“You most be the dumbest person to have ever graduated Harvard” shouted the head trader. Bill, a trader, had given his opinion on a trade that was so far off base that Paul, the head trader, had lashed out at him in disbelief. Bill was actually pretty smart; yet, in that particular instance, he knew little of what was happening so his opinion infuriated his superior. On Wall Street, opinions matter.

Your intellectual currency goes a long way in building a financial career. Traders, bankers and salesman want to hear your opinion on the markets if it can make them money. People take note of your successes and misses. Traders have a daily profit and loss statement that is a scorecard of their performance. Analysts are forever being graded by the clients they serve. Traders who make money are seen as more credible and an analyst with a better track record is sought out for his or her knowledge. Traders and analysts who don’t make money are eventually fired, never to be heard from again. For all intents and purposes, nobody cares what they think because their ideas didn’t make money.

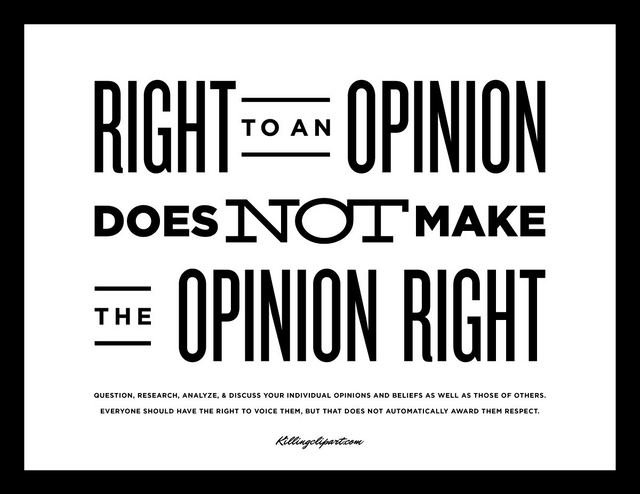

However, generally speaking, there is a mistaken notion that all opinions are valued and should be treated the same.The youth are especially prone to this belief as evidenced by the protests seen on college campuses. The students often act in puerile and juvenile ways when confronted with opposing opinions. Look at the campus riots when Ben Shapiro, or Ann Coulter, speak at colleges. Although some may categorize the opinions of these speakers as controversial, for many they are mainstream.

The wake-up call comes soon after graduation. Entering the professional world, former students quickly learn that their opinions aren’t worth very much.

When I first started trading emerging market debt, I was given a small amount of bonds to trade. “Small” because I didn’t have the experience to trade anything larger. When I shared my observations at mandatory morning meetings, they were given little credence because I lacked the requisite depth of knowledge to opine on the markets. Never did I feel slighted or insulted. Others knew it took time to gain the necessary understanding to form credible opinions about the markets.

Ray Dalio, the hedge fund manager of Bridgewater, actually scores and evaluates the opinions of the people who work for him. All of his employees have baseball cards with their current stats…area of expertise…knowledge base on certain subjects… and track record. Whenever there is a meeting and feedback is solicited, everybody in the room will refer to the persons playing card to gauge their knowledge and performance record. In sports, the use of cards is quite common with current statistics being used to gauge the outcome of a play. For example, in baseball, when a pinch hitter is up, the first thing an announcer will comment on is that hitter’s batting average as a pinch hitter. They do so to give the viewers some perspective on what the outcome might be.

Ray Dalio uses cards because he knows that we humans tend to give more credit to, and value, the opinions of others when they have been shown to be successful. Ray Dalio would never have fallen into the trap that ensnared basketball great Michael Jordon. Jordan, seen as one of the greatest basketball players of all time, failed in the role of General Manager. Lacking the necessary skills that make one a great evaluator of talent, Jordan’s team has under-performed. A great player does not make a great General Manager. In Dalio’s world, Michael Jordan would never have been given the GM job until he had been proven himself to be expert in the job requirements.

For Dalio, the cards act as a filter that allow people to assess strengths and weaknesses. He first experienced this problem first hand when he made investments outside his scope of expertise. The people at his firm did not stop him from making those investments because he had been so successful in the past. However, the investments always ended up badly. Those failures caused him to evaluate not only his inclinations, but also the opinions of everyone else in the firm. He came to the conclusion that the things we don’t know far outweigh the things we do.

People in the media make the similar mistake of thinking all opinions are equal. When Lebron James criticized Donald Trump over Trump’s performance as President, Laura Ingraham, talk-radio host, aptly pointed out that James should be quiet on that matter. “It’s always unwise to seek political advice from someone who gets paid $100 million a year to bounce a ball,” she said. “Keep the political comments to yourselves. Shut up and dribble.” Like her or not, Ingraham is immensely qualified to talk about politics. Take a look at her biography. She was simply making the point that Lebron James is not. Politics is a profession. It takes years to gain experience in this arena… years and experience Lebron James has not accumulated

We each have a tendency to opine on things we know nothing about. We think our opinions should matter. Religious leaders are no exception. In a recent CBS interview with Steve Bannon, the reporter asked Bannon about his opposition to the Pope’s stated position regarding Trump’s immigration plan. Bannon is Catholic. As a Catholic, doesn’t he have an obligation to follow the teachings of the Church and of its highest authority? Bannon’s response? “In matters of faith, the Pope is infallible…in regards to immigration, the Pope is just another guy with an opinion.”

Steve