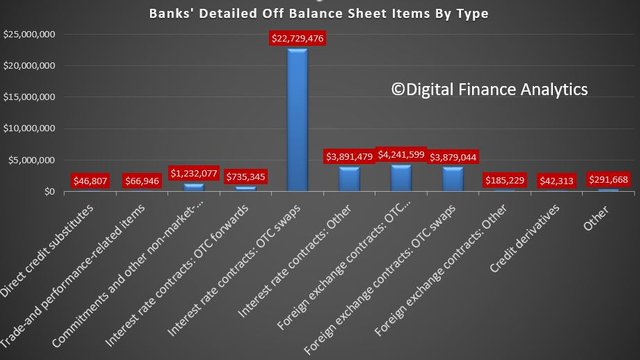

When we look at Australia, we tend to find that they are following in the same path as the U.S., Canada, the UK and others. Accumulate as much debt as possible, take as much risk as you can, and remove any protections put in place in the system. At the center of it all is the derivatives. This is a completely fraudulent creation of mad scientists and should not exist.

Derivative Risks In The Australian Banking System – Digital Finance Analytics (DFA) Blog

http://digitalfinanceanalytics.com/blog/derivative-risks-in-the-australian-banking-system/

15-June-2018-The-CEC-Report-Glass-Steagall-to-be-Introduced.jpg (1124×650)

Banks-Off-Balance-sheet.jpg (844×498)

Banks-Off-Balance-sheet-Details.jpg (920×517)

Banks-Off-Balance-sheet-Details.jpg (920×517)

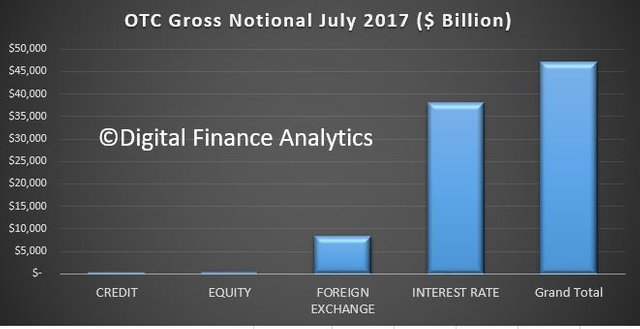

AFMA-2017-OTC.jpg (661×340)

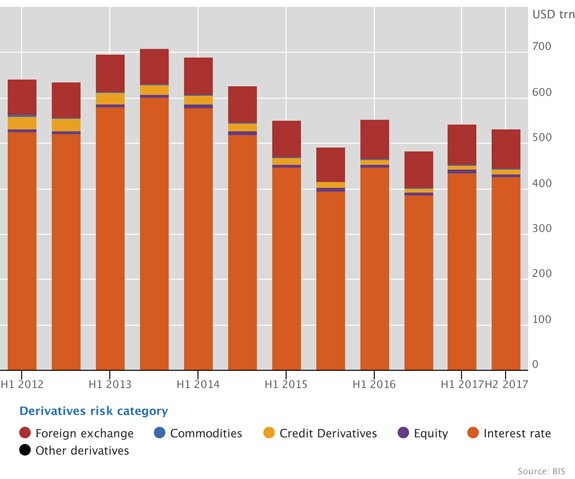

otc_hy1805_graph1.jpg (575×479)

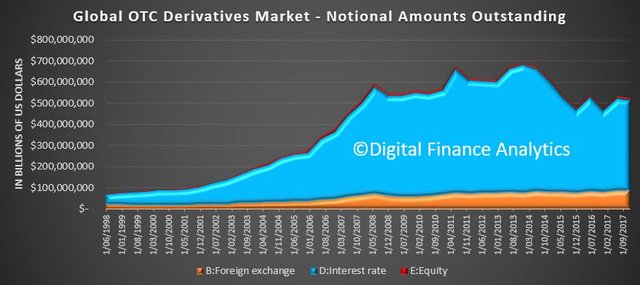

BIS-OTC-Trends.jpg (833×371)

▶️ DTube

▶️ IPFS

Hiii...

Great Post with Fabulous information of Australia.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks David. Keep up the good work. Looks like it is bombs everywhere waiting to blow. Still I think the fuse is more likely to be Italy or Greece.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for this information. Look at all those swaps! Now where did I hear that word before? Australia's residential loan book, I think is a little under 2 trillion. Leverage ratio at 20 to 1. I think that was the ratio mentioned in "The Big Short". Australia's GDP is also around 2 trillion, oh bugger!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Australia 🇦🇺 is just another Zionist British Colony .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit