Ripple just became the world’s second most valuable cryptocurrency. This is a big deal. But why? Is Ripple a good investment? Will banks adopt it? Let’s find out.

WHY IS RIPPLE CAUSING WAVES?

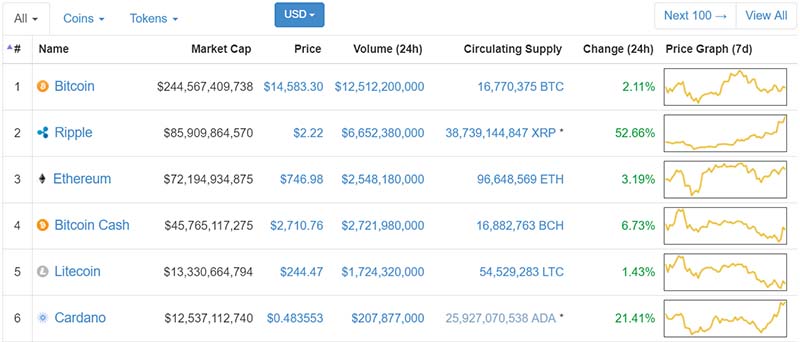

While Bitcoin and the rest of the top 10 cryptocurrencies are well below their peak, Ripple is enjoying a meteoric rise and is trading at $ 2.22, up more than 49% from this time yesterday. In fact, it just unseated Ethereum as the #2 cryptocurrency in terms of market cap. So why is Ripple’s current so strong?

6 REASONS WHY RIPPLE’S TIDE IS RISING

There are a number of factors that could be contributing to the sudden rise in Ripple’s price, but here are the six most likely reasons:

Ripple CEO Brad Garlinghouse’s appearance on CNBC to explain to a mainstream investment audience the advantages of Ripple over the current system. His example of outrageous cross-border ATM fees and the amount of time it takes to send money from New York to London resonated with a financially savvy audience. It also helps that Garlinghouse looks and sounds like a Wall Street insider.

Most cryptocurrency transaction fees are high and burdensome, while Ripple’s are some of the lowest available. Ripple claims banks can save an average of $3.76 per payment using their network. If you’re going to use cryptocurrency for international payments, there isn’t a real competitor to Ripple.

Ethereum and Bitcoin are the dialups of cryptocurrency. A transaction can sometimes take up to 30 – 40 minutes to clear with ETH and an hour or more with BTC, whereas it takes only seconds with Ripple’s XRP. Amid that aggravation, Ripple’s daily transaction volume has soared from 150,000 to more than 1,050,000 in the last few weeks.

Asia’s role in the run-up cannot be understated. Last year Ripple partnered with SBI Holdings to launch SBI Ripple Asia which is a dedicated sales and engineering venture to serve countries like Japan, China, Korea and Taiwan. The Ripple Asia tests begin next quarter so I believe there is some built in anticipation.

American Express’ adoption of Ripple is helping to legitimize the cryptocurrency because it will offer its millions of users’ instant block-chain based payments.

Rumors that Coinbase will soon support Ripple may be adding to the runup. For perspective, look at what happened when Bitcoin Cash was added to the largest Crypto Platform.

If you would have told me 3 months ago that Ripple would surpass Ethereum in market cap by the end of 2017, I would have had a long laugh at your expense. But clearly, the joke is on me.

But not everyone is convinced. Take this tweet from Ryan Selkis who claims he knows of no banks that are using it or plan to use it.

You didn't link the tweet from Ryan Selkis.

Banks aren't going to adopt cryptocurrency any time soon because it would be very expensive to do so. Banks also prefer to use stable currencies rather than volatile ones which can lose and gain insane amounts of value in a week.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://bitcoinist.com/ripple-dethrones-ethereum-now-2-cryptocurrency-behind-bitcoin/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit