Ending 2020, the year when I finally managed to recover my trading account (lol).

Although I had crypto reserves from earlier, could only get into trading from 4 Sep.

Admittedly, it's as easy as it could possibly be with the current market trends, I'm still happy with my +52% stock portfolio performance.

This of course does by no means mean that I'm a good trader (I only lost with those yet) and maybe an average investor in the recently diluted field. The reason for my gains is that I just bought TSLA (still kinda late) and the hype exceeded everyone's expectations to date.

It's pretty much the same with crypto, in which I ended up reversing my BCH play. I need the money to work yet and that I can most efficiently do with BTC with the current trends. Will see for the future.

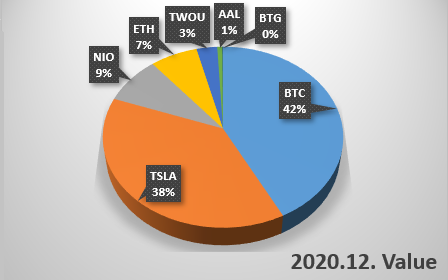

But either way, let's get to the point. Here's how it looked going into 2021. (12.31. 23:57 CET)

Ticker | Value | Positions @ Price | Appreciation | % total

BTC | $4447.07 | 0.152587 @ $29145.5) | ? | 42.4%

TSLA | $3998.35 | 5.672624 @ $704.85 | +64.32% | 38.1%

NIO | $896.69 | 18.34 @ 48.89 | -2.84% | 8.6%

ETH | $734.44 | 0.9897 @ 742.08 | ? | 7%

TWOU | $320 | 8 @ $40 | +17.82% | 6%

AAL | $79.05 | 5 @ $15.81 | +5.82% | 1%

BTG | 9.47 |1.1264 @ $8.4 | ? | 0.2%

Total value: $10,486

BTC and TSLA together make up 80.5% with the whole portfolio consisting of 50.5% in shares and 49.5% in crypto. This is most likely to drop in 2021 as I'll be looking for ways to diversify to an extent (more on that later). For the time being, my strategies for various tickers are:

- Long on BTC, institutions have just started pouring into it properly and there's hype around it as well.

- TSLA I might take some profits on post Q4 report momentum (if I do, only to diversify) but planning long in general.

- Now NIO, there's a chance I might sell for profits post NIO Day since I would like to grab the share at a lower price point ($50.35 DCA atm), I FOMOed into them pretty badly so it couldn't be that hard (famous last words).

- ETH is a mid term hold, there's likely more to come for cryptos in 2021 and the 2.0 framework's still being deployed. Also FOMOed it pretty hard back in 2017, sadly at $950+, need to correct.

- TWOU I grabbed from ARK's top 5 back in 30. November. Had a good run with +18% so far, not bullish on it but there's potential for more, quite a bit below ATH but potential to sell.

- AAL is a "hell, they'll need to move up either way" kind of mid-term play, not significant with $80 total value at all. Could sell in 2021 as the recovery's rather slow.

- BTG is just there chilling in the corner being unnoticed.

As you can see I'm still on the verge between trying to hold long and thinking short/mid term. I know the former is the way to go but there is an urge for the latter. So far I've only ever done two actual loss trades with $70-ish each. My larger motivator with trying to diversify is that there might be stocks out there with better growth potential in 2021. Will see, trying not to be hasty either way - most of these "sell" ideas probably won't materialize.

As for diversifying:

- For a start I'd like to push the EV market's share from 46.7% down to around 30% total. Potential for sells.

- Crypto holdings are going to stay the same, most likely no sells but total % could drop. A more ideal ratio would be around 30% as well, down from 49.50%.

- Would like to get into online services and platforms like TWOU more, needs DD of course.

- ETFs are another that I haven't touched yet. Aiming 10-20% total share, most likely Clean Energy ETFs for a start, namely ICLN or a European derivative.

- Cash should be 5-10%, unless I always want to touch my shares I need leverage for what I'm aiming to be doing and also as safety net ofc.

So the ratios would be:

- 40% Shares (down from 50.5%)

- 30% Crypto (down from 49.5%)

- 20% ETF (up from 0%)

- 10% Cash (up from 0%)

Portfolio value goal is around $30-40, 000 by the end of 2021, which feels quite ambitious with ~$555 monthly income before expenses (and roughly $335 per month to spare). From this source, total investment could probably be in the $3500-$4000 range for the year.

I do plan on securing other sources of income (eg. with dropshipping) so there's potential chance for more.

That is all for now, will see how it pans out. See you in a few months time with another one of these.

A rookie