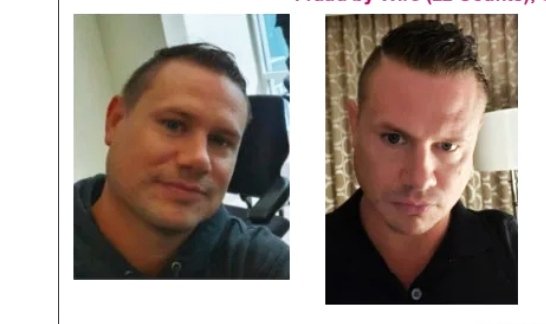

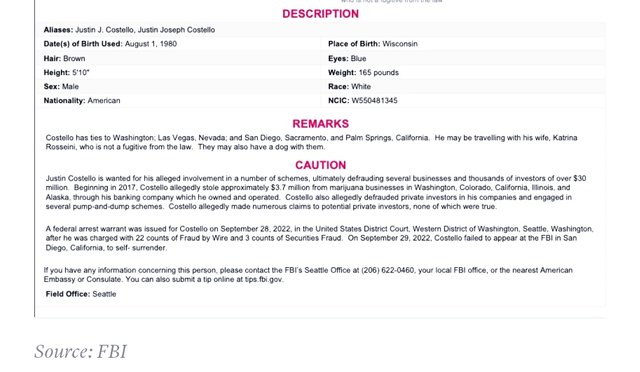

A fugitive charged with an audacious $35 million fraud — in which he allegedly told investors he was a hedge fund billionaire, a Harvard MBA and a special forces veteran who had been twice wounded in Iraq — was arrested by an FBI SWAT team in California after days on the lam, authorities said Wednesday.

Las Vegas resident Justin Costello, 42, is accused by federal prosecutors and the Securities and Exchange Commission of swindling thousands of investors and others as part of a complex scam that touted his purported efforts to build a cannabis conglomerate, among other things.

One of his companies, Pacific Banking Corp., provided banking services to three marijuana companies. Authorities said he also used it to divert at least $3.6 million to himself and other firms he owned.

They also say that he engaged in a scheme that cost more than 7,500 investors about $25 million by making false claims about plans by one of his own companies to purchase 10 other firms.

Another 29 investors lost $6 million after investing directly with Costello based on his false representations, prosecutors said.

Costello, who also had a residence in La Jolla, California, used about $42,000 of investors’ money for costs associated with his wedding to Katrina Rosseini, prosecutors said.

A video of that wedding reviewed by CNBC shows both a cake and an ice sculpture boasting the James Bond movie logo of the numbers “007” over a semi-automatic pistol and a belly-dancing performance by Rosseini, who is not charged in the cases against her husband.

Costello, who previously lived in Bellevue, Washington, had agreed through his lawyer to surrender last Thursday to the FBI office in San Diego after being informed he had been indicted on criminal charges by a grand jury in federal court in Washington state a day earlier, law enforcement officials told CNBC. The complaint accuses him of 22 counts of wire fraud and three counts of securities fraud in the case.

But Costello never showed up as promised at that FBI office that day, officials said.

On the same day, the SEC charged Costello and an alleged co-conspirator, David Ferraro, in a civil lawsuit accusing them of defrauding investors and of using Twitter to promote penny stocks without disclosing their own sales of the stocks as prices rose.

As in the federal indictment, the SEC accuses Costello of fraudulent conduct in connection with two publicly traded companies he previously controlled, Hempstract and GRN Holding Corp.

The SEC said in one instance, Costello sold a married couple $1.8 million in stock at a more than 9,000% markup to its price.

Ferraro, a 44-year-old Radford, Virginia, resident who was not charged in the criminal indictment with Costello, did not immediately respond to a request for comment from CNBC.