Most of you have probably already heard of the snapchat IPO where they managed to raise no less than $3,4 billion. On the first day of trading the price of the stock jumped from $17 to $24 in no time. It all seemed as if this was gooing to be the stock of the year but a lot has changed since the first week of trading. None of the financial analysts recommend to buy this stock but to short is to the floor.

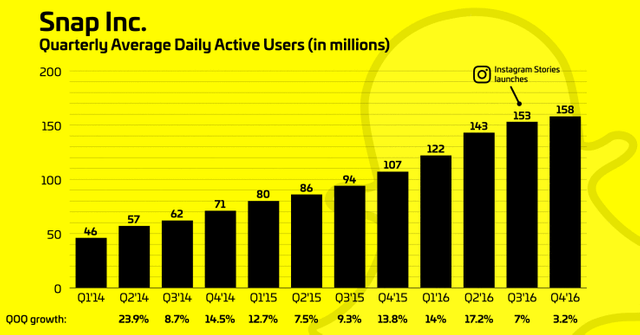

Slow user growth

``

``

source: https://techcrunch.com/2017/02/02/slowchat/

The user base of snapchat used to grow 40-50% every year but since the introduction of similar platformes from competitors (facebook/insatagram in particular) the growth rate has slumped to 5% on average each quarter. Not only new platformes but also the rather small market that they serve (young people) is a reason why the user base doesn't grow like it used to anymore.

Price/earnings ratio

Currently the company is valuated at $30 billion with $404 million in revenue in 2016. This means that they have a P/E earnings of 75. According to big investors like Benjamin Graham and Warren Buffet a healthy P/E ratio fluctuates around 15-20 but since it's a startup 50 should be an absolute maximum. If they don't manage to meet the estimates which is $1 billion in revnues at the end of 2017, interest in this stock will fade away and it will obviously crash.

conlcusion

Be cautious if you buy this stock. There's a change that you might make a profit if snapchat manages to meet the estimates but there's also a big chance that they will never be able to realise this and according to the P/E ratio of the stock, there's plenty of space to slide down, hard.

This is honestly a no brainer. I've been following Snpachat's business practices for a long time before anyone even considered mentioning IPOs and I saw their development.

To make it simple, they turned to advertisement revenue too soon, sold private data too soon, and most importantly went public too soon.

Their 2016 business model was a disaster with Snap Kids being considered a good idea. The price will slowly crash back into IPO land until the few investors start seeing their quarterly earnings being a disappointment and the shorters start seeing the massive gains.

In my book, this is a clear tank.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit