NEXO: A Crypto Credit System

A crypto credit system? The fears are obvious.

But banks are the problem! Crypto is meant to destroy banks, not empower them! We don’t need lenders in crypto! This is a scam! They’re just trying to steal your crypto! There’s no use for a crypto credit system, just HOLD.

Look. If you want cryptocurrencies to remain an obscure internet subculture, instead of being used as a means of exchange of value, then, yeah. Fight against any and all financial services who take the risk of being early adopters to this tech. But if you want crypto to have use-value, and thereby securing it as a means of exchange, then adoption by financial services is one inevitable step towards that.

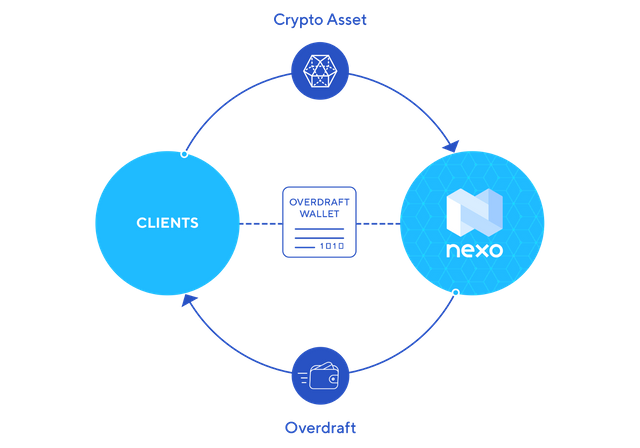

NEXO is one of those financial systems. Though not the first of its kind, it’s the head of the pack. NEXO allows clients to enter a lending agreement whereby they put up their cryptocurrency as collateral for fiat, either in the form of a bank transfer or by giving you your own NEXO credit card.

How It Works

When you pay your balance, you get your crypto back. This is an advancement from traditional credit systems. With NEXO, there’s no credit check. There’s no hidden fees that credit card companies stack on the debt balance with conveniently ambiguous titles like ‘application fee’ or ‘administration fee’ or ‘commitment fee’.

To make up for a lack of credit check, NEXO does require nearly twice as much the value of your loan as a guarantee. This means that if you want $10k, you need to put up about $20k worth of BTC. I agree this is overdoing it, but this could always change in the future. The amount of crypto required is dependent on the volatility of the asset. And, sorry, but crypto isn't known as being a stable asset.

You need to think of this as a guarantee on your part for NEXO to give you the overdraft. They’re giving you money, and they need to ensure you’ll pay back your balance.

The credit has an interest rate. This is to be expected, as they’re lending money. Filling out the steps on their website, I got about 12% interest on a hypothetical $10k credit. That’s high, but alot lower than some credit cards or loans today.

It’s important to understand that the interest rate is really the only fee we’re talking about here. What’s innovative about NEXO is that you’re going to get your crypto back after you pay the balance. NEXO’s process of liquidating the value of your crypto, while still retaining your portfolio, allows you to get get money while avoiding paying capital gains tax.

This is pretty huge. If you need cash today, due to whatever it is the world threw at you, you can get that money invested in crypto and only pay the interest on the credit. Instead of hating yourself for selling the crypto (which could moon the next week), you put it up as collateral. NEXO’s process ensures you

- Don’t miss out on your crypto asset mooning

- Don’t pay capital gains tax

- Don’t pay bank transfers or exchange fees

Understanding these points, an interest on the credit seems pretty damn reasonable.

Who would use it? Well, who uses credit systems? Everyone, for a vast array of different reasons. Hedging on an investment, getting money for a crisis situation, or just to increase your purchasing power. NEXO is a next-gen financial service.

NEXO Tokens: Dividends on a Trillion Dollar Market

NEXO will have its own token system. NEXO tokens have multiple uses. Maybe the most desireable is their potential use as passive income. Token holders will earn 30% dividends from company profits. This means that the more clients using the system, the more profit for the company, and thus the more NEXO token holders earn.

But aside from their use as a kind of share in the profit from interest on loans, the tokens will function as a means of exchange for the NEXO ecosystem. You can pay back your credit using NEXO tokens, and in so doing get a discount on the interest payments of your loan.

This ensures two things. First, there’s a use-value for NEXO tokens as passive income. Second, there’s a use-value in the token as a means of payment for the credit. These two uses ensure that the value of the token will increase (due to a continued increase in demand). The more credit is issued, the more interest is earned, and the more dividends are paid. Theoretically, this process can increase exponentially.

To understand, the average U.S. household has a credit card debt of around $15,000. Crypto itself has a market capitalization of half a trillion dollars. Should it grow, as we all hope it does, we’re looking at a market of a trillion dollars. NEXO could find a place in this ecosystem as a financial service, offering a service of liquidating your asset value while retaining the asset. In a trillion dollar market, possibly five trillion by 2025, the dividends on loans could be immense. NEXO tokens could be a prized gem in crypto holder’s portfolios.

Conclusion

Credit gets a lot of shit, and not all of that is undeserved. But credit makes life easier (when used with discipline) and can even be a lifesaver in times of crises. Look, shit happens, and often that means you need to pay up. NEXO will allow you to take the value of your crypto NOW, in the form of fiat. Even better, you don’t need to follow through with credit score checks or pay capital gains tax. The limit to your value is the limit of the crypto you put in. This means, you’re in control of what your credit limit it, not a bank.

Used with discipline, NEXO is a step towards crypto going mainstream. Maybe it’s not for everyone, but it is a step forward for crypto as a whole.

This is an entry for the original works contest, linked here:

nexo2018

This post has been submitted for the OriginalWorks Sponsored contest!

You can also follow @contestbot to be notified of future contests!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cool, following you. Whats your current favorite coin/token?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

currently none of them. I came aboard crypto in Dec/Jan. My favorite will be the one that breaks even first.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit