We get this one a lot, so we decided to post a detailed review here for everyone’s benefit. There are plenty of payment solutions over the blockchain, and it can be difficult to understand how they compare — especially these days when a new project seems to come up every single day.

We’ll start by diving into household names, and then discussing more recent entrants into the space. We’ll wrap everything up with a simple table that summarizes this entire post nicely.

Verify vs Paypal

Ah yes, Paypal. The elephant in the room, and one that’s undoubtedly hated on by various players in the market. Say what you will about Paypal, but they are the largest and one of the oldest payment solutions on the market.

Still, Paypal today has:

- No support for cryptocurrencies (and there’s nothing planned). In fact, Paypal still doesn’t have support for many developing countries, almost 20 years later.

- Have you googled “blocked by Paypal” recently? There are hundreds of horror stories of companies processing $1m+ getting shutdown without any notice. You can’t really blame Paypal — they are simply working within the card networks rules (which are ruthless towards merchants and payment processors alike). When a payment processor accepts a fraudulent transaction, they lose 100% of the sale. If they reject a legitimate transaction, they lose just the 1% transaction fee.

- The fees are incredibly high, even in the credit card space. It’s 5%+, once all the hidden fees are factored in (processing, FX, transfer and withdrawal fees)

Verify vs Credit/Debit Cards

Despite their age, credit cards today are the second-most widely used financial instrument used for settling transactions (the first is still cash). Card networks like Visa and MasterCard have created such strong network effects that they are able to leverage control over both the supply side (i.e. issuing banks) and demand side (i.e. acquiring banks).

However, there are some key areas where credit cards fall short compared to Verify:

- Fraud. It’s no surprise this is the first issue on the list, because it’s a big one for sellers accepting card payments. Chargeback losses are projected to hit $31B by 2020, over 1.5% of all transaction volume. Like I said earlier, card networks have such strong leverage over participants in the network that they can dictate their own rules — and these were done over a long-enough period of time that they could never have gotten away with them otherwise. Consider the fact that sellers are liable for fraud performed using stolen credit cards, despite there being no concrete way for sellers to completely verify that any given card is not stolen.

- High fees. This is just the reality of the credit marketplace — there’s a cost to extending credit, and that cost is ultimately borne by the seller (who passes it indirectly on to the buyer). The many transaction intermediaries each get their cut too.

- Difficult to get started as a merchant. Despite all of the hurdles above, card networks have made it even more difficult for sellers by putting huge barriers to entry for merchants to start accepting credit cards. This often involves putting down security deposits in the tens of thousands of dollars, or rolling reserves for a large portion of all transactions. This further adds to the cash-flow pressures that sellers face.

Sellers are eager to find an alternative method that isn’t as eye-gouging.

Now they have one.

Verify vs Monetha

With the big players out of the way, let’s consider the smaller, more recent ones. Monetha ICO’d a few months ago and may sound similar to Verify in some respects. While it is not fully operational (and a solution hasn’t even been created yet), we could gather from published material that their focus is to facilitate a smooth transaction between the buyer and the seller using Ethereum — with an automatic rating system that according to the transaction details would rate the buyer and the seller. The idea sounds appealing at first, but lacks one crucial element:

- No buyer protection. Monetha displays a rating for stores, but fails to offer the escrow mechanism that would facilitate dispute resolution between buyers and sellers. They are thus unable to offer buyers a refund if the transaction does not work out. The only recourse they offer is a “hit” to the seller’s reputation — the damage to the buyer, however, would be irreversible (given that crypto-payments are strictly one-way).

- Only accept ETH-based currencies. Monetha only accepts Ethereum based payments, completely disregarding the largest cryptocurrency in existence: BTC.

Verify vs Utrust

Utrust is a more recent entrant in the space. Before proceeding, it is worth mentioning that this material is based entirely on the Utrust white paper and website. The team has not delivered any product to date, and do not even tout an MVP. Now, unlike Monetha, Utrust promises buyers a refund in the form of UTK tokens in two cases where 1) the seller voluntarily agrees to refund the buyer or 2) when the Utrust resolution team decides on refunding the buyer; in the case of the latter, a 2% fee is levied on the amount on hold. The way Utrust achieves this is through holding the transaction value until the transaction is completed. The hold period changes for sellers if they perform well. This protects buyers from sellers and vice versa.

- The first issue is the same one we started with: the lack of domain and execution record for the team. The white paper only outlines a high-level description of a reputation system with no consideration for crucial implementation decisions related to hold periods, recourse and risk management (e.g. for various forms of established reputation system vulnerabilities like Sybil attacks, ballot stuffing, traitor attacks, etc.).

- It fails to consider the inherent cost in exchanging tokens to fiat (typically 0.5% each way, resulting in a 1% fee on the total transaction).

Summary

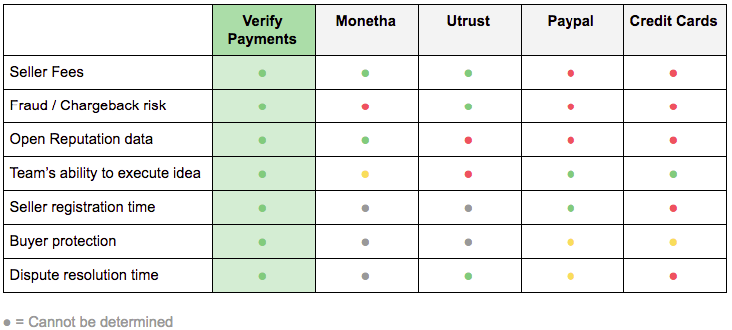

In summary, here’s a handy table that explains the most important differences between the various platforms we described here. Remember that Verify is a reputation protocol, and this is a comparison of Verify Payments vs the

others:

Verify.as

Verify is a Reputation Protocol for buying and selling things using

cryptocurrencies → https://verify.as/

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://techburst.io/so-hows-verify-different-than-a4c09a40909b

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit