What is Seasonal Token and what is its plan of action?

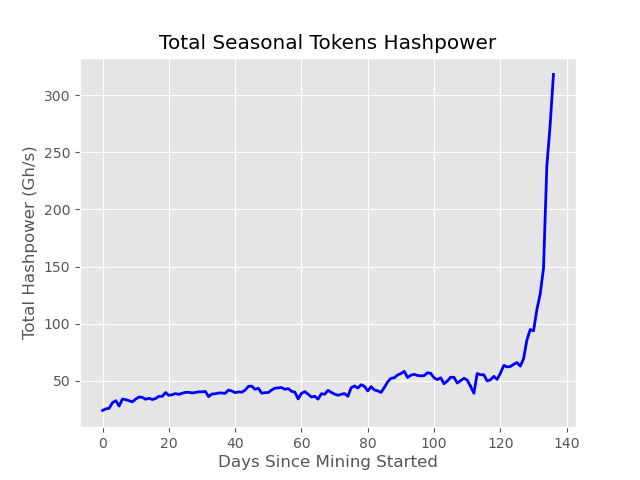

A nonstop activity, mineral extraction brings about the age of tokens that are just accessible during explicit seasons. Considering the way that the rates at which they are produced have been laid out so that everybody will actually want to get a portion of the new tokens in any case, exchanging them on a repetitive premise ought to permit everybody to acquire a portion of the new tokens over the long haul. To accomplish this objective, a greater part of individuals know about the compromises that should be made by all gatherings included.

In particular, round exchanging alludes to the kind of managing that happens in the cryptographic money market that permits sellers to benefit from the presentation of new tokens available without constraining different merchants to encounter the very sorts of misfortunes that they personally are bringing about. While it is impossible, it is feasible to cause an exchanging misfortune by, for instance, trading the tokens the other way of their worth when the market is in a condition of unpredictability when the market is in a state of security.

The process for investors:

There are no seasonal tokens accessible for Ethereum, which is the digital currency that is generally well known among new financial backers and has the most elevated market cap. A rancher should trade about portion of the ETH allowed for cultivating to get seasonal tokens, and afterward give liquidity on Uniswap utilizing the ETH and tokens procured because of the exchanging exchange. A rancher’s liquidity position is gotten by the financial backer. The individual may in a split second store cash into the homestead and start producing pay from the activity.

Exceptional benefits that you get:

There are ranchers who supply liquidity to the token/ETH exchanging pairings on the Uniswap stage, and there are ranchers who work as counterparties for repetitive merchants on different stages. Ranchers who supply liquidity to the token/ETH exchanging pairings on the Uniswap stage, as well as there, are ranchers who work as counterparties for repeating dealers on different stages, are remembered for this class. Notwithstanding ranchers who give liquidity to the token/ETH exchanging pairings on the Uniswap stage, the stage likewise incorporates ranchers who go about as counterparties for repetitive exchanging matches.

What will happen to the value in the future?

The tokens develop more hard to get extra time, yet the individuals who truly do prevail with regards to acquiring them might use them to improve their wealth by means of cultivating and recurrent exchanging, the two of which are very rewarding. The possibility to amass countless tokens after some time without the need to purchase or mine them turns out to be more interesting to financial backers in reality as we know it where digital money tokens are developing increasingly more exorbitant to mine and procure over the long haul. So in the event that you are intrigued, don’t sit tight for what’s to come. Begin working with it immediately.

About the cyclical traders

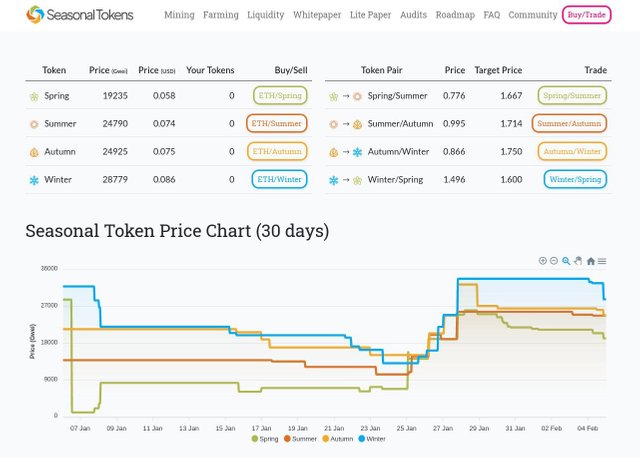

The choice to trade your Spring tokens for Summer and afterward offer them to another person is imperative. The creation pace of this token is split like clockwork. The balance among organic market will be disturbed when the symbolic’s shortage develops. As a result, that token is in more interest at the ranch. Four months after the Spring token stock is split, the advantages of the ranch for ranchers who offer liquidity will move. Rancher’s liquidity is moving from different tokens to Spring as an outcome of this. They’ll require Spring tokens to follow through with this job. There is a decent opportunity spring token will be popular. It very well might be hard for brokers who feel Summer’s cost will climb soon to purchase Spring and sell Summer.

The concept of seasonality is nothing new. It has been a part of global trading and supply chains since time immemorial. Certain goods are in greater supply during certain times of the year, while others are plentiful at other times. Seasonal tokens are similar in that they are based on a time-sensitive market. However, they are unique in that they are tied directly to a product or service that fluctuates in supply. Seasonal tokens are also unlike traditional tokens in that they are not available to anyone. Seasonal tokens are specific to a specific event or time of year, and they are a finite resource. While there are many benefits to owning and trading seasonal tokens, they do come with risks. Before getting started, it’s important to understand what seasonality is and how to use seasonality tokens properly.

What is Seasonality?

Seasonal trading is the practice of investing in goods that have a seasonal supply. In some cases, they also have seasonal demand. Goods that have a seasonal supply include items like foodstuffs, flowers, and other plant life. They also include various agricultural produce and livestock. Examples of seasonal demand include popular events like the Super Bowl, the World Cup, and the Winter Olympics.

How to Use Seasonal Tokens

There are many different ways to use seasonal tokens. Let’s say you want to invest in the Christmas holiday season. You could purchase gift cards and use the tokens to redeem them for specific items on December 25th. You could also invest in a custom-made Christmas tree. Or, you might decide to buy a token as a gift for someone else. In this case, you would simply hold the token until the recipient redeemed it for goods on Christmas.

The Benefits of Seasonal Tokens

Seasonal tokens have a lot of potential for profit, but they are not right for every investor. Before you get started, it’s important to understand the key benefits of using seasonal tokens. They include: Peak-time scarcity — Many seasonal tokens are only available at certain times of the year. For example, the Easter holiday is a time of high demand for eggs. Therefore, a token that represents an Easter egg is more valuable during this time.

Many seasonal tokens are only available at certain times of the year. For example, the Easter holiday is a time of high demand for eggs. Therefore, a token that represents an Easter egg is more valuable during this time. Limited supply — Seasonal tokens are unique in that they have a limited supply. For example, the egg token may only be available for a month.

Seasonal tokens are unique in that they have a limited supply. For example, the egg token may only be available for a month. Part of a niche market — Seasonal tokens are often specific to a particular event or market. For example, the pumpkin spice phenomenon is specific to the autumn season.

Seasonal tokens are often specific to a particular event or market. For example, the pumpkin spice phenomenon is specific to the autumn season. Easy to trade — Seasonal tokens are often easy to trade because they have a few different terms and conditions. For example, the egg token has no expiration date, no minimum investment requirements, and no maximum number of tokens held.

The Risks of Seasonal Tokens

Like with all types of investments, there are risks associated with seasonal tokens. Before you invest, it’s important to understand the key risks of using seasonal tokens. They include: Lack of demand — Some seasonal goods do not have a high enough demand to support a seasonal token. For example, pumpkins are not an ideal token for a fast-food chain.

Some seasonal goods do not have a high enough demand to support a seasonal token. For example, pumpkins are not an ideal token for a fast-food chain. Poor timing — Investing in the wrong goods at the wrong time can be a risky move. For example, investing in too many oranges when they are not in high demand during the winter holidays can result in low profits.

Investing in the wrong goods at the wrong time can be a risky move. For example, investing in too many oranges when they are not in high demand during the winter holidays can result in low profits. Bad publicity — Many seasonal goods have a bad reputation. For example, egg-laying hens are considered a “ cruel ” industry, and “the fattening up” of poultry can lead to public backlash and subsequent boycotts.

Many seasonal goods have a bad reputation. For example, egg-laying hens are considered an “industry” and “the fattening up” of poultry can lead to public backlash and subsequent boycotts. Fraudulent tokens — Like with any type of token, it’s important to be careful about purchasing fraudulent seasonal tokens.

How to Trade Seasonal Tokens

Like any type of investment, trading seasonal tokens requires research and a bit of luck. Before you get started, it’s important to understand the core concepts of trading seasonal tokens. These include Price discovery — Price discovery is the process by which buyers and sellers determine the price of a good or service.

Price discovery is the process by which buyers and sellers determine the price of a good or service. Trading platforms — Many trading platforms exist that allow users to buy and sell seasonal tokens. The most popular of these is Binance.

Many trading platforms exist that allow users to buy and sell seasonal tokens. The most popular of these is Binance. Risk Management — Like with any investment, it’s important to manage the risks involved with trading seasonal tokens. This includes understanding the goods and services that are available, their popularity, and the risks involved with each investment.

Like with any investment, it’s important to manage the risks involved with trading seasonal tokens. This includes understanding the goods and services that are available, their popularity, and the risks involved with each investment. HODL — HODL is an acronym for “hold on for dear life.” As with all investments, it’s important to understand the amount of risk involved. However, it is also important to remember that tokens do have potential for profit.

Conclusion

Seasonal tokens are a unique and interesting way to invest in the cryptocurrency ecosystem. They are based on a time-sensitive market and have limited supplies. There are lots of benefits to using these tokens and they are easy to trade. However, they do have some risks. Before using them, it’s important to understand the concept, how they work, and the risks involved. Best of luck trading!

visit the website for additional details

website: https://www.seasonaltokens.org/

Whitepaper: https://github.com/seasonaltokens/seasonaltokens/blob/main/whitepaper/whitepaper.md

Twitter: https://mobile.twitter.com/Seasonal_Tokens

Discord: https://discord.com/invite/Q8XZgJEDD3

Medium: https://seasonal-tokens.medium.com/

Reddit: https://www.reddit.com/r/SeasonalTokens/

#Proof Of Registration

Forum Username: mshahbaz23

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2845216

Telegram Username: @sajjad7481

Participated Campaigns: Twitter, Discord, Article

Bitcoin Wallet Address: 1Gj7krjspX9AZAmRXXmgu6FPKVoBrDGGuE

Hi, @mshahbaz23

Hello, welcome to Steemit!

I invite you to take part in the competition and get a guaranteed prize of 1 steem!

The grand prize is 15 steem! Details here: https://steemit.com/hive-176147/@steemit-market/steem-market-opens-the-prize-money-is-50-steem-everyone-is-guaranteed-a-prize

Good luck!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit