Trading vs Investing

Your trading journey is just getting started. Here are the key differences between trading and investing to help you kickstart your crypto adventures with us.

Pick The Right Instrument

Understand each trading instrument available on Binance, and pick one that suits your risk tolerance level and trading style.

Spot: Buy, sell, and trade your crypto in real time in an open market.

Convert: Exchange crypto with one click in a chart-free environment.

Recommended for advanced users:

Margin: Borrow funds and trade crypto with leverage

Futures: Predict how the market will move and go short or long

The Basics of Strategy

Choose a suitable approach to your trading, whether you prefer to be active, like a daytrader, or more passive, like a HODLer.

Day trading: Enter and exit positions within the same day.

Swing trading: Take advantage of price swings over a longer time frame. Similar to day trading, but your positions could last up to two weeks.

Recommended for passive investors:

Dollar-Cost Averaging (DCA): Accumulate your assets over time with periodic buys every day, week, or month.

Make Your Next Trade Today

To get you started, here are three different order types for your next crypto purchase.

Limit order: Limit orders allow you to get better selling and buying prices and they are usually placed on major support and resistance levels. Learn more.

Market order: Market orders are easy to use and the quickest way to open and close positions immediately. Learn more.

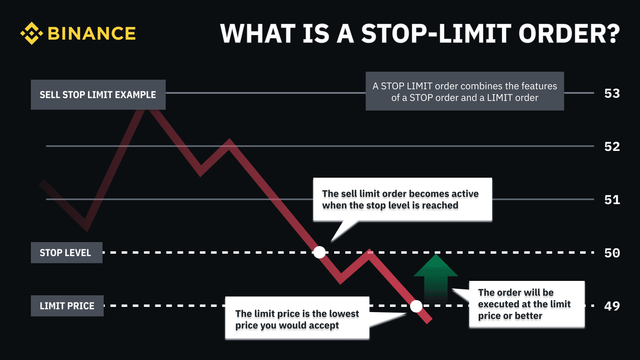

Stop limit: Stop limit orders combines the best of both worlds, allowing you to set the maximum and minimum amount of profit you’re happy to take.

Cool reading folks.