I think there is a good chance that 2018 is going to be a great year for the precious metals. In fact 2018 could be THE year to be holding gold and silver, in the same way that 2017 was the year for holding cryptocurrencies. So if you want to get rich, start piling into the shiny stuff. If only it was that simple...

By way of introduction, I have spent the last 18 months watching Youtube videos, telling me that society is about to collapse, the dollar is going to become worthless, and that silver and gold are the places to be. Yet very often those shouting loudest about the wonders of the precious metals are talking their own book. They sell coins and bullion, or they are financially connected to bullion storage services. And when they mention gold and silver, they tend to prefix these metals with the word "physical". So they don't just say "you need to buy silver", but "you need to buy physical silver".

This is an important distinction. If you have a US broker account, you can supposedly get instant exposure to the precious metals, without having to take physical delivery. You can buy futures in the precious metals, or you can go for ETFs like GLD for gold and SLV for silver. The advantage of GLD and SLV is that you can hold them like shares, with minimal slippage. However if you responded to the silver bulls by buying futures or ETFs, the bullion firms sponsoring them wouldn't make any money. Partly for this reason, the mortal dangers of the paper markets have to be pumped up.

The argument goes that the big precious metal ETFs can't be trusted, and if they do have the metal they claim to possess, there may be numerous claims on its ownership. The futures markets are even worse. It is a sea of paper, with no physical substance, which is used as a tool for manipulating precious metals prices - mainly downwards. The physical metals enthusiasts point to a growing disconnect between the physical and paper exchanges, and they suggest that at some point it will break down. Those holding paper gold and silver will be left holding worthless assets, while those holding physical will be smiling.

Which leads to the big question. How much precious metal do you need to own to be rich? Or at least comfortably off? Now I am often told that the function of the precious metals is not to get rich, but to save yourself and your family when civilization as we know it collapses. However I am not a survivalist, and I am not into conspiracy theories. I just want to be comfortably off, which means having a particular sum of money. Let's call that sum four million dollars, and let's not worry about tax. I've seen some pretty crazy figures about what price the metals could get to, but let's start with something reasonable.

Keith Neumeyer, CEO of silver miner First Majestic, suggested a target of $130 an ounce. This is reasonable, in the sense that it is fairly close to an inflation adjustment of gold's $50 peak in 1980. So if I want to have four million dollars worth of silver, with the price at $130, I need to own around 30,000 ounces. At today's price of $17.10, that is going to cost me over half a million dollars, assuming I buy at spot. In other words, you're going to have to be quite well off in the first place to have any chance of getting rich with precious metals. However let's be optimistic. I've seen target figures of $500 an ounce for silver. I'm not quite sure how that's going to happen, but let's say it does. That means, with current prices, you only need 8000 ounces, which will cost around $140,000.

All of this means that the one group of people who are never going get rich from silver are small-scale stackers. If you haven't got 10,000 ounces, either under your bed or in allocated storage, you're not going to benfit from any moonshot in the silver price - particularly as there is likely to be substantial resistance at $50. I know, civilization could collapse, and we may be reduced to barter and bullets, but outside the conspiratorial bubble, that's not going to happen.

So who is going to get rich if silver does moonshot? Well, it could be those who are great stock pickers, who have put their money in the right silver mines. Right now First Majestic looks pretty cheap at around $7, though it will never do a Bitcoin. Or it could be those holding leveraged paper. This means that if you are of modest means, and you want to do with silver what the crypto-holders did since 2010, you have to catch a wave with precious metal futures, and hope that any corrections aren't big enough to stop you out.

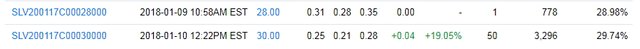

Alternatively you could gamble on crazy out of the money options on GLD or SLV. For example, for around $11,200 you could buy 400 $30 options in SLV, expiring in January 2020 (see above, from Yahoo Finance). So if silver hits Keith Neumeyer's target of $130 by January 2020 you'll be able to sell your options for just short of $4,000,0000 and live happily ever after. It's far more likely that you'll lose every penny of your $11,200 if you hold until expiry, but it's a good punt, isn't it?