Bull Put Spread

This is a review of an article about an advanced options strategy called a spread. Source

Bull Put Spread

The bull put spread option trading strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. The bull put spread options strategy is also known as the bull put credit spread as a credit is received upon entering the trade.

Bull Put Spread Construction😀

Buy 1 OTM Put

Sell 1 ITM Put

Bull put spreads can be implemented by selling a higher striking in-the-money put option and buying a lower striking out-of-the-money put option on the same underlying stock with the same expiration date.

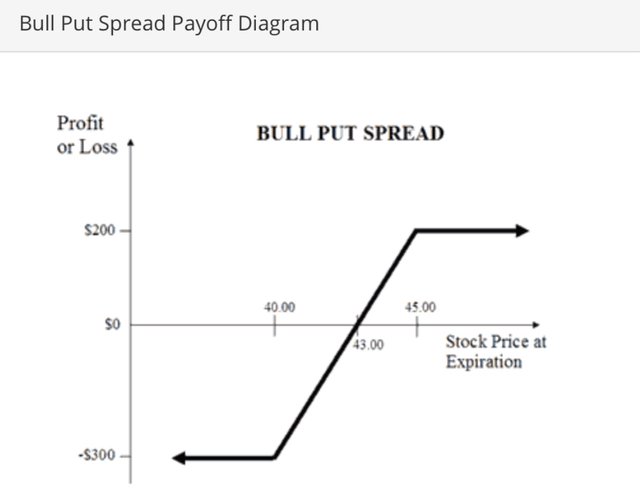

Limited Upside Profit

If the stock price closes above the higher strike price on expiration date, both options expire worthless and the bull put spread option strategy earns the maximum profit which is equal to the credit taken in when entering the position.

The option diagram for calculating maximum profit is given below:

The formula for calculating max profit is below:

>• Max Profit = Net Premium Received - Commissions Paid

>• Max Profit Achieved When Price of Underlying >= Strike Price of Short Put

Trading options is a calculated financial risk, where you know the probability of success, the possible gain and possible loss going into the trade. Once mastered a degree of financial independence and personal freedom can be achieved.

References

Summarized by @shortsegments

Read other articles by me on the Steemit Social Media Platform, where writers get paid for their content by the community by upvotes worth the cryptocurrency, called Steem.

Please follow my Steemleo investment Blog

Please follow my Twitter Feed Here

😅😊

I posted this article on my Twitter: https://twitter.com/shortsegments/status/1209770501045772288

#posh #theycallmedan

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit