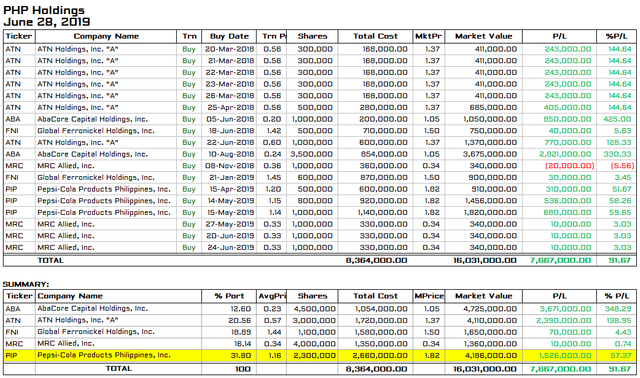

As I said earlier, I sold my previous stocks asset class (portfolio) in exchange for real properties. Since then, I’m in the process of reallocating and rebalancing my portfolio once again. As of today, Pepsi-Cola Products Philippines, Inc. (PIP) is 31.80% of my most recent stocks portfolio.

Why PIP?

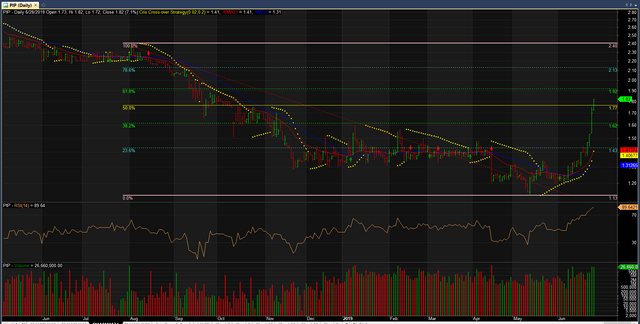

I believed consumer stocks are sustainable for long-term investment. Technically, on June 4, 2019 my buy signal indicator confirmed that 1.13 price on May 15, 2019 is the most current support for PIP, which re-affirmed by EMA 21 crossed MA 34 on June 10, 2019.

Today, we just surpassed the 50% Fibonacci which for me signaled a bullish territory. If 61.8% Fibonacci will be broken up in the next two weeks then the resistance of 2.40 can easily be achieved. Otherwise, a sideways pattern is to be expected in the near mid-term as PIP fundamentally edged up a bit only in 1Q19 compared the same period last year.

Please upvote and follow me on https://steemit.com/@php-ph.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of this security.

Congratulations @php-ph! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit