The two most popular digital currencies, bitcoin and Ethereum, fell Monday after Chinese authorities over the weekend said they planned to shut down platforms that help individuals buy and sell bitcoin in the country, dealing a fresh blow to the nascent industry.

A single bitcoin BTCUSD, -0.13% bought $4,173.01 early Monday in New York, after falling below $4,000 on Saturday, according to digital-currency news and data site Coindesk.com.

Ether tokens, which trade on the Ethereum blockchain, were trading at $290.80, after hitting $275 on Saturday.

The Bank of China has led a draft of instructions that would ban Chinese exchanges from providing virtual-currency trading services, The Wall Street Journal reported. The news follows a number of efforts by Chinese regulators to limit the use of digital currencies, which some worry are being used to launder money, as well as for other elicit activities.

Last week, Chinese authorities declared so-called initial coin offerings, or ICOs, illegal. Such offerings, used to raise money for digital-currency linked ventures, have been growing at a rapid clip, eclipsing that of traditional venture-capital investing, Goldman Sachs said in a note last month.

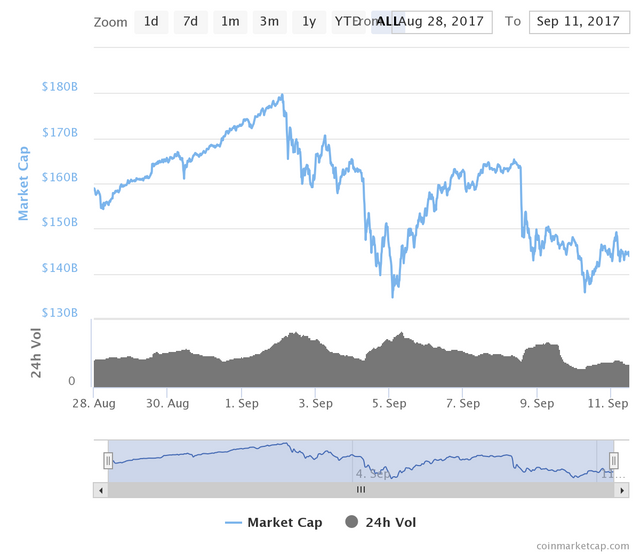

Although rebounding somewhat on Monday, digital currencies overall have been in a slight draft. The market value for an array of cybercurencies were down to $144.6 billon, compared with a recent peak of nearly $180 billion early this month, according to research site Coinmarketcap.com.

Meanwhile, a fund that is tied to bitcoin, the Graycale sponsored Bitcoin Investment Trust GBTC, -1.74% has lost 28.5% so far in September, but boasts a year-to-date return of nearly 500%, according FactSet data. The fund has been the subject of investors betting that its value will tumble, because it is trading at a premium to underlying bitcoin.

Critics of digital currencies make the case that enthusiasm for bitcoin and Ether tokens, highlighted by a precipitous climb in value for those units, represent a bubble that could pop at any moment.

Thank you for your analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit