Introduction

As an emerging decentralized finance project in the blockchain industry, creating a token or digital asset is one of the foremost steps taken, as it sets the platform in the right light to deliver its services and offerings to clients and compete with other prominent platforms. With the incorporation of the token in the processing of transactions and payments on the network, a DeFi platform enables transparent, fast, reliable, and secure applications. Hence, the development team of the Savix DeFi Network developed their digital asset, called the SVX token, which is designed to improve the delivery of the financial solutions of the network to investors and other users. Presently, all over the world, the adoption of cryptocurrency and tokens has risen to an incredible level where the masses and organizations are utilizing it as their primary source of revenue. Thus, the SVX token, while improving services, will function as a means of earning revenue to the project and its clients.

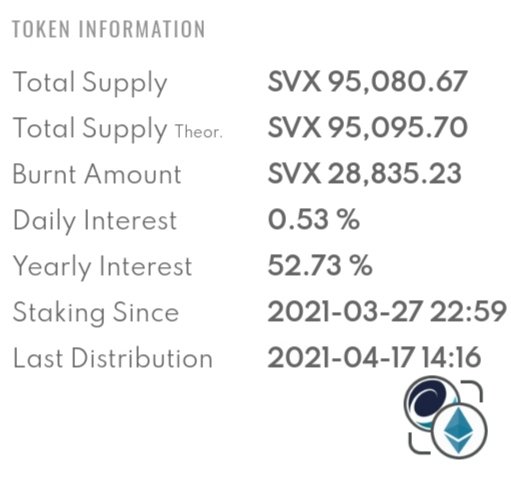

Tokenomics is the aspect of a cryptocurrency or blockchain-related project that contains detailed information of the token or digital asset of that project. Often, it gives information on the total number of tokens in circulation, the blockchain network on which the token system is built, and, the various purposes of allocating the assets. For the Savix DeFi project, its token, SVX, is developed on the Ethereum Blockchain Network, and this enables the compatibility of the token with all ERC-20 supported digital wallets. The team intends to release a limited amount of tokens for circulation, only about 100,000 SVX coins. With such an inadequate supply of SVX coins, the Savix team plans to use the forces of demand and supply to boost the price of its digital asset in the market. This is possible as the token will remain in limited supply, and the development team does not intend to mint more tokens.

Allocation of SVX tokens by the Savix DeFi Network will center on about eight (8) different purposes which include initial pre-sales, Unicrypt Presale, Ecosystem, Bounty, IEO Markets, Team, IEO LaToken, and Uniswap. Based on the projected availability and improved market value implementation on the token, there will likely be mass adoption of the SVX token in the market, as most individuals and businesses will begin to own the cryptocurrency when the increase in currency pairings starts.

Initial Pre-sale

This will cover the tokens distributed to early investors during the initial coin offering of the project. About 5% of the total token supply is allocated for sales to the investors at a discounted price.

IEO Markets and LaToken

As a way to penetrate the exchange markets and integrate its token, Savix allocates about 15% of the total amount in circulation for both the exchange markets and LaToken.

Unicrypt Presale

This will take about 30% of the entire circulation.

Uniswap

About 20% of SVX assets will support the integration of the Uniswap DeFi exchange platform.

Ecosystem

The community members of the platform will receive 7% of the total assets.

Bounty

Savix intends to gain the attention of crypto enthusiasts to join their network and will utilize about 3% of its entire supply to organize bounty programs.

Team

As an incentive and reward to its team for their contributions to the success of the project, the network allocates about 5% of SVX tokens to them.

USEFUL LINKS

Website: https://savix.org/

Whitepaper: https://savix.org/docs/Savix-Whitepaper-V2-0.pdf

Telegram: https://t.me/savix_org

Twitter: https://twitter.com/savix_org

https://savix-org.medium.com

Github: https://github.com/SavixOrg

Reddit: https://www.reddit.com/r/SavixOrg/

AUTHOR'S DETAILS

Bitcointalk Username: Pullorient

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2767518