Janet Yellen, the former chair of the Federal Reserve, has doubled down on her longstanding criticisms of bitcoin and other cryptocurrency assets.

Speaking on Monday at the 2018 Canada FinTech Forum in Montreal, the Obama appointee, who led the Fed from 2014 to 2018 following a four-year tenure as vice chair, alleged that bitcoin’s decentralized nature inhibited its utility as a payment instrument.

She said:

“It has long been thought that for something to be a useful currency, it needs to be a stable source of value, and bitcoin is anything but. It’s not used for a lot of transactions, it’s not a stable source of value, and it’s not an efficient means of processing payments. It’s very slow in handling payments. It has difficulty because of its very decentralized nature.”

Of course, supporters would argue that cryptocurrency is still an early-stage technology, comparable to the internet in the early 1990s in that it has shown promise while also suffering from growing pains and a sub-optimal user experience.

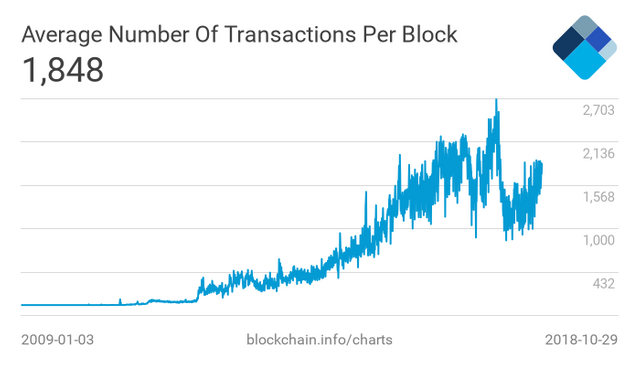

Despite a fairly steep dropoff during early 2018, the average number of bitcoin transactions per block has steadily increased throughout the network’s history, from just 1 in 2010 to more than 1,800 today. Developers also predict that second-layer technologies such as the Lightning Network (LN) should allow the network to scale its transaction capacity exponentially while also making BTC useful for everyday payments and microtransactions.

Though perhaps not useful for the proverbial “cup of coffee” today, bitcoin is regularly used to move hundreds of millions of dollars across borders, often much more quickly and cheaply than settling such transactions through the conventional financial system. Earlier this month, for instance, a crypto user sent $194 million worth of bitcoin for just $0.10.

To Yellen’s other point, bitcoin, as the face of an entirely new asset class, is indeed volatile, though it has grown more stable in recent months, bolstered by the launch of cryptocurrency derivatives and other tools that aid in price discovery.

Nevertheless, Yellen’s bearish outlook on bitcoin is largely in line with criticisms she has made in the past. Last December, days before the bitcoin price crested near an all-time high near $20,000, she lambasted bitcoin as a “highly speculative asset” with a “very small role” in the financial system.

She said:

“I would simply say that Bitcoin at this time plays a very small role in the payments system. It is not a stable store of value and it doesn’t constitute legal tender. It is a highly speculative asset.”

Her successor, Trump appointee Jerome Powell, has struck a similar tone, warning lawmakers earlier this year that cryptocurrency is a risky investment class that is dangerous for “unsophisticated” retail investors. He also said that bitcoin and its peers should not be considered real currencies since they have no intrinsic value.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://virtualmining.com/yellen-bitcoin-not-a-store-of-value-anything-but-a-useful-currency/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cryptodworld! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 15.12% upvote from @brupvoter courtesy of @cryptodworld!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit