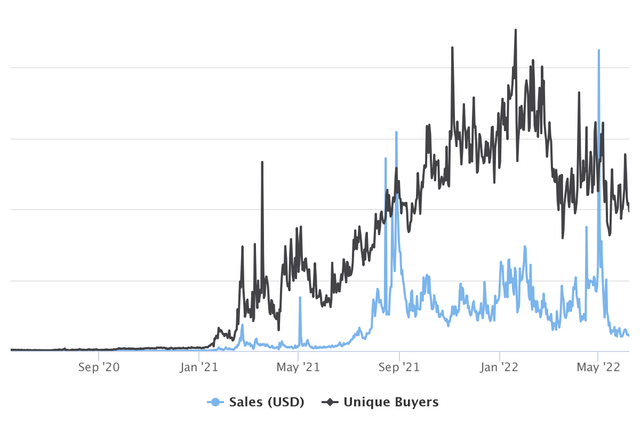

In the last week of May, average daily NFT sales were $33 million, while that figure exceeded $150 million over the same period in April. Overall, sales rolled back to the level they were at in mid-2021.

Image source: cryptoslam.io

The cryptocurrency market's correction didn't overtake the NFT sector, which is considered by many to be an investment opportunity. When new collections from eminent brands are released, participants actively buy tokens with the expectation of a future resale.

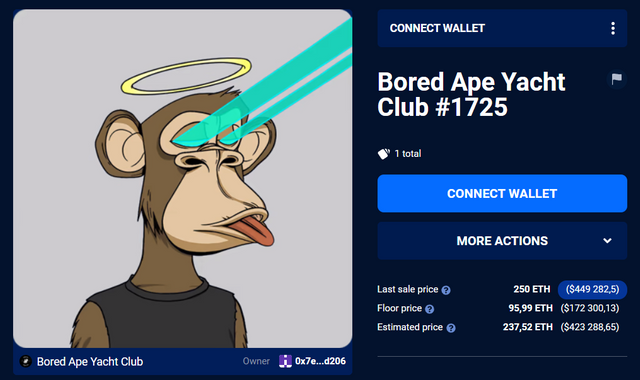

This was clearly manifested in early May with the release of the NFT collection from Yuga Labs, responsible for the popular Bored Ape (Bored Ape Yacht Club or BAYC). BAYC ranks sixth in the overall NFT standings, with a turnover of $2 billion, and on 10 May, one of the apes was bought for 250 ETH ($450,000).

Image source: dappradar.com

In the new collection from Yuga Labs, tokens are land in the Otherside metaverse. The first 55,000 plots were sold out within a few hours.

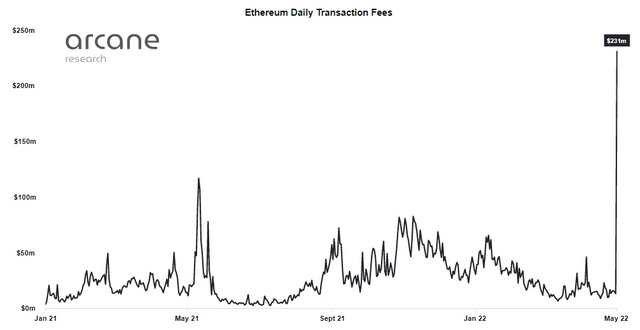

Due to Ethereum's low throughput in the wake of the hype, buyers were inflating tips for miners to get their transactions processed as soon as possible. As a result, miners earned a record $231 million per day, with commission exceeding $1,000 at its peak.

Image source: arcane.no

However, this surge did not lead to significant results for the NFT market, which has contracted by 65% over the past 30 days. Ethereum was also not positively impacted as the subsequent collapse of Terra (LUNA) and the flight of investors from DeFi hit the altcoin's capitalisation.

Image source: StormGain.com

Search engines have also seen a drop in interest in NFT. The search term "NFT" in Google Trends decreased from a maximum of 100 points in mid-January to its current 22 points. The lower interest in this field leads to Ethereum's usual weakness against Bitcoin since support for smart contracts is the trump card by which the altcoin significantly distinguishes itself.

StormGain Analysis Group

(cryptocurrency trading, exchange and storage platform)